FundedNext Review 2025: Comprehensive Insights and Analysis

Last Updated: January 1, 2025

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

I've been exploring FundedNext, a well-known proprietary trading firm, and it's quite the powerhouse in the financial market. They've got a team filled with industry veterans, financial experts, and tech enthusiasts, all focused on bringing innovative solutions to the table. Their goal is pretty ambitious – they want to transform the trading experiences of 50 million traders worldwide using advanced strategies and tech. I'm really impressed by their commitment to excellence. FundedNext's funded trader programs are all about fostering a culture of growth and innovation, aiming to create real value for their customers, people, and stakeholders. And it's not just about being the best; they want to significantly impact the global trading community. For someone like me, getting into the trading scene, FundedNext seems like a place where big things are happening.

FundedNext Key Takeaways: Is it for You?

FundedNext offers diverse programs and features, catering to traders of all skill levels. Whether you're a novice or an experienced trader, FundedNext provides options that align with your expertise. This detailed summary highlights the firm's key aspects, including the broad spectrum of programs available, the potential for lucrative profit splits, a range of account sizes to suit different trading capacities, a variety of tradable assets, access to leading trading platforms, and the nature of the evaluations conducted. Understanding these elements is essential to appreciate the wide range of opportunities and the adaptability that FundedNext offers its users.

| Key Takeaways | Details |

|---|---|

| Account Size | $6,000 - $200,000; Scalable to $4M |

| Price Range | $59 - $1,099 |

| Daily Loss/ Max Drawdown | 5%/10% |

| Profit Target | 10% - 25% |

| Funding Models | Four unique models: Two-step Stellar, One-step Stellar, Evaluation, and Express. |

| Profit Sharing and Commissions | Up to 95% profit share, low commission rates ($3 per round lot for forex/commodities, zero on indices). |

| Tradable Assets and Leverage | Offers a range of assets with varying leverage options across Forex, Indices, and Commodities. |

| Payout Timeframe | 24-hour payout processing with $1,000 compensation if delayed. |

| Trading Platforms | MT4/MT5 with features like raw spreads and minimal execution slippage. |

| Consistency Challenge | 2 Phases, 15% Profit Share, Varying Profit Targets and Loss Limits |

| Non-Consistency Challenge | 1 Phase, 15% Profit Share, Specific Profit Targets and Loss Limits |

| 1-Step Challenge | 1Phase, 15% Profit Share, Set Profit Targets and Loss Limits |

| 2-Step Challenge | 2 Phases , 15% Profit Share, Different Targets and Loss Limits per Phase |

FundedNext Review 2025: A Comprehensive Overview

FundedNext, founded in March 2022 by entrepreneur Abdullah Jayed, offers traders up to $4 million in capital. Headquartered in the UAE with global offices, it provides initial capital of up to $200,000, growing as traders meet targets. The firm features four funding models and a high profit-sharing scheme in partnership with Eightcap. Reflecting Jayed's vision of innovation, FundedNext supports traders with unique benefits like 15% profit sharing from challenge phases, no time limits on challenges, balance-based drawdowns, competitive spreads, and low commissions.

FundedNext's innovative approach extends to ensuring an optimal trading environment. This is achieved through features like raw spreads, including in Swap Free accounts, and the lowest possible commissions to enhance profitability for traders. Its commitment to being a reliable prop firm is evident in its strategic offerings and global outreach, covering over 195 countries, with an impressive $80M+ in total payouts and an average payout time of just 5 hours, supporting over 81,000 traders. FundedNext stands out as a firm dedicated to the success and growth of its traders.

FundedNext offers traders a versatile trading environment, offering four unique funding models: Two-step Stellar, One-step Stellar, Evaluation, and Express. These models cater to various trading styles and experience levels—the firm partners with broker Eightcap to offer a platform combining advanced features and ease of use. Traders can trade up to $300,000 with profit shares up to 95%. FundedNext stands out for its competitive trading conditions, including raw spreads and low commission rates for various trading instruments.

