Earn2Trade Review 2025: Comprehensive Insights and Analysis

Last Updated: April 5, 2025

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

Earn2Trade Discount Coupon Code

Get 20% OFF with promo code: DTI

April Discount : 60% OFF of the first 60 days of subscription

Key Takeaway:

Profit Split - 80% to the trader

Free Resets - Available after each monthly subscription renewal

Trading Account Types - TCP25, TCP50

Gauntlet Mini Fund Management - Up to $150,000

LiveSim One-Time Fee - $139 deducted from first withdrawal

Professional Monthly Fee - $135/month/exchange

Live Account Data Fee - $135/month/exchange

Minimum Withdrawal Amount - $100

Withdrawal Processing Day - Weekly on Tuesdays

Withdrawal Fee - $10, waived for withdrawals over $500

Gauntlet Mini Withdrawal Cap - $4,000 after achieving $5,000 in profits

Max Contract for $50,000 Account (Gauntlet Mini) - Up to 2 contracts, can increase to 4 contracts

Micro Contracts Count - Up to ten micro contracts count as one standard contract

Earn2Trade is a great platform that helps beginners become professional traders. It's especially great because it focuses on hands-on training with simulations that mimic real trading situations. They have several challenges, which when you pass, you could get a trading account that you don't have to fund yourself, and you can keep up to 80% of the profits you make. This is an awesome deal for anyone new to trading who wants to avoid risking their money immediately.

The platform is welcoming to all levels of traders. Whether you're just starting or trading but want to improve, Earn2Trade has something for you. Their lessons are easy to understand and engaging, which makes learning about trading less intimidating. They also have good customer support, which is a big help when figuring things out. If you're serious about trading, Earn2Trade gives you the tools and support to do well in the trading world.

Earn2Trade Overview

Earn2Trade was founded in 2016 by Ryan Masten and Illya Barziy to turn aspiring individuals into skilled traders. Based in the United States, this educational platform equips users with the necessary skills through rigorous training programs and challenges. Over the past eight years, Earn2Trade has grown significantly, helping more than 10,000 traders by providing comprehensive courses and hands-on trading simulations. One of their most popular offerings, the "Gauntlet Mini" challenge, allows participants to prove their trading prowess. Those who succeed in this challenge can trade with a funded account, managing up to $150,000 of the company's money.

Pros and Cons

When considering the firm, it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals.

Pros

- Substantial Fund Management Opportunity: Participants who pass challenges like the Gauntlet Mini can manage up to $150,000 of the company's funds, providing a significant hands-on trading experience.

- Favorable Profit Split: Traders retain 80% of their profits, which is a generous share compared to many other platforms.

- Comprehensive Educational Resources: Earn2Trade offers a range of courses from basic to advanced levels, suitable for traders at all stages of their careers. Lifetime access to these materials allows for continuous learning and skill enhancement.

- Structured Risk Management: Tools like the Progression Ladder help traders understand and manage their trading limits based on their account size and profit levels, promoting responsible trading practices.

- Support for Multiple Trading Platforms: Earn2Trade supports a variety of trading platforms, including NinjaTrader and Finamark. Some of these platforms offer free access during the training programs, providing flexibility and convenience for traders.

Cons

- Restrictions on Trading Certain Assets: The platform does not allow trading in Forex and restricts trading volatile futures such as Bitcoin and Ether Futures, which may limit opportunities for traders interested in these markets.

- Upfront Costs and Fees: Notable fees include a $139 one-time activation fee for LiveSim accounts for non-professional CME status traders and monthly data fees of $135 per exchange for professional traders, which could be a barrier for some individuals looking to start trading.

Tradable Assets and Trading Platforms

Assets:

Earn2Trade allows trading on all CME Group futures, including those on the Chicago Mercantile Exchange (CME), Chicago Board of Trade (CBOT), New York Mercantile Exchange (NYMEX), and Commodity Exchange (COMEX). This coverage extends to Micro futures as well. However, it's important to note that Forex trading is not permitted in any of Earn2Trade's programs like the Trader Career Path or Gauntlet Mini.

As of December 5, 2019, due to high margin requirements and the doubling of margins by many futures commission merchants for Bitcoin futures, these assets are no longer available for trading on live accounts and won't count towards completing the Trader Career Path or Gauntlet Mini programs. Additionally, due to the extreme volatility of Ether Futures, Earn2Trade does not allow trading of this asset either.

It's also worth noting that trading contracts with low liquidity on Rithmic presents risks. Rithmic's system calculates open equity based on Bid/Ask prices, which could result in large fluctuations in a trader's account balance. If these fluctuations cause a trader to fail their Trader Career Path or Gauntlet Mini attempt, Earn2Trade does not take responsibility. Traders should know the liquidity of their trading assets and manage their risk accordingly.

