Alpha Futures Review for 2025: Comprehensive Insights

Last Updated: November 19, 2025

Author: Day Trading Insights Research Team

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

Alpha Futures Discount Code:

dtinsights000620 (Additional 15% OFF, No Activation Fee)

Key Takeaway:

- Account Sizes: From $50,000 all the way up to $450,000 in simulated funds.

- Largest Payout Cap: $15,000, which is 3X the industry average.

- 1-Step Evaluations: Just don't hit your Maximum Loss Limit of 4% which is calculated at the end of the day (unrealized profits intraday).

- 3 Tier Profit Split: Payouts 1 and 2 get 70%, 3 and 4 get 80%, 5 and above get 90%.

- Very Competitive Pricing: Accounts starting at $79/month with resets as low as $59.

Alpha Futures is a relatively new futures prop trading company, but the phrase “new kid on the block” is inappropriate for it. This is because the firm, under the stewardship of CEO Ben Chaffee, is in the hands of veteran futures traders. Headquartered in London, England (and also registered in Wales), the company has a simple but ambitious goal: to provide traders with substantial capital, robust tools, and the support they need to achieve consistent profitability. The company has been able to establish themselves as a solid future prop firm and has solid reputation within the trader community as well.

What is Alpha Futures?

Alpha Futures is the sister company of the well-regarded Alpha Capital Group, which focuses on forex prop trading and is operated by Alpha Futures Limited. This firm approaches funded trading accounts innovatively: the evaluations are extremely straightforward and there are no restrictions like daily drawdown. Even better, you only have to hit a 6% profit target when evaluating for the Standard account. This rule is not there once you graduate to the “Qualified” status.

The company's commitment to trader development extends beyond just providing capital. It maintains a wealth of educational material that helps traders with market analysis and much more. Some of the educational resources available include trading webinars, a FAQ section, and blog posts. Besides that, there is a community of experienced professionals ready to answer questions as they arise. This ecosystem approach demonstrates the firm's understanding that successful prop trading requires more than capital—it needs a supportive environment where traders can grow and refine their strategies.

What are Alpha Futures' Account Sizes?

| Feature | Zero Plan | Standard Plan | Advanced Pro |

|---|---|---|---|

| Evaluation Type | 1 Phase | 1 Phase | 1 Phase |

| Min Trading Days - Evaluation | 1 | 2 | 2 |

| Min Trading Days - Qualified | 5 | 3 | 5 |

| Profit Target | 6% | 6% | 8% |

| Max Position Size | 3 to 6 | 5 to 15 | 5 to 15 |

| Max Drawdown | 4% | 4% | 3.50% |

| Profit Split | Up to 90% | Up to 90% | Up to 90% |

| Daily Drawdown | 2% | 2% | None |

| Activation Fee | NONE | $149.00 | $149.00 |

| Starting Price | $99.00 | $79.00 | $139.00 |

The prop trading firm takes a streamlined approach to account sizing, starting traders at a base account size of $50,000. This standardized starting point applies to all three of their trader funding routes: their Zero, Standard and Advanced evaluation paths. The lowest plan is the Alpha Futures Standard 50K plan that starts at $79 before any discounts are applied.

From this initial $50,000 base, traders can scale their accounts in $50,000 increments, with the firm offering a maximum allocation of up to $450,000 for qualified traders. To get to the $450K, a trader would need to have 3 accounts with $150K each.

If you choose to go with the Alpha Futures Zero Plan, you will not need to pay any activation fee. That's right, the activation fee to go with the Zero plan, is actually zero. Other two plans do require $149 one time activation fee per qualified account.

Pros and Cons

When considering the firm, it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals. The good news with the Alpha Futures funded trader firm is that there are very few negatives about it.