FundedNext offers low commission rates for traders: $3 per round lot for currency pairs and commodities and zero commission on indices. This pricing is part of their approach to provide advantageous trading conditions.

You can check out their official website for more details.

Pros and Cons

When considering FundedNext, it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals.

Pros:

- High Profit Sharing From Challenge Phases: Offers 15% profit share from challenge phases, higher than many competitors.

- Advantageous profit sharing and low commissions: Provides up to 95% profit share and low commission rates, optimizing traders' earnings.

- Quick Payouts with Compensation Guarantee: Ensures an average payout time of just 5 hours and offers $1,000 compensation for delays beyond the promised 24-hour window.

- Scalable Account Sizes: FundedNext offers the opportunity to scale account sizes based on trader performance, potentially growing from an initial $200,000 up to $4 million.

Cons:

- Cost of Entry: Initial fees for challenges range from $59 to $1,099, which could be a barrier for traders with limited initial capital.

- Variability in Leverage and Risk: Leverage varies across challenges (e.g., 1:100 for Forex in some challenges), which could impact risk management strategies.

Tradable Assets and Leverage

FundedNext offers a range of tradable assets and leverage options across different asset classes tailored to enhance trading flexibility while promoting disciplined trading.

For Evaluation and Express Challenge:

- Forex - 1:100 (Challenge phase and FundedNext Account)

- Indices – 1:50 (Challenge Phase), 1:25 (FundedNext Account)

- Commodities - 1:50 (Challenge phase and FundedNext Account)

Stellar Step 1 Challenge:

- Forex - 1:30 (Challenge phase and FundedNext Account)

- Indices – 1:5 (Challenge phase and FundedNext Account)

- Commodities - 1:10 (Challenge phase and FundedNext Account)

Stellar Step 2 Challenge:

- Forex - 1:100 (Challenge phase and FundedNext Account)

- Indices – 1:20 (Challenge phase and FundedNext Account)

- Commodities - 1:40 (Challenge phase and FundedNext Account)

Payout Timeframe and Trading Platforms

FundedNext commits to processing payout requests within 24 hours. This period starts when a trader requests a payout, during which the operations team ensures all checks and preparations are done for the transfer. After processing, traders receive confirmation with proof. If the 24-hour window isn't met, FundedNext offers $1,000 compensation to the trader's payout, upholding their commitment.

Traders are encouraged to log into MT4/MT5 using the provided credentials to observe the raw spreads offered on different instruments. FundedNext ensures top-tier prop trading conditions, characterized by these raw spreads and minimal execution slippage, available on Platforms 4 and 5.

Pricing Information

FundedNext presents a range of funding options with varying fees, catering to different levels of trader commitment and expertise. The pricing changes with the account size, different models and Steps of the challenge. To give you an idea, here are two examples:

For the lowest Account Size of $6,000 in the Steller Challenge :

Step 1

- Profit Share: 15% or $90

- Commission : 3$/Per Lot

- Refundable Fee: $59 (Swap Account) and $65 (Swap Free Account )

Step 2

- Profit Share: 15% or $225

- Commission : 3$/Per Lot

- Refundable Fee: $59 (Swap Account) and $65 (Swap Free Account )

For the highest Account Size of $200,000 in the Steller Challenge:

Step 1

- Profit Share: 15% or $90

- Commission : 3$/Per Lot

- Refundable Fee: $999 (Swap Account) and $1,099 (Swap Free Account )

Step 2

- Profit Share: 15% or $3,900

- Commission : 3$/Per Lot

- Refundable Fee: $999 (Swap Account) and $1,099 (Swap Free Account )