Reset:

The main action to reset the Gauntlet Mini or Trader Career Path is done through your dashboard. Simply navigate to the Evaluation tab and click on the Reset button. It's important to note that resetting doesn't affect your billing period. Instead, it restores your account to its initial balance and clears any failed rules, giving you a fresh start.

With the Trader Career Path evaluation, you receive a free reset with each monthly renewal of your subscription, starting from your first renewal. This benefit is applicable to both the TCP25 and TCP50 plans. You can accumulate these free resets during your subscription and use them at your convenience. However, it's important to remember that they will be forfeited if you cancel your subscription. If you are running multiple evaluations, each one keeps track of its free resets separately, and they can only be used for the specific evaluation they were provided for.

To check how many free resets you have, go to your E2T dashboard, click the "Evaluation" tab, and look near the "Reset" button.

It's also worth noting that TCP subscriptions bought in 2022 and renewed in 2023 will continue to receive free resets at each renewal. Free resets are not granted retroactively for renewals before 2023.

Payout, Withdrawal and Trading Platforms

Payout:

The profit split is 80:20, with the trader receiving 80% of all profits.

Withdrawal:

Proprietary trading firms process withdrawals weekly on Tuesdays. To ensure your withdrawal is included, submit your request by email before 2 PM on the preceding Friday. You can only withdraw $100 for both live and LiveSim accounts. Withdrawals over $500 are free of charges from the prop firm, though banks, payment providers, and crypto exchanges may impose their fees.

For LiveSim account holders with non-professional CME status, a one-time activation fee of $139 is deducted from your first withdrawal. You need at least $239 in profits ($100 minimum withdrawal + $139 setup fee) to make your first withdrawal. After you're funded, there are no restrictions on withdrawing your profits.

Withdrawal Methods: Traders can withdraw funds using bank wires or crypto withdrawals. These services are facilitated through Rise, an international payment management platform. The prop firm charges a $10.00 fee for each withdrawal, which is waived for withdrawals exceeding $500.

LiveSim Withdrawals: You can withdraw funds after passing the Gauntlet Minior Trader Career Path evaluations and choosing the LiveSim funding option. The maximum withdrawal from a LiveSim following a Gauntlet Mini evaluation is $4,000, provided your profits reach $5,000 (the prop firm deducts 20% monthly or at each withdrawal, but never more than 20%). For LiveSim accounts from the Trader Career Path program, the maximum withdrawal amount is your profit target minus 20% for the prop firm, with no monthly deductions.

Supported Platforms:

Here's a list of trading platforms available for participants in the Gauntlet Miniand Trader Career Path programs. While participants generally need to provide their licenses, several platforms offer special access for those enrolled in these programs:

- NinjaTrader is recommended and available for free during participation in either the Trader Career Path or Gauntlet Mini.

- Finamark is also free during these programs and includes a 90-day live trading license.

- R | Trader & R | Trader Pro are freely accessible.

- Overcharts offers 60 days free for new users.

- Sierra Chart, as of 2020, does not officially support Rithmic. Users can still employ Sierra Chart with Rithmic at their own risk, as no official support is provided for connection issues.

Other platforms that can be used include Inside Edge Trader, Investor RT, Motive Wave, MultiCharts, Bookmap, Photon, QScalp, Quick Screen Trading (QSI), ScalpTool, Trade Navigator, Volfix.net, Jigsaw Trading, ATAS Order Flow Trading, and Quantower.

If someone's preferred platform isn't mentioned, they should contact support to explore possible solutions.

What is the Consistency Rule ?

The "Maintain Consistency" rule is an important guideline in the Trader Career Path evaluation and the Gauntlet Mini programs. This rule requires that no trading day contributes 30% or more to your total profit and loss (PnL).

Suppose your profit target is $5,000. Keeping the 30% rule in mind, no single day's profit should exceed $1,500, which is 30% of your overall goal. If you earn $1,800 on a particular day, this represents 36% of your $5,000 target. To comply with the consistency rule, you must increase your total profits to at least $6,000. Here's how you calculate it: if $1,800 is your highest single-day profit, dividing this amount by 0.3 gives you $6,000. Thus, once your total profits reach or exceed $6,000, the $1,800 becomes less than 30%, aligning with the consistency requirement.

It's worth noting that the Maintain Consistency rule does not apply to LiveSim and live accounts. Additionally, the daily PnL percentage is calculated regardless of whether your account balance is above or below the starting balance.