Pros

- Flexible account options with scalable growth opportunities

- Up to 90% profit split and no post-qualification profit targets

- Access to industry-standard platforms plus proprietary AlphaTick software

- Competitive commission rates

- Affordable resets from $59

- News trading allowed

- Transparent risk management rules

Cons

- Challenging 6–8% profit target with a 50% consistency rule

- Limited position size (2–3 contracts per $50K)

- No scaling options for Advanced qualified accounts

Alpha Futures Trading Tools

What Assets Can You Trade With Alpha Futures?

There are 6 main assets classes that Alpha Futures Trader Funding programs allow: Equity & Index, Currency, Commodities & Agricultural, Metals, Financial Interest Rates, and Crypto.

Equities futures:

- E-mini S&P 500 (ES) and its micro counterpart (MES)

- E-mini NASDAQ (NQ) and Micro E-mini NASDAQ (MNQ)

- Mini-DOW (YM) and Micro Mini-DOW (MYM)

- E-mini Russell (RTY) and its micro version (M2K)

- Nikkei (NKD)

Currency

| Symbol | Name | Description |

|---|---|---|

| /6A | Australian Dollar | Standard futures contract for AUD/USD |

| /M6A | Micro Australian Dollar | Smaller-sized (1/10th) version of the AUD/USD futures |

| /6B | British Pound | Standard GBP/USD futures |

| /M6B | Micro British Pound | Micro GBP/USD futures |

| /6C | Canadian Dollar | Standard CAD/USD futures |

| /6E | Euro FX | Standard EUR/USD futures |

| /E7 | E-mini Euro FX | Mid-size EUR/USD futures (between standard and micro) |

| /M6E | Micro Euro | Smallest EUR/USD futures contract |

| /6J | Japanese Yen | Standard JPY/USD futures |

| /6S | Swiss Franc | Standard CHF/USD futures |

| /6M | Mexican Peso | Standard MXN/USD futures |

| /6N | New Zealand Dollar | Standard NZD/USD futures |

Commodities & Agricultural

| Symbol | Commodity | Description |

|---|---|---|

| /CL | Crude Oil | Standard WTI Crude Oil futures (1,000 barrels) |

| /MCL | Micro Crude Oil | 1/10th the size of /CL, ideal for smaller accounts |

| /QM | E-mini Crude Oil | Mid-size crude oil futures (500 barrels) |

| /NG | Natural Gas | Standard Natural Gas futures (10,000 mmBtu) |

| /QG | E-mini Natural Gas | Smaller (2,500 mmBtu) version of /NG |

| /MNG | Micro Natural Gas | 1/10th the size of /NG, newer contract for retail traders |

| /RB | RBOB Gasoline | Futures for reformulated gasoline blendstock (gasoline prices) |

| /HO | Heating Oil | Futures tracking the price of heating oil (diesel fuel proxy) |

| /ZC | Corn | Agricultural futures for corn prices |

| /ZW | Wheat | Futures for global wheat market prices |

| /ZS | Soybeans | Standard soybean futures |

| /ZM | Soybean Meal | Processed soybean byproduct used for livestock feed |

| /ZL | Soybean Oil | Oil extracted from soybeans; used in food and biodiesel |

| /LE | Live Cattle | Futures tracking live (non-slaughtered) cattle prices |

| /HE | Lean Hogs | Futures for hog prices after fattening (used for pork pricing) |

Metals

- GC: Gold

- MGC: Micro Gold

- SI: Silver

- SIL: Micro Silver

- HG: Copper

- MHG: Micro Copper

- PL: Platinum

Financial Interest Rate

- ZT: 2-Year Note

- ZF: 5-Year Note

- ZN: 10-Year Note

- ZB: 30-Year Bond

- UB: Ultra-Bond

- TN: Ultra-Note

Crypto

- MBT: Micro E-mini Bitcoin

- MET: Micro E-mini Ether

What are Alpha Futures' Trading Platforms?

Alpha Futures offers leading virtual trading platforms tailored to different trading styles. Choose the tools and workflow that fit you best and trade confidently. The choices that Alpha Futures are plentiful and should fit majority of the traders.