Reputation and Social Media

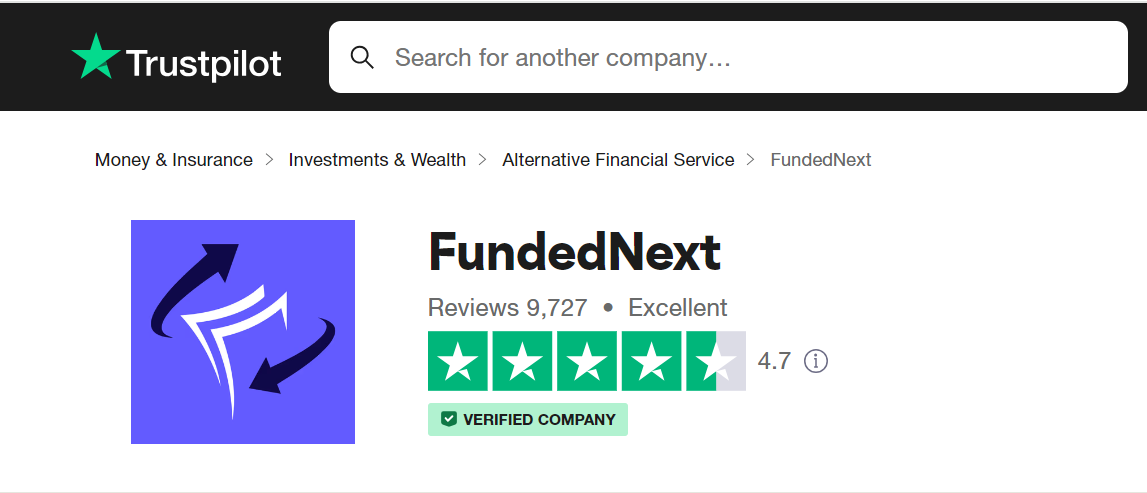

FundedNext has garnered a notable 4.7-star rating on Trustpilot from 9,727 reviews, with 86% being 5-star ratings. Additionally, 8% of users have given it four stars, showcasing high customer satisfaction. Notably, less than 1% of the reviews are three-star and two-star, and only 5% are 1-star, indicating a strong positive reception among its user base.

You can stay connected with FundedNext's latest updates by following their Instagram account, which boasts over 1,699 posts and 99.1K followers. Their feed offers insights into the company's growth and updates from the FundedNext Academy. For direct inquiries, you can also reach out to them via Instagram's direct messaging feature.

FundedNext's Twitter account, with over 89.3K followers and 288 posts, is a hub for engaging with the firm and its community. It features reviews, questions, and media content and updates followers on the latest news, including discount offers. Users can interact by commenting on posts and staying connected with FundedNext's latest developments.

Challenge Types and Rules

Funded Next focuses on realistic and manageable trading requirements for their funded accounts. They emphasize achievable objectives and clear rules, creating a fair and attainable trading environment.

1) Stellar Challenge:

Objective: Hit a specific profit target without time limit.

Profit Split: Initial 80%, scalable to 90% or 95% with add on features.

Features:

- Maximum Daily Drawdown Limit: 5% of the initial balance.

- Overall Drawdown Limit: 10% of the initial balance.

- Minimum Trade Requirement: At least 5 trades.

- No Consecutive-Day Trading Requirement: Trade on any day, without the need for consecutive day trading.

- No Overall Trade Limit: Unlimited number of trades allowed.