Drawdown

Three types of drawdown rules are applied in Earn2Trade's Trader Career Path and two in the Gauntlet Mini, each crucial for maintaining account standards through different stages of a trader's journey.

End-of-day Drawdown is used across TCP25, TCP50, and LiveSim accounts. It calculates and sets your minimum account balance based on the positions closed at the end of each trading day.

Trailing Drawdown is active in live accounts and adjusts your minimum balance throughout the trading day, considering both open and closed positions. As you make profits, your minimum required balance increases accordingly.

Fixed Drawdown sets a permanent minimum balance for your account. For example, after passing TCP25 or TCP50 and reaching trading accounts of $200,000 or $400,000, the minimum balances are fixed at $194,000 and $380,000, respectively.

It's worth noting that after successfully completing the TCP evaluation and opting for the LiveSim option, traders can continue trading within this setup until they reach the profit target, minus a 20% profit split ($1,400 or $2,400 for the 25K and 50K LiveSim accounts, respectively). However, once these targets are met, traders are required to upgrade to the next live account size. Similarly, after passing the Gauntlet Mini, a LiveSim account remains valid until the first $5,000 is earned (minus the 20% split), after which a switch to a live account is necessary.

Traders need to understand that although the End-of-Day drawdown is calculated at the close of each day, going below the minimum balance at any point due to open positions can lead to the termination of the evaluation or funded account. The platform updates these drawdown values daily during the market close from 4-5 pm CT. For a processing delay, traders should check the dashboard and Rithmic Trader Pro's Auto Liquidate Threshold column to ensure values are in sync.

Earn2Trade regularly reviews and may revise these minimum balance requirements, encouraging traders to monitor their account standings closely.

What are the Rules ?

Candidates in the Trader Career Path and Gauntlet Mini program are required to follow a strict trading plan that includes several key rules. Adhering to these rules not only ensures a smooth progression in the program but also enhances your trading skills and understanding. Failing to adhere to these rules means they cannot receive an offer unless they restart the program through a reset.

Here’s a breakdown of the essential rules:

- Trade a minimum of 10 trading days: It’s crucial to trade for at least ten days within the evaluation period. This requirement has been reduced from 15 to 10 days, effective April 1, 2024, to ensure a fair evaluation process for all candidates. However, active subscriptions before this date will still need to complete the original 15-day period, even if reset or rebilled.

- Stay within the daily loss limit: Traders must stay within the set daily loss threshold.

- Stay within the maximum position size: This is determined by a progression ladder that dictates how much can be traded as you advance.

- Maintain the minimum account balance (EOD Drawdown): At the close of each trading day, the account balance should not fall below a specified minimum.

- Only trade during approved times: Trading outside of designated times is prohibited.

- Maintain consistency: Avoid having any single day’s profit exceed a significant portion of your total gains.

Additionally, the use of copy trading strategies is strictly prohibited.

The EOD Drawdown rule has been applicable to all Gauntlet Mini attempts since July 1, 2021, affecting both new evaluations and resets. The "Maintain Consistency" rule has been in effect since April 1, 2020, and also applies to all resets and new evaluations. All rules take into account both closed and open equity intraday to ensure compliance throughout the trading day.

Trader Career Path (TCP)

| TCP25 | TCP50 | TCP 100 | |

|---|---|---|---|

| Virtual Starting Capital | $25,000 | $50,000 | $100,000 |

| Profit Goal | $1,750 | $3,000 | $6,000 |

| EOD Drawdown | $1,500 | $2,000 | $3,500 |

| Daily Loss Limit | $550 | $1,100 | $2,200 |

| Follow Progression Ladder | Up to 3 Contracts | Up to 6 Contracts | Up to 12 Contracts |