Announcement: on November 18th, Alpha Futures announced that ProjectX has decided to no longer work with any other firms besides Topstep. Therefore ProjectX will no longer be available on Alpha Futures as a choice, starting in February of 2026. Alpha Futures will help current account holders that are plugged into the ProjectX platform to transition their accounts to programs of their choice.

NinjaTrader

NinjaTrader offers professional charting, execution, and analysis on desktop and mobile. With fast support and seamless integration with Replikanto Trade Copier, it's designed for performance-focused futures traders.

Tradovate

Tradovate is a web-based futures platform known for its accessibility and intuitive design. It offers live chat and phone support, third-party charting integrations, and a built-in copy analyst feature, making it a favorite among modern prop traders. Tradovate’s browser-based interface enables smooth trading on virtually any device without complex installations.

TradingView

TradingView, a top charting platform, lets traders use custom indicators, create setups, and trade directly on charts. Its clean interface and community support appeal to technical traders.

Alpha Analyst (Coming Soon)

Coming soon: Alpha Analyst, Alpha Capital’s proprietary platform for Alpha Futures Analysts. It will feature TradingView charts, custom risk management, analytics, an economic calendar, news, and AI-assisted insights in a customizable interface.

Alpha Futures Reviews: Who Is It For?

The company targets a diverse range of traders but particularly appeals to those who appreciate structure and technological innovation in their trading journey. Its offerings are well-suited for futures traders who are:

- Data-driven: The proprietary AlphaTick platform, combined with TradingView integration, provides sophisticated charting and analysis tools. This setup particularly benefits traders who rely heavily on technical analysis and market data for decision-making.

- Disciplined risk managers: The company's clearly defined risk parameters and 2% daily loss guard system work well for traders who prioritize capital preservation alongside growth. The fixed drawdown rules encourage methodical trading approaches.

- Scaling-focused: With a clear path from $50K to $450K, the program appeals to traders looking to systematically grow their capital allocation. The structured progression rewards consistent performance rather than aggressive risk-taking.

- News traders: Unlike many prop firms that restrict news trading entirely, this firm allows this strategy with some reasonable limitations. This makes it an attractive option for traders who incorporate fundamental analysis and market events into their strategy.

The firm might not be the best fit for day traders seeking ultra-high-frequency trading opportunities or those requiring extremely large position sizes, as the 5 contracts per $50K limit is maintained throughout the program.

What Is The Alpha Futures Leverage?

This firm takes a measured approach to leverage through its innovative scaling plan, focusing on earned position size increases rather than fixed leverage ratios. This "earn your large positions" philosophy demonstrates their commitment to sustainable trading growth.

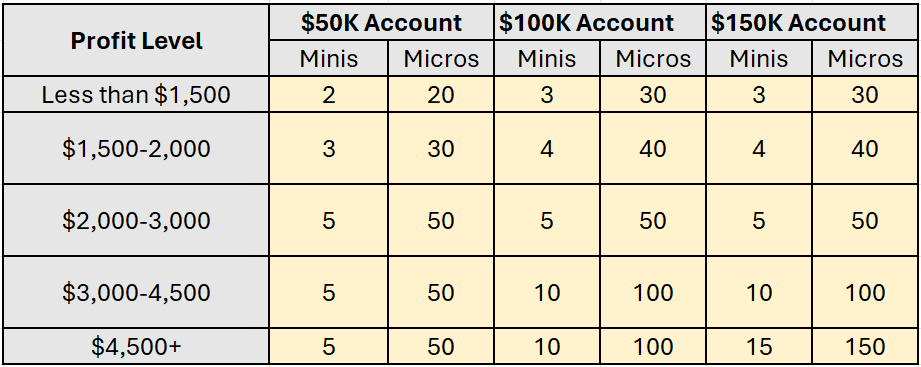

The leverage structure works on a tiered system based on account performance:

For Zero Account:

- At Zero $50K initial position: 3 minis or 30 micros

- At Zero $100K initial position: 6 minis or 60 micros

The Zero Account plan do not scale up the contract size during evaluation phase. Until the trader is funded, the cap remains within the initial limits. Once the trader reaches the Qualified status, their account can then follow the same scaling progression outlined for other plans.

