Funded Trading Plus Review: Ultimate Guide and Analysis

Last Updated: January 1, 2025

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

I've recently started exploring the world of proprietary Trading and came across Funded Trading Plus, a trading firm that caught my attention. The firm offers various programs designed to provide traders with significant capital, and what's appealing is how these programs are tailored to different levels of trading experience and risk tolerance.

Their impressive Trustpilot rating of 4.9/5.0 initially drew my interest. It suggests a high level of user satisfaction and effectiveness, which is reassuring for someone like me who's still exploring the world of prop trading.

Funded Trading Plus Key Takeaways: Is it for You?

The Funded Trading Plus seems to offer a wide range of programs and features. From what I understand, these are designed to cater to everyone from beginners to more seasoned traders. This inclusivity is something I appreciate, considering my intermediate level of expertise in Trading.

| Feature | Details |

|---|---|

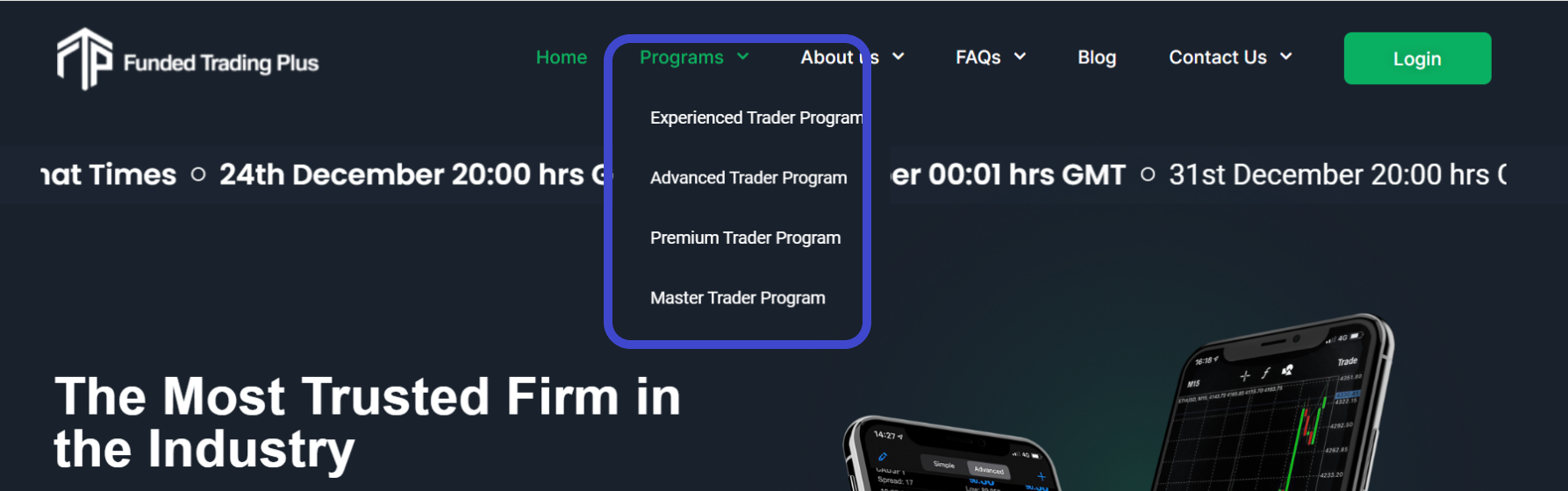

| Program Varieties | Experienced Trader, Advanced Trader, Premium Trader, Master Trader |

| Profit Splits | Starts at 70%, can increase up to 90% based on performance |

| Account Size Range | From $5,000 to $200,000, scalable up to $2.5 million |

| Asset Range | Forex, indices, commodities, cryptocurrencies |

| Trading Flexibility | No minimum trading days, No maximum challenge duration |

| Trading Platforms | Access to MT4 and MT5 platforms |

| Evaluation Types | Options for one-phase or two-phase evaluations |

Funded Trading Plus Platform: A Comprehensive Overview

The firm is based in the UK and offers varied account sizes ranging from $5,000 to $200,000. These accounts are scalable based on performance, which is a great way to progress as I gain more experience and confidence. They also support different trading platforms like MetaTrader 4 and 5 and allow Trading in diverse markets such as Forex, indices, commodities, and cryptocurrencies. This variety seems crucial for adapting to the evolving needs of modern Trading.

I'm particularly interested in their focus on trader education and support. Knowing there's a structure in place to help novice and experienced traders develop their skills is comforting. They Funded Trading Plus, combining flexibility with growth opportunities, which is ideal for someone like me who's looking to expand their understanding of trading dynamics.

Learning about the firm's origins has also been fascinating. It started as an extension of Trade Room Plus, a well-known UK live trade room and training facility. The diverse backgrounds of the founders, Simon M., James F., and Michael C., add a unique depth to the firm's approach. Their mission to support traders with limited funds and provide opportunities regardless of background is admirable.

As someone exploring the proprietary, Funded Trading Plus seems like a good fit. It offers a blend of educational resources, diverse trading options, and scalability, all important factors for me at this journey stage. Anyone in my position must consider the pros and cons of such a platform to see if it aligns with their trading goals and style. For me, it is a promising start.

Pros and Cons

When considering Funded Trading Plus, it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals.

Pros:

- Diverse Trading Programs: Funded Trading Plus offers a range of trading programs tailored to different experience levels, including instant funding options, one-step and two-step evaluation programs, and a Master Trader Program, allowing traders to find a program that matches their expertise and trading style.

- Wide Asset Range: The firm provides access to an extensive selection of tradable assets, from Forex pairs to indices, commodities, and cryptocurrencies, ensuring that traders have plenty of markets to explore and trade.

- Profit Sharing: Starting with a 70% profit share, the potential increase to 90% for consistent performers is an attractive feature. This generous profit split can significantly benefit successful traders.

- Expert Advisors: Compatible with numerous EAs.

- Flexibility: Users can take advantage of the flexibility by the firm, there are no minimum trading days, regular payouts and weekly withdrawals options provided.

Cons:

- No Overnight Trading: For swing traders and those who apply long-term strategies, the inability to hold positions overnight might be a significant drawback as it limits their strategies.

- Lack of Free Trial: The absence of a free trial means traders can only test the platform after committing funds, although discounted resets are available.

- Focused on Forex and CFDs: While there is a range of assets available, those looking for broader market access, including stocks, might find the offerings somewhat limiting.

- Extra Cost: Additional VAT costs for UK and European users at checkout.

Tradable Assets: What You Need to Know

Forex and CFDs: Funded Trading Plus provides a robust platform for Forex traders, offering various currency pairs. Major, minor, and exotic pairs are all part of the mix, giving Forex traders the diversity needed to employ various strategies, from scalping to long-term positional plays. The CFDs component extends to trading indices like the DAX, Nasdaq, and Dow Jones, which opens the door to Trading on the performance of market sectors and the broader economy.

Commodities and Metals: For those interested in the commodities market, Funded Trading Plus allows Trading in pivotal commodities such as natural gas and crude oil, which can be essential for traders looking to diversify their portfolios or hedge against market volatility. Metals trading includes opportunities in gold and silver, providing a classic hedge against inflation and currency devaluation.

Cryptocurrencies: In alignment with modern market demands, Funded Trading Plus has incorporated an impressive range of over 250 cryptocurrency pairs into its offerings. This variety caters to the burgeoning demand for digital asset trading and provides a fertile ground for traders specializing in the highly volatile crypto markets.

Funded Trading Plus offers a comprehensive array of tradable assets that can satisfy various trading preferences. The platform's ability to cater to different asset classes makes it an attractive option for traders looking to diversify their strategies across Forex, CFDs, commodities, metals, and cryptocurrencies. However, before engaging with the firm's services, potential users must consider the platform's pros and cons about their trading needs and strategies.

Account Tiers and Sizes

Funded Trading Plus caters to traders with various experience and investment capabilities through its tiered account system. These accounts offer a range of balances starting from $5,000 and extending up to $200,000.

The unique aspect of these accounts is their scalability - based on a trader's performance, the account balance can grow to a staggering $2.5 million. Traders can access funding through different pathways, including one-phase or two-phase evaluations and instant funding options.

Furthermore, the pricing structure of these accounts is tiered to suit various budget ranges, starting from $119 and going up to $4,500.

Leveraging Trades Details and Tips

Funded Trading Plus offers a range of leverage options tailored to different asset classes.

- Forex - 1:30

- Indices - 1:30

- Metals - 1:30

- Commodities - 1:30

- Cryptocurrencies - 1:2

This variation in leverage is significant because higher leverage can amplify potential profits and risks. Therefore, traders must align their leverage use with risk management strategies.

A thorough understanding of market volatility, particularly in the highly fluctuating cryptocurrency market, is crucial for effective leveraging decisions. This knowledge helps traders make informed choices that suit their trading style and risk tolerance.

The Payout Structure

As one of the best funded trader programs, FTP's profit split structure is carefully designed to motivate and reward successful trading.

- The initial profit split is 70% for instant funding, increasing to 80% for standard accounts.

- Consistent performance can raise the profit split to 90%.

This tiered approach to profit sharing incentivizes traders to perform well and aligns the trader's interests and the platform, ensuring that both parties benefit from successful trading activities.

Reputation and User Experiences

Funded Trading Plus has built a reputation for trustworthiness by adhering to regulatory standards, providing consistent payouts, and fostering a transparent trading environment. With a focus on trader education and robust customer support, the platform is committed to its users' success and trust.

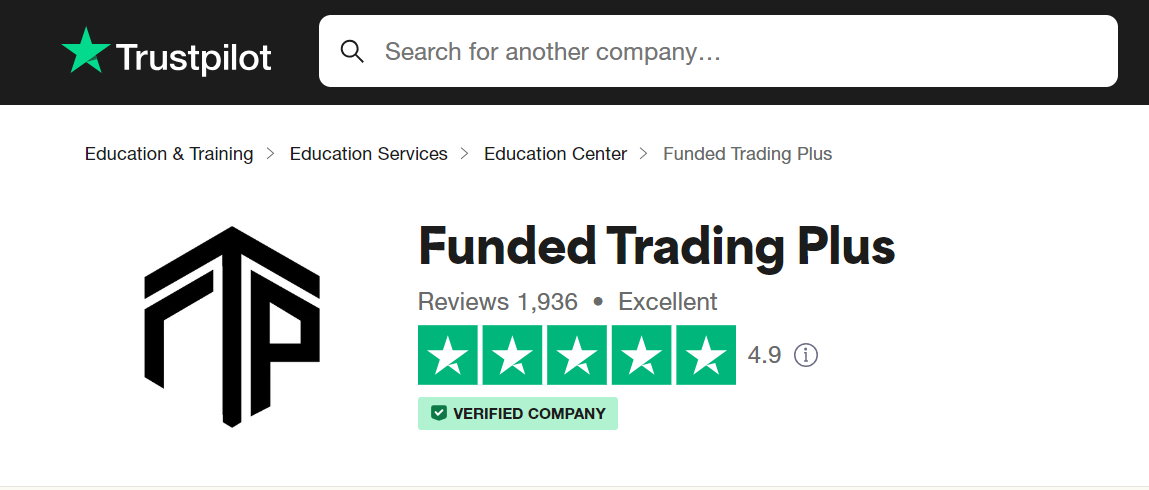

Trustpilot has awarded an impressive 4.9-star rating to Funded Trading Plus based on 1,936 reviews. Among these, 93% of reviewers gave the trading firm a 5-star rating. This is followed by 5% who were awarded four stars. Notably, less than 1% of reviewers have rated the firm with three stars, two stars, or 1 star. These ratings underscore the firm's credibility and trustworthiness.

You can stay updated with the latest information and news from Funded Trading Plus by following their Instagram account. With over 247 posts and a growing follower base exceeding 20,000, they regularly share a variety of content. This includes trading tips, the latest discount coupons, and other news. Additionally,

you have the option to send them a direct message for personal communication.

Funded Trading Plus also maintains a Facebook account, boasting over 23,000 followers and 22,000 likes. On this platform, you can engage with both the firm and its community by exploring reviews, questions, and mentions on their wall. Additionally, you can comment on posts and stay informed about the latest updates, including discount coupons and news. For more private inquiries, the option to send a direct message to the firm is available, should you prefer not to post publicly on their wall.

Pathway to Professional Trading

The Experienced Trader Program is tailored for traders with a solid foundation in the field, aiming to refine and enhance their trading skills. This program provides in-depth strategies and expert guidance, enabling participants to further their trading expertise and success.

- Single-phase Evaluation: Qualify for funding by meeting profit targets without exceeding drawdown limits.

- Profit Split: 80/20 and can go up to 100.

- Flexible Timing: No minimum days are required for trading; at your own pace.

- Simulated Loss: Maximum daily drawdown of 4% and a maximum relative drawdown of 6%.

- Profit Target: 10% profit to pass the evaluation and gain access to a live-funded account.

- Trading Platform: MT4, MT5, or TradingView.

- Account Size: Can range from $12,500 up to $200,000

- Refundable Fee: Ranges from $119 up to $949 depending on the account size

- Maximum Simulated Leverage: 30:1

- Monthly Fee: None

The Advanced Trader Program: Elevating Your Skills

The Advanced Trader Program is an immersive experience intended for traders serious about elevating their craft to the highest standards. It is a commitment to excellence, broken down into strategic phases:

- Two-Phase Evaluation Phase: Qualify for funding by meeting profit targets without exceeding drawdown limits. You can take your time.

- Profit Split: 80/20, which can go up to 90/10 and then 100.

- Flexible Timing: No minimum days are required for trading; complete the challenge at your own pace.

- Simulated Loss: Maintain a maximum daily drawdown of 5% and a maximum relative drawdown of 10%.

- Profit Target: Achieve 10% for Phase 1 and 5% for Phase 2.

- Trading Platform: MT4, MT5, or TradingView

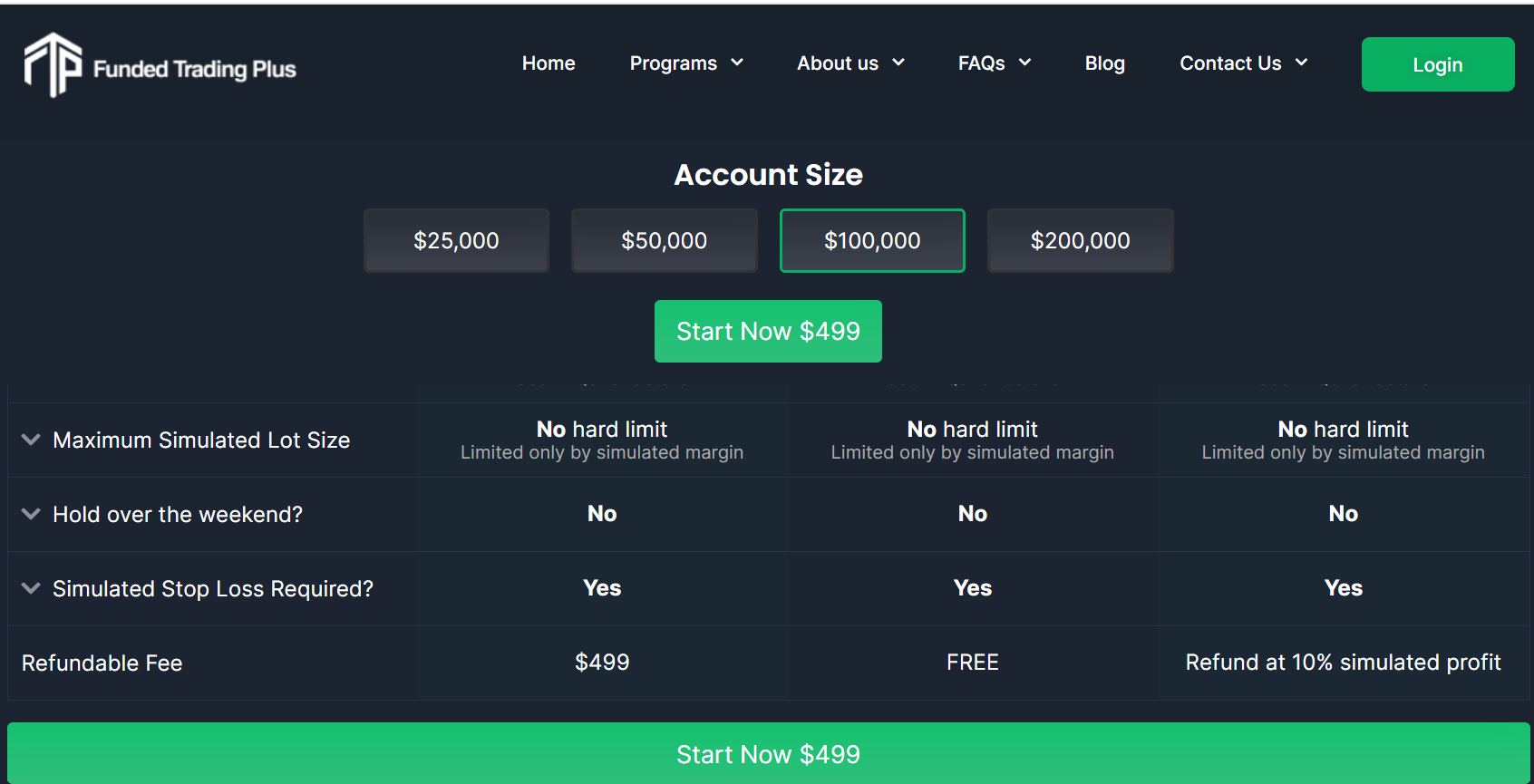

- Account Size: Can range from $25,000 up to $200,000

- Refundable Fee: Ranges from $199 up to $949 depending on the account size for Phase 1, Phase 2 is Free.

- Maximum Simulated Leverage: 30:1

The Advanced Trader Program offers a higher maximum simulated loss limit than the Experienced Trader Program, requiring the completion of two evaluation phases for risk management and capital allocation for successful traders. The program retains the straightforward rules of the Experienced Trader Program.

The Master Trader Program: Your Route to Trading Mastery

Likely the most advanced program offered, this could be aimed at traders seeking the highest level of expertise, providing comprehensive education and resources to achieve mastery in trading.

- Instant Evaluation Phase: Qualify for instant funding without evaluation. Maintain your account above the set drawdown limit to preserve it.

- Profit Split: 80/20, which can go up to 90/10 and then 100.

- Flexible Timing: No minimum days are required for trading; complete the challenge at your own pace.

- Simulated Loss: Maintain a maximum daily and relative drawdown of 6%.

- Profit Target: None.

- Trading Platform: MT4, MT5, or TradingView

- Account Size: Can range from $5,000 up to $100,000

- Fee: Ranges from $225 to $4,500 depending on the Account Size.

- Maximum Simulated Leverage: 30:1

This program features a simple goal: reach a 5% profit, and we'll stop tracking your max loss, which also starts at 5 %. This means you can grow your capital faster once you hit your target.

Note: For all the above Programs, the prices listed don't include VAT, which will be added for UK and European customers at checkout. Also, the fee you pay depends on your account size and can be a one-off or refundable.

Withdrawal and Profit-Sharing Rules

I checked out this trading program where you start off earning big. Initially, you pocket 80% of the profits from your simulated account. Once you