| Monthly Subscription | $150 | $190 | $350 |

| Free Reset When Rebilled | Yes | Yes | Yes |

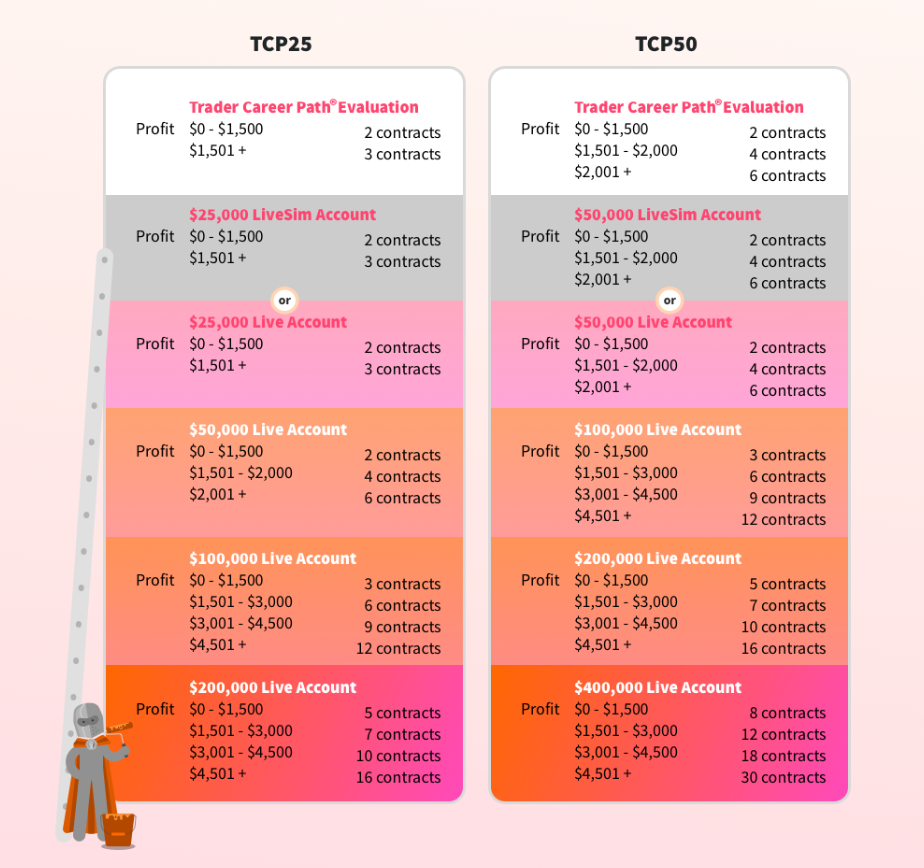

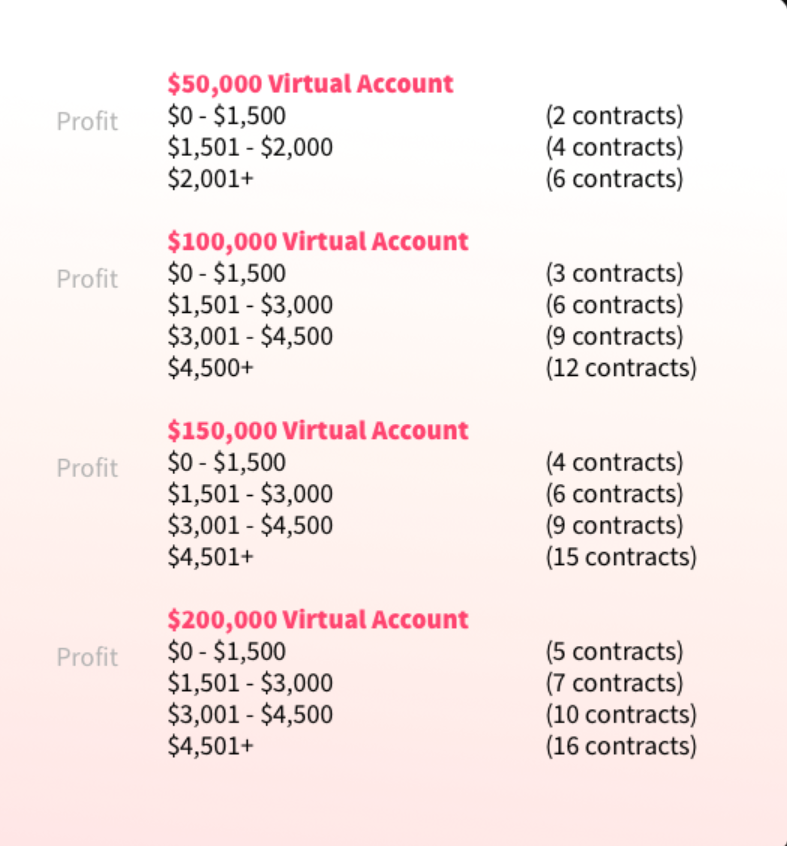

Progression Ladder

Earn2Trade's Progression Ladder limits the number of contracts traders can open based on their account size and profit levels. Traders need to self-regulate their trading activities. As their profits increase, they may open more positions, although this is optional.

If traders exceed the allowable number of contracts, their evaluation will be blocked for that day. However, starting from March 1, 2024, exceeding this limit will not necessitate an account reset. The block will be lifted at market close, allowing traders to resume trading with the same account the next day.

For instance, in a $25,000 account, traders can open up to two contracts, such as two ES or one ES and one CL contract. Opening a third contract would immediately fail the examination unless the trader's profits have increased their account balance to $26,501 or more. In such a case, they can open a third contract but must ensure their profits stay within this new threshold while the positions are open.