For a $50K account:

- Initial position limit: 2 minis or 20 micros

- At $1,500-2,000 profit: Increases to 3 minis or 30 micros

- At $2,000-3,000 profit: Maxes at 5 minis or 50 micros

For a $100K account:

- Initial position limit: 3 minis or 30 micros

- At $1,500-2,000 profit: Increases to 4 minis or 40 micros

- At $2,000-3,000 profit: Increases to 5 minis or 50 micros

- At $3,000-4,500 profit: Increases to 10 minis or 100 micros

For a $150K account:

- Initial position limit: 3 minis or 30 micros

- At $1,500-2,000 profit: Increases to 4 minis or 40 micros

- At $2,000-3,000 profit: Increases to 5 minis or 50 micros

- At $3,000-4,500 profit: Increases to 10 minis or 100 micros

- At $4,500+ profit: Maxes at 15 minis or 150 micros

This progressive scaling system encourages traders to prove their profitability before accessing larger position sizes, aligning with the firm's focus on sustainable trading practices.

Alpha Futures' Payout System

The prop trading firm maintains two distinct payout structures, varying between Zero, Standard and Advanced plan accounts. The goal is to reward consistent performance while encouraging sustainable trading practices.

Zero Plan Payouts:

This is a newly introduced plan which mirrors the Standard and Advanced plan with its own twists:

- Profit split of 90% consistently from day 1

- Flexible Withdrawals: Up to 4 payouts per month after achieving 5 consecutive profitable days ($200 min. each)

- Payout Structure: Up to 50% profit initially withdrawable. 100% after 30 winning trading days ($200 min. each)

- Withdrawal Limit: $200 min. per payout. Maximum payout cap of $1,500 for $50K Zero Account and $3,000 for $100K Zero Account

- No drawdown reset on payout

Standard Plan Payouts:

The company implements a tiered profit-split system that rewards trader longevity:

- First two payouts: 70% profit split

- Third and fourth payouts: 80% profit split

- Fifth payout and beyond: 90% profit split

Traders can request withdrawals every 14 days from their first qualified trade, provided they satisfy the 40% Consistency Rule. The minimum withdrawal amount is set at $200, and all payout requests are processed within 48 hours.

Advanced Plan Payouts:

This plan offers more frequent access to profits with unique features:

- Weekly withdrawal opportunities

- Requires 5 winning trading days with $200+ profit between requests

- Initially allows withdrawal of up to 50% of profits

- After 30 trading days with $200+ profit, enables 100% profit withdrawal

- Maintains a consistent 90% profit split from day one

A key consideration for both plans is the Maximum Loss Limit (MLL). For instance, with a $50,000 account grown to $55,000, traders can withdraw the $5,000 profit (subject to their profit-split tier), but doing so would bring the account to MLL and result in closure. The firm encourages traders to prioritize account longevity over maximum withdrawals, promoting sustainable trading practices.

Alpha Futures' Pricing Information

The company employs a transparent pricing structure that varies based on account size and evaluation type. It divides costs into three main categories: monthly subscription fees, reset fees, and activation fees.

Monthly evaluation fees:

- $50K Account

- Standard Plan Evaluation: $79/month

- Advanced Plan Evaluation: $139/month

- Zero Plan Evaluation: $99/month

- $100K Account

- Standard Plan Evaluation: $159/month

- Advanced Plan Evaluation: $279/month

- Zero Plan Evaluation: $199/month

- $150K Account

- Standard Plan Evaluation: $239/month

- Advanced Plan Evaluation: $419/month

The subscription automatically rebills monthly from the signup date until the trader passes the evaluation, at which point it automatically terminates. If a trader fails their evaluation, they receive a fresh account with the original starting balance upon rebill, effectively serving as a free reset.