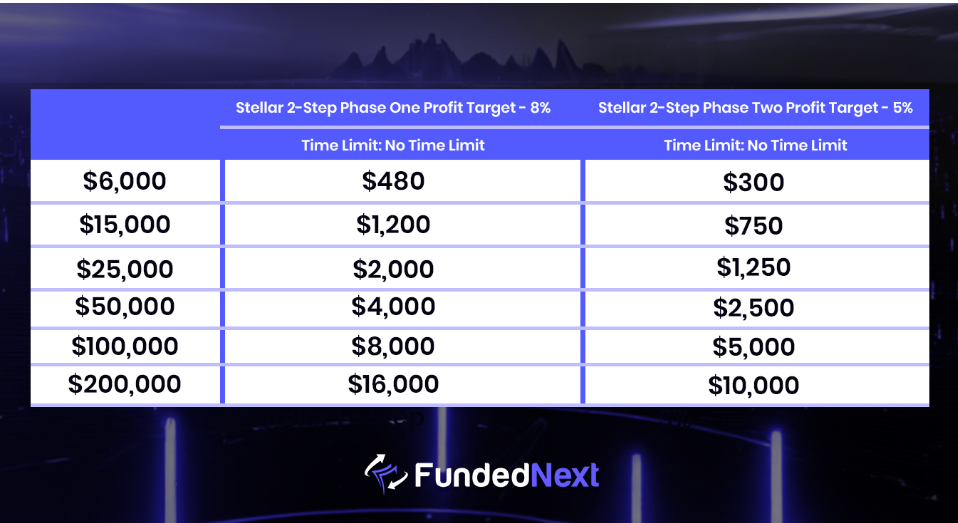

- Phase 1 Profit Target: 8%, with no time limit for achieving this target.

- Phase 2 Profit Target: 5%, also without any time limit.

- FundedNext Account Flexibility: No set profit target or minimum trading days requirement.

2) Express Challenge:

Objective: Reach an ambitious profit target with no time limit.

Profit Split: Begins at 60% and can increase to 90% based on performance.

Features:

- Option to immediately boost profit split to 95% with add-ons.

- Maximum Daily/ Overall Drawdown Limit: 5% / 10% of initial balance.

- Minimum Trades: 10 separate trades, no consecutive day requirement.

- Challenge Goal: Increase account by 25% in 4-week cycles, trading at least 10 days per cycle.

- Funded Account: No profit target, up to 90% profit share.

- Trading Flexibility: No time limit for challenge completion, but 10 trading days per cycle required.

- Non-Consistency Accounts: Allow overnight and weekend trades.

- Account Size: Funded account is 25% of challenge account size.

- The difference lies in trading rules: Consistency accounts require following specific trading guidelines, often restricting the ability to hold trades overnight or over weekends, fostering a disciplined trading style. Non-consistency accounts, however, offer greater flexibility, allowing traders to hold positions overnight and during weekends, accommodating diverse trading strategies.

3) Evaluation Challenge:

Objective: Demonstrate trading skills in two phases with achievable profit targets.

Profit Split: Starts at 80%, potentially increasing to 90% or 95% through a scale-up program and exclusive add-ons.

Features:

- Maximum Daily/ Overall Drawdown Limit: 5%/10% of the initial balance.

- Minimum Trades: 5 separate trades per cycle, no consecutive day requirement.

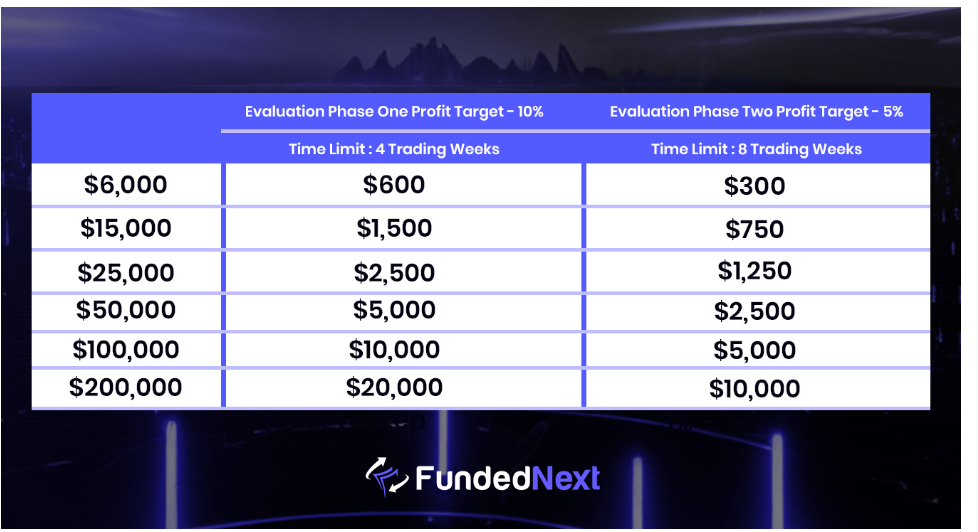

- Evaluation Phase 1/ Phase 2: 10%/5% profit target in 4/8 weeks.