Micro contracts like MES, MNQ, and others count differently on the ladder. Up to ten micro contracts are considered as one standard contract. This allows some flexibility in trading strategies while maintaining strict adherence to the progression rules.

Traders are advised to carefully monitor their account balances and trading positions to avoid examination failure and to minimize risk exposure.

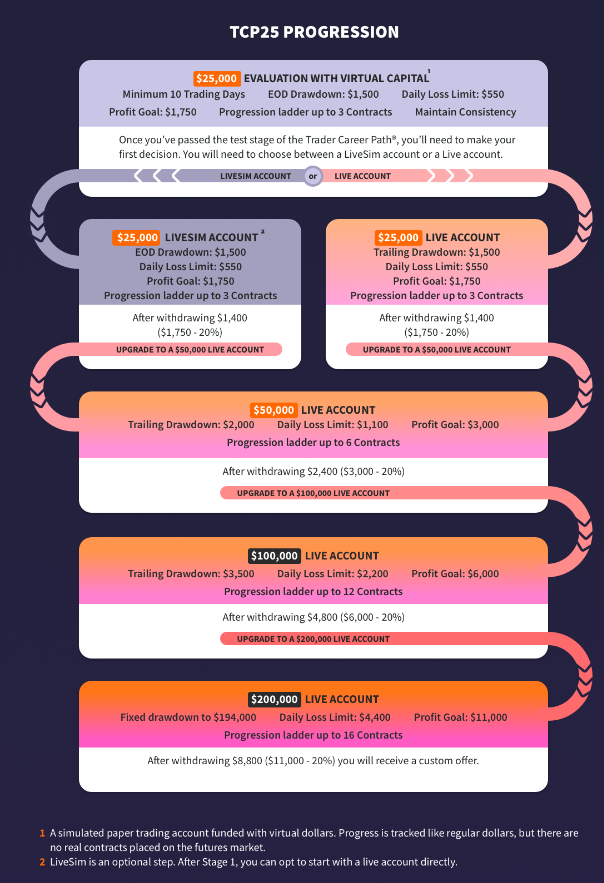

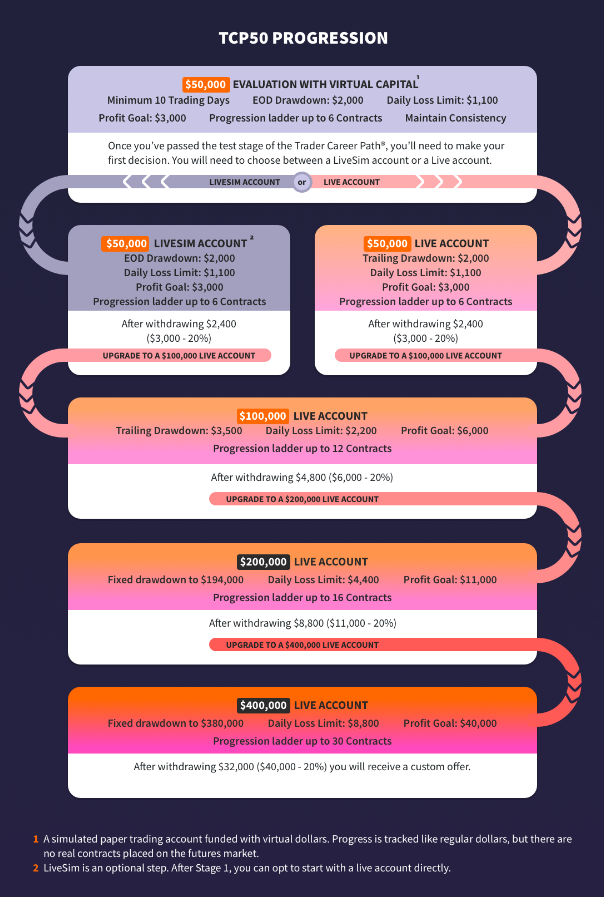

Completing The Trader Career Path

When candidates complete The Trader Career Path (TCP), they are guaranteed a funding offer from one of the proprietary trading partners. This offer starts traders with an account of a similar size to the TCP25 or TCP50 they passed. Traders can get funded on either a Live or a LiveSim account. Additionally, the offer includes a scaling plan, allowing traders to access more capital from the firm by withdrawing their profits.

The rules for these funded trading accounts are as follows:

- Profit Split: Profits can be withdrawn and are subject to an 80/20% profit split in the trader's favor.

- Trading Rules: The approved times, progression ladder, and daily loss rules remain in effect.

- Daily Loss Limits: These can be removed upon request once the trader's account balance exceeds the initial amount (e.g., $52,000 on a $50,000 account). Traders need to contact the Helios support team to adjust this.