Reset options:

Traders can purchase resets at any time during their subscription period, with costs matching their monthly evaluation fee. For example, a $50K Standard account reset costs $79. These resets:

- Can be used unlimited times

- Don't affect the monthly rebill date

- Can be purchased directly through the dashboard

- Return the account to default settings, including starting balance and maximum loss limits

Qualified account activation:

Once traders pass their evaluation, they move to a simpler pricing model:

- One-time activation fee of $149 per Qualified Account for Standard/Advanced Plan

- No activation fee for Zero Plan qualified accounts

- Must be paid within 30 days of passing evaluation

- Account access granted within 1-2 business days after payment

- No monthly subscription fees for qualified traders

This pricing structure encourages traders to maintain consistent performance while providing flexible options for account resets and progression to funded status.

What are Alpha Futures' Evaluation Rules and Goals?

Alpha Futures structures its evaluation process to identify disciplined traders while helping them develop sustainable trading habits. The evaluation framework combines clear profit targets with protective measures to ensure traders can demonstrate both profitability and risk management skills.

Core evaluation requirements:

- Profit Target: 6% across all account sizes

- Maximum Loss Limit (MLL): 4% on all evaluation accounts

- Position Size: 5 contracts per $50K (50 micros)

- Trading Hours: All trades must close before 4:59 ET daily

- Consistency Rule: 50% maximum profit from any single trading day

The company sets a straightforward path to qualification with only one way to fail: breaching the Maximum Loss Limit. Notably, evaluation accounts operate without a daily loss limit, offering traders flexibility in their day-to-day performance while maintaining overall account protection through the MLL.

Qualified account differences:

Once traders succeed in evaluation, their qualified accounts feature several key changes:

- Implementation of a 2% daily loss guard

- Access to scaling plans for position sizes

- Adjusted consistency rule to 40%

- Profit split up to 90%

- Maximum allocation of $450K

This transition from evaluation to qualified status reflects the company's focus on developing "consistent, disciplined traders, not gamblers." The firm maintains unlimited reset options during evaluation (at the cost of the monthly fee), allowing traders to refine their approach until they achieve consistent profitability.

What are Alpha Futures' Scaling Plans?

This prop firm follows the philosophy of "earn your large positions." In this regard, the company implements a thoughtfully structured scaling system that rewards consistent profitability with increased trading capacity. This approach ensures traders grow their position sizes in tandem with their demonstrated ability to generate profits.

The scaling plan is structured across three account tiers:

This structured progression shows that the company wants sustainable trading growth for its funded trades. As such, traders increase their leverage only after proving their ability to manage smaller positions profitably. The system serves as a safeguard against over-leveraging while providing clear incentives for consistent performance.

The scaling plan allows traders to gradually increase their position sizes as they demonstrate proficiency and build account equity, reflecting the company's focus on developing sustainable trading practices rather than encouraging aggressive risk-taking.

What is Alpha Futures' Consistency Rule?

The firm implements distinct consistency rules for evaluation and qualified accounts to promote sustainable trading practices rather than high-risk, one-day profits. These rules vary based on account type and trading phase.

Evaluation phase rules:

Both Standard and Advanced accounts follow a 50% consistency rule during evaluation. This means no single trading day's profit can exceed 50% of total profits. By contrast Zero Plan Evaluation accounts have NO consistency rule. This means that traders can hit the entire profit in a single day.

| Standard Account Size | Profit Target | Recommended Largest Day |

|---|---|---|

| $50K | $3,000 | $1,500 or less |

| $100K | $6,000 | $3,000 or less |

| $150K | $9,000 | $4,500 or less |

| Advanced Account Size | Profit Target | Recommended Largest Day |

|---|---|---|

| $50K | $4,000 | $2,000 or less |

| $100K | $8,000 | $4,000 or less |

| $150K | $12,000 | $6,000 or less |

Qualified account rules:

- Standard Plan Accounts: Operate under a 40% consistency rule

- Single trading day profits cannot exceed 40% of total profits

- Rule resets between withdrawal requests

- Violation doesn't breach the account but requires additional trading to satisfy the ratio

- Formula: Biggest Day/Total Profit ≤ 40%

- Advanced Plan Accounts: No consistency rule applies

- Zero Plan Accounts: 40% consistency rule after qualification, identical to the Standard Plan Accounts

Traders can monitor their consistency ratio through their dashboard, where the payout feature remains inactive until the rule is satisfied. This structured approach reinforces the trading provider's emphasis on consistent performance over occasional big wins.

What are Daily Loss Guard and Maximum Loss Limit?

The company implements two distinct risk management features: the Daily Loss Guard (DLG) for qualified accounts and the Maximum Loss Limit (MLL) for both evaluation and qualified phases.

Daily Loss Guard (Qualified Accounts Only):

This 2% protective measure serves as a "soft breach" rule:

| Account Size | Daily Loss Guard |

|---|---|

| $50K | -$1,000 |

| $100K | -$2,000 |

| $150K | -$3,000 |

When a trader hits the DLG:

- All open positions are automatically flattened

- Pending orders get canceled

- Trading is suspended until the next day (6 pm ET)

- Account remains active (not terminated)

Traders using AlphaTicks can customize their DLG to implement even stricter risk parameters if desired.

Maximum Loss Limit:

The MLL functions as a trailing drawdown mechanism:

- Standard Accounts: 4% drawdown limit

- Advanced Accounts: 3.5% drawdown limit

- Zero Accounts: 4% trailing drawdown limit

How MLL Works:

- Calculated from end-of-day balance highs, not intraday peaks

- Example with $50K Standard Account:

- Initial MLL: $48,000 ($2,000 below starting balance)

- After $500 profit: New MLL becomes $48,500

- After subsequent $500 loss: MLL remains at $48,500

- MLL stops trailing once it reaches the initial starting balance

Consequences of breaching limits:

- MLL Breach in Evaluation: Account loses funding eligibility

- Solution: Purchase reset or wait for monthly rebill

- MLL Breach in Qualified Account: Account closes at day's end

- DLG Breach: Trading pauses until the next day; the account remains active

This dual-layer risk management system reflects the organization's commitment to protecting both trader and company capital while fostering disciplined trading habits.

Is Alpha Futures a Scam or Legit?

In a market where new prop firms appear regularly, evaluating legitimacy becomes crucial for traders seeking reliable funding partners. Several factors indicate Alpha Futures operates as a legitimate proprietary trading firm.

First, the company is exceptionally transparent in its operations. It has clear and detailed documentation of all policies—the evaluation rules, risk management protocols, pricing structure, profit-sharing model, and trading requirements are openly displayed and consistently enforced. This level of transparency is only possible when a company runs legitimate operations.

Second, Alpha Futures implements robust risk management tools. Rather than promising unrealistic returns, the organization has developed structured scaling plans that reward proven performance. The inclusion of well-defined daily loss guards and maximum loss limits shows a serious approach to capital preservation. Their automated system protections for trading hours compliance reflect a professional understanding of market operations.

Third, the trader-centric features of their business model point to legitimate operations. The company offers multiple evaluation paths through Standard and Advanced options, indicating an understanding that different traders require different approaches. Their proprietary AlphaTicks platform, designed specifically for futures trading, represents a significant investment in trader success. The reasonable reset fees and progressive profit splits encourage long-term relationships rather than quick profits.

Perhaps most telling is their approach to trading environment integrity. The firm maintains strict policies against market manipulation, clearly prohibiting algorithmic trading abuse and exploitative practices like tick scalping. Their prevention of account rolling and group trading, along with protection against simulation environment exploitation, shows a commitment to maintaining a fair trading environment.