- Funded Account: No profit target, 15-90% profit share.

- Extension Option: Available in Phase 1 under specific criteria.

- Unlimited Retakes: Offered if rules are followed and the account is profitable.

- Weekend Trading: Allowed for all trading styles.

- Subscription Fee Refund: Available in the first payout on the FundedNext account.

- Profit Share Increase: It begins at 15% in the Challenge Phase and goes up to 90% in the FundedNext account.

- Trading Style Flexibility: Suitable for Scalp, Intraday, or Swing trading.

- No Time Limit: For completing the Evaluation Challenge.

- Trading Cycle: 4-week periods with a 10-day minimum trading requirement.

- Profit Sharing: 15% during each assessment phase in the Evaluation model.

- Trading Fund Size: Options up to $200,000.

- Account Reset: If rules are violated or the profit target is unmet.

Challenge Comparison

FundedNext offers a unique trading challenge, allowing traders to showcase their skills and earn significant capital. The challenge includes realistic profit targets and flexible trading conditions, catering to various trading styles. Successful participants can access substantial funding, up to $4 million, with a high profit-sharing potential. It's an excellent platform for traders to grow, learn, and potentially profit in the trading world.

Evaluation Express Stellar

| Consistency | Non-Consistency | 1-Step | 2-Step | ||

|---|---|---|---|---|---|

| Challenge Phase | 2 | 1 | 1 | 1 | 2 |

| Challenge Phase Profit Share | 15% | 15% | 15% | 15% | 15% |

| Profit Target | P1:10%, P2:5% | 25% | 25% | 10% | P1:8%, P2:5% |

| Maximum Daily Loss | 5% | 5% | 5% | 3% | 5% |

| Maximum Overall Loss | Maximum Overall Loss | ||||

| Drawdown Type | Balance Based | Balance Based | Balance Based | Balance Based | Balance Based |

| Time Limit | P1: 4 weeks P2: 8 weeks | No Time Limit | No Time Limit | No Time Limit | No Time Limit |

| Minimum Trading Day | 5 | 10 | 10 | 5 | 5 |

| Commission | 3$/Per Lot | 3$/Per Lot | 3$/Per Lot | 3$/Per Lot | 3$/Per Lot |

| Profit Split Upto | 90% | 90% | 90% | 90% | 90% |

| Trading Leverage | 1:100 | 1:100 | 1:100 | 1:100 | 1:100 |

| Reset Discount | 10% | 20% | 20% | 10% | 10% |

| First Payout | Monthly | Monthly | Monthly | Bi-Weekly | Monthly |

| Subsequent Payouts | Bi-Weekly | Monthly | Monthly | Bi-Weekly | Bi-Weekly |

Take Part in Their Competition

The FundedNext Trading Competition held monthly, is open to traders of all backgrounds and is free to enter. It starts on the first day and ends on the last day of each month, allowing traders to demonstrate their skills and compete for prizes. Those ranking from 101st to 600th win a lottery coupon, with 50 selected for a Stellar 1-Step 6K account. Participants can also trade during news events, offering a dynamic trading environment. This competition not only tests trading acumen but also offers substantial rewards. Here are the rules:

- Drawdown based on balance.

- 5% daily, 10% overall loss limits.

- Minimum 5 trading days requirement.

- News trading allowed.

- $3 commission for Forex/Commodities, none for Indices.

- Overnight/weekend holding permitted.

- Swap-free accounts.

- No use of EAs (Expert Advisors).

- Max 3 lots per trade for indices, commodities, metals.

- Max 5 open positions at a time.

- One account per person, linked to one IP.

- Trading starts on competition's first day.