- Drawdown Rules: LiveSim accounts are subject to an end-of-day drawdown, whereas Live accounts use a trailing drawdown. The drawdown limit is fixed at $194,000 for the $200,000 account and $380,000 for the $400,000 account.

- Data Fees: Monthly data fees are the trader's responsibility unless they already have their own data feed.

- Account Activity: An absence of five consecutive trading days without notification will lead to account termination.

Moreover, funded traders who reach the profit target on the $200,000 account after taking the TCP25 or the $400,000 account after taking the TCP50 will be eligible for a custom offer from the proprietary trading firm, providing an opportunity for further growth and increased trading capital.

Scaling Plan

The Trader Career Path features a scaling plan for candidates who successfully pass their evaluation. This plan allows funded traders to progress to higher capital accounts based on profit withdrawals.

Traders starting with the TCP25 program can increase their initial funding to $200,000. On the other hand, those who begin with the TCP50 can increase their funding up to $400,000.

The proprietary trading firm offers a custom deal once funded traders achieve the profit target on either the $200,000 account from the TCP25 program or the $400,000 account from the TCP50 program. This tailored offer allows traders to expand their trading capabilities with increased capital based on their demonstrated success and profitability.

The Gauntlet Mini

| GAU50 | GAU100 | GAU150 | GAU200 | |

|---|---|---|---|---|

| Virtual Starting Capital | $50,000 | $100,000 | $150,000 | $200,000 |

| Profit Goal | $3,000 | $6,000 | $9,000 | $11,000 |

| EOD Drawdown | $2,000 | $3,500 | $4,500 | $6,000 |

| Daily Loss Limit | $1,100 | $2,200 | $3,300 | $4,400 |

| Follow Progression Ladder | Up to 6 Contracts | Up to 12 Contracts | Up to 15 Contracts | Up to 16 Contracts |

| Monthly Subscription | $170 | $315 | $350 | $550 |

Progression Ladder

The Progression Ladder in the Earn2Trade programs sets limits on the number of contracts traders can open based on their account balance and profit levels. Traders need to self-regulate and ensure they do not open more contracts than allowed, as exceeding this limit will result in their evaluation being blocked for the day. However, starting from March 1, 2024, if a trader violates the progression ladder rule, their account will be blocked for that day but won't require a reset. The block will be removed at market close, allowing the trader to continue the next day with the same evaluation account.

For example, in a $50,000 account, a trader is normally allowed to open up to two contracts, such as two ES contracts or one ES and one CL contract. If the trader's profit increases their account balance to $51,501 or more, they can open up to four contracts. It's crucial that the trader's profits do not fall below this new limit while the positions are open; otherwise, they risk failing the examination.

Micro contracts such as MES, MNQ, MYM, M2K, MGC, MCL, M6B, M6E, and MHG are treated differently in the progression ladder. Up to ten micro contracts count as only one standard contract, providing traders more flexibility. For instance, if the ladder allows four contracts, a trader could manage up to 40 MES contracts as their total permitted exposure.

Traders must carefully monitor their accounts to avoid dipping below required levels and ensure they are not taking on excessive risk, which could jeopardize their evaluation.

Completing The Gauntlet Mini

If candidates complete The Gauntlet Mini, they are guaranteed a funding offer from Helios Trading Partners. This offer is based on the specific account parameters chosen during The Gauntlet Mini, with a few key differences:

- Profit Withdrawal and Split: Profits can be withdrawn and are subject to an 80/20% split, favoring the trader.

- Daily Loss Limits: Initially, these limits are in place to protect the trader's account balance. However, once the trader’s account balance exceeds the initial amount, for example, reaching $52,000 on a $50,000 account, they can request these limits removed. This adjustment can be made by contacting the Helios support team. Data Fees: Monthly data fees are the trader's responsibility unless they already possess their own data feed.

- Account Activity: If a trader does not trade for five consecutive days without prior notification, their account will be terminated.

LiveSim Account

Once traders complete an Earn2Trade evaluation, they can trade with a prop firm on a live account or opt for a simulated trading account, the LiveSim.

The LiveSim offers a simulated trading environment where traders can further refine their skills. This environment uses live data feeds and supports a variety of trading platforms. It is a transitional step for those who pass their evaluation but aren't ready to trade live. It allows them to practice trading in conditions similar to a live market and even withdraw profits they make.

It's important to understand that while LiveSim is available, Earn2Trade's ultimate goal is to identify traders who can successfully trade live and contribute to a proprietary trading firm. The firm may transition them directly to a live trading account, depending on a trader's performance.

For funded traders opting for a LiveSim account with Non-professional CME status, a one-time activation fee of $139 is deducted from their first profit withdrawal. This fee covers all four CME exchanges and is necessary for setting up and maintaining the account. A trader's first withdrawal must total at least $239 to cover this fee plus the minimum withdrawal amount.

Traders with Professional status and those trading on live accounts are subject to a fee of $135 per month per exchange.

Fee Structure for LiveSim Account

The fee structure for live and LiveSim accounts can vary depending on the trading platform used, but generally, the fees are as follows:

FCM Commissions: The maximum charge for full-size contracts such as ES, RTY, GC, and CL is $0.54 per side. For micro contracts like MES, MGC, and MNQ, the maximum is $0.46 per side.

Rithmic Platform Fee: $0.10 per side is added as the platform fee.

NFA Fee: An additional $0.02 per side is charged.

Trading Platform Fee: This fee depends on the trading platform being used. For instance, Finamark's fee is included in the Rithmic Platform Fee.

Exchange Fees: These vary based on the asset contract and are specific to each exchange. For accurate and current fees, traders should consult the CME Group's website for clearing fees: CME Group Fee Finder.

For LiveSim and live accounts, the fee structure related to exchange data varies based on the trader's CME status and the type of account:

LiveSim Account:

- Non-professional CME Status: A one-time activation fee of $139.00 is charged. This fee is deducted from the trader's first withdrawal and covers all four CME exchanges.

- Professional CME Status: Each exchange fee is $135 per month.

Live Account:

- The data fee is $135.00 per month for each exchange. It is charged to the trader's credit card or other payment methods and billed before the end of each month for the following month.

It's important to note that the CME charges these data fees per calendar month and does not pro-rate them. This means that even if the data service is activated during the last week of the month, the full monthly fee of $135 is still charged, regardless of how many days the data is used. These fees are pass-through costs directly from the exchange.

The funding firm, not Earn2Trade, charges the fees for live data—additionally, Earn2Trade acts as a billing agent on behalf of HTG. Please be aware that these fees are subject to change at any time.

Reputation And Social Media

Earn2Trade stands out impressively with a 4.7-star rating on Trustpilot with over 2.2K glowing reviews, demonstrating exceptional customer satisfaction. An overwhelming 86% of reviewers have given it 5 stars, with an additional 7% awarding 4 stars, underscoring the platform's superior quality and strong endorsement from the trading community. Minimal ratings fall below 3 stars, with only 1% at 3 stars, less than 1% at 2 stars, and 5% at 1 star. This predominantly positive feedback underscores Earn2Trade's esteemed reputation and effectiveness in enhancing the trading experiences of its diverse user base.

Stay connected with Earn2Trade on Instagram, boasting over 3.7K posts and a vibrant community of over 11.8K followers. Their feed is packed with insights, updates, discounts, weekly tips, monthly competition details, and educational content. For questions, the direct messaging feature offers a quick way to reach out.

Join over 5K followers by connecting with Earn2Trade on X, where you can explore an extensive collection of more than 51K posts packed with engaging insights and lively discussions. The platform regularly shares various content, including insightful reviews, exciting announcements, and the latest updates, all enriched with diverse media content. Stay up-to-date with Earn2Trade by interacting with their posts and keeping engaged with every new development, including exclusive discounts.

Beginner Crash Course

The Beginner Crash Course is designed to introduce novice traders to the futures markets, covering both fundamental and advanced trading concepts. This course includes 60 videos, each lasting between six to ten minutes, that explain market mechanics, general market conditions, risk management, and technical trading. The content is presented straightforwardly and easy to understand, using animations and simple examples to clarify complex ideas. A quiz follows each video to reinforce what students have learned.

Students who enroll in this course gain a solid foundation in trading basics, including understanding how exchanges and brokerages operate, what instruments can be traded, how to analyze charts, identify chart patterns, and make informed trading decisions. The course is structured to be accessible to anyone, regardless of their prior trading knowledge.

Upon purchasing the course, students receive lifetime access to all materials, allowing them to revisit the lessons anytime. This access continues indefinitely, provided the account shows activity; it may be canceled after four months of inactivity.

Overall, the Beginner Crash Course offers a comprehensive introduction to trading in future markets, equipping learners with the necessary skills to trade independently and effectively, focusing on fundamental trading knowledge, risk management, and technical analysis strategies. It also includes webinars that delve into more specialized topics, suitable for advancing your trading expertise.

Multiple Trader Career Path, Gauntlet Mini and Live/LiveSim accounts

At Helios, the proprietary trading firm, we offer a flexible account system. You can hold up to three accounts simultaneously, each serving a unique purpose. However, there are specific rules: you're allowed just one active LiveSim account at any time, but you can have multiple Live Accounts (live brokerage accounts through the prop firm). Setting up multiple accounts might lead to a longer compliance process, and the firm does not support a leader-follower or any other trade copying system between the accounts. For optimal results and to avoid issues with concentration, it is recommended to trade just one account at a time.

If you decide to reserve an account for future use, it's crucial to clearly disclose your plans for its activation and adhere to a timeline agreed upon with the prop firm. This responsible approach ensures smooth operations. Be aware that special account setups might incur additional costs, which you will be required to pay before the accounts are established.

For those enrolled in the Trader Career Path or Gauntlet Mini programs, each account must be registered under a separate email address. Although your various trading accounts—including those for evaluation, LiveSim, and live trading—might be linked to a single data feed user, please reach out to customer support if you encounter any issues managing multiple accounts.

Regarding the use of trade copiers, they are strictly forbidden. Suppose you use trade copiers and pass the evaluation. In that case, you will be limited to only one account (either a LiveSim or a Live Account) and will not be eligible for refunds on any additional accounts. Once paid, data fees to the CME and the data feed provider are non-refundable. Moreover, you cannot use trade copiers on your live or LiveSim accounts after passing the evaluation.

After Completing Evaluation

Earn2Trade confirms their eligibility and awards them with a certificate. The partner firm then discusses whether the candidate would prefer a Live or LiveSim account and sends over the funding offer. Candidates must sign this offer and submit documents for identity and address verification. The partner firm then facilitates the creation of the trading account, deposits the necessary capital, and provides the candidate with the account login details. A certified translation will be needed if the candidate’s primary language is not English.

Once the trading account is set up, traders can manage their trading as long as they adhere to the set rules and can start withdrawing their profits. Typically, this entire setup process takes about 5-7 business days, though timings may vary depending on the responsiveness of the involved parties. For those choosing a LiveSim account with Non-professional CME status, a one-time fee of $139 is deducted from the first withdrawal if profits are made, covering setup costs for all four CME exchanges. Professional traders or those with Live accounts are charged a monthly fee of $135 per exchange.

Risk Disclaimer

Earn2Trade provides educational materials solely for learning purposes and is not a financial services provider. Users should understand that Earn2Trade does not take responsibility for any losses or damages that may occur from using the information available on its website, including educational content, price quotes, charts, and analysis. Trading in the financial markets is risky and unsuitable for everyone; investing only what you can afford to lose is crucial. Also, the information on Earn2Trade, such as data and quotes, may not come directly from exchanges and might differ from actual market prices.

Before trading in the Forex market, consider your investment goals, experience level, and risk tolerance. Forex trading involves significant risks, including the potential for substantial price or liquidity changes due to varying political and economic conditions. The use of leverage can amplify both gains and losses. Trading on margin carries a high level of risk and may only be suitable for some investors since it's possible to lose more than your initial investment. Earn2Trade encourages you to use caution and to only trade with funds you can afford to lose.

Is Earn2Trade Legit ?

Earn2Trade is widely regarded as a legitimate and reliable funded trading platform, particularly for those looking to break into the futures market. The platform has successfully funded many traders, providing them up to $200,000 in trading capital. The evaluation process, known as the Gauntlet Mini, is clear and structured, giving traders a fair opportunity to showcase their skills without unnecessary complications. Earn2Trade offers a competitive profit split, with traders retaining up to 80% of their profits. The platform is transparent about its fees, with the Gauntlet Mini starting at $150, making it accessible to a wide range of traders. The consistency in payouts and the clear communication regarding costs and profit-sharing reinforce the platform's credibility and trustworthiness.

Customer feedback supports the platform's legitimacy, with many traders appreciating the educational resources, including live webinars and a supportive community. The platform's clear guidelines, straightforward evaluation process, and responsive customer service are frequently highlighted as major positives. These factors, combined with transparent operations and a fair profit-sharing model, make Earn2Trade a trustworthy and legitimate option for aspiring traders seeking funded capital.

Earn2Trade: Final Thoughts

Based on the document, Earn2Trade is a beneficial educational platform for aspiring and seasoned traders. It offers comprehensive training through courses and real-time simulations like the Career Path and Gauntlet Mini challenges, allowing participants to manage significant funds and retain substantial profits. The platform provides resources across various trading levels with tools such as the Progression Ladder to guide trading activities and lifetime access to materials for continuous learning. Although it restricts trading in Forex and highly volatile futures, this cautious approach to risk management emphasizes Earn2Trade's commitment to responsible trading. Overall, Earn2Trade equips traders with the necessary skills and support to advance their trading careers effectively.