While relatively new to the prop trading space, Alpha Futures has established itself through professional operations, transparent policies, and a clear focus on developing sustainable trading practices rather than promoting get-rich-quick schemes. Their structured approach to trader development and emphasis on risk management aligns with legitimate prop firm practices, making them a credible option for serious traders seeking funding opportunities.

Alpha Futures Reviews and Social Media Presence

On Trustpilot, where the authenticity of reviews can be verified, the company maintains a respectable rating (4.6 stars), though the total number of reviews (50) remains moderate, given their relatively recent entry into the market. The distribution of these reviews tells a compelling story – 94% of reviewers give the firm a perfect 5-star rating. What's particularly noteworthy is the absence of middle-ground reviews (no 3-star or 4-star ratings), with only 2% giving 2-star reviews and 4% leaving 1-star feedback. This polarized distribution, heavily skewed toward excellent ratings, suggests that when the firm delivers, it does so exceptionally well.

On X (formerly Twitter), the company has built a significant following since joining in April 2024, currently engaging with over 7,900 followers. Their verified account (@Alpha_Futures_) showcases their commitment to community engagement through regular updates, educational content, and promotional activities—including a recent million-dollar evaluation account giveaway. With 306 posts in just a few months, the firm maintains active communication with its trading community.

Their Instagram presence (@alpha_futures) has attracted nearly 6,000 followers, with 248 posts featuring a mix of trader success stories, educational content, and performance highlights. The account regularly shares trader disbursements and weekly top-performer statistics, providing transparency about payouts while maintaining an engaging visual presence. Their profile highlights key offerings, including their maximum allocation of $450K, absence of withdrawal caps, and up to 90% profit splits.

Alpha Futures Review: Final Thoughts

The prominent theme throughout this review is that Alpha Futures is a noteworthy contender in the prop trading space. The company may be a new player in the field, but it has quickly established itself through a combination of innovative features and trader-centric policies.

The firm’s standout attributes include its dual evaluation paths (Standard and Advanced), which cater to different trading styles and risk appetites. Their scaling system, which allows traders to grow from an initial $50K to a substantial $450K account, indicates that this prop firm wants to establish a long-term relationship with its funded traders. Most importantly, the proprietary AlphaTick platform is evidence that the company is willing and able to invest in traders.

Risk management is a key pillar of Alpha Futures’ operations, as evidenced by the thoughtfully structured daily loss guard and maximum loss limit systems. The 2% daily loss guard on qualified accounts protects traders from significant drawdowns, while the trailing maximum loss limit of 4% for Standard and 3.5% for Advanced accounts provides reasonable risk parameters without being overly restrictive.

The firm's profit-sharing model is competitive, with qualified traders earning up to 90% of profits. Their transparent approach to consistency rules – 50% during evaluation and 40% for qualified accounts – helps maintain disciplined trading practices while still allowing for profitable opportunities.

However, potential traders should carefully consider certain aspects. The evaluation profit targets (6% for Standard and 8% for Advanced) represent significant hurdles, and the position size limitations of 5 contracts per $50K might restrict certain trading strategies. Additionally, as a newer firm, they have a shorter track record compared to some established competitors.

Overall, Alpha Futures appears to have struck a balance between providing attractive trading opportunities and maintaining necessary risk controls. Their growing social media presence and positive trader reviews suggest they're building a sustainable operation focused on long-term success rather than short-term gains. For traders willing to adapt to their structured approach, this prop firm offers a viable path to funded trading.

FAQs

Day Trading Insights Research Team

Day Trading Insights Research Team publishes articles written by active day traders, financial market researchers, or aspiring traders who are actively learning and investing on a regular schedule. Our research team brings formal training in finance and computer science, blending market theory with code-driven testing and tools. We’re passionate about understanding how trading works, how markets evolve, and how technology can sharpen professional decision‑making. Our content is education‑first and independently produced, free from outside bias.