The competition calculates drawdowns from the balance, with strict daily and overall loss limits to ensure disciplined trading. Participants must trade for at least five days. News trading is permitted, adding dynamism. Commissions apply to Forex and Commodities, but not Indices, allowing diverse trading strategies. Overnight and weekend holdings are allowed in swap-free accounts. EAs are prohibited to maintain fairness. The maximum lot size and open positions are capped to encourage balanced trading. Each participant is limited to one account, ensuring equal competition opportunities.

Comparing with Other Firms

Lets see how FundedNext performs next to its competitors:

| Variables | FundedNext | FTMO | The Funded Trader |

|---|---|---|---|

| Profit Share From Challenge Phase Profits | 15% | 0% | 0% |

| FundedNext Account Profit Share | 95% | 90% | 90% |

| Profit Target | 8%/5% | 10%/5% | 10%/5% |

| Drawdown | Balance Based | Balance Based | Balance Based |

| Account Reset Option | Yes | No | No |

| One Step Challenge | Yes | No | Yes |

| Free Competitions | Yes | No | Yes |

| Lowest Package with Price | 6K/$49 | 10K/$169 | 5K/$65 |

Risk Disclosure

FundedNext provides generic content without endorsing specific securities or funds. They don't guarantee the representation of all clients in testimonials. Trading in futures and FX carries risks, and investors may lose their initial investment. It's advised only to trade with risk capital. Past performance doesn't guarantee future results. CFTC Rule 4.41 cautions that hypothetical or simulated performance outcomes don't represent actual trading. Margin trading in CFDs is high-risk and not suitable for all. The company advises understanding local laws and seeking independent financial advice before trading. Users are responsible for complying with local regulations. FundedNext encourages trading within one's comfort zone, allowing any trading style.

FundedNext's website may include third-party links, but the company doesn't review or take responsibility for its content. These external links don't imply endorsements of products or services. The site's content is informational and shouldn't be seen as a solicitation or offer in areas where it's prohibited. It's not advice for specific currency or precious metal trades. Users should be aware of their local trading laws and exit the site if they need clarification on compliance with local regulations.

FundedNext emphasizes responsible trading by urging users to stay within their comfort zone and adopt a suitable trading style. They promote the idea of growth through freedom in trading choices. Traders are encouraged to make informed decisions and select their trading plans thoughtfully to achieve their best performance. This approach aims to foster individual and collective growth in the trading community.

FundedNext Review: Final Thoughts

FundedNext is an intriguing proprietary trading firm that started in March 2022. The founder, entrepreneur Abdullah Jayed, has set up something to shake up the financial industry. They have this ambitious goal of transforming the lives of 50 million traders globally with their innovative solutions and technologies. What's really impressive is their team – a mix of industry veterans, financial experts, and tech enthusiasts, all committed to excellence.

Their approach to funding traders is generous. They start traders with $200,000 in initial funding, and there's a possibility to scale up to $4 million. FundedNext offers four different funding models, providing a variety of opportunities for traders. What makes them stand out are their competitive trading conditions, like low commission rates, as low as $3 per round lot for currency pairs and commodities, and even zero commissions on indices. This could be a big draw for traders who are conscious of costs.

One of the things about FundedNext that caught my attention is their payout speed. They're committed to processing requests within 24 hours, which means traders can access their earnings pretty quickly. They even offer a $1,000 compensation if they miss this 24-hour payout window. This level of efficiency and their commitment to service are appealing.

The challenge types at FundedNext, like Stellar, Express, and Evaluation, provide traders with clear and achievable goals. They offer both consistency and non-consistency accounts, allowing traders to choose a style that suits them. Plus, they host a monthly trading competition, which is a great opportunity for traders to compete, win prizes, and show off their skills.

Finally, FundedNext's profit-sharing structure is quite compelling, especially compared to other prop trading firms. Traders have the potential to earn up to 95% profit share from the FundedNext account. Starting account sizes are as low as $6,000 in the Stellar Challenge, making it accessible to a broad range of traders. Their focus on responsible trading and fostering growth within the trading community adds to their appeal, offering a well-rounded opportunity for traders looking to make their mark in the financial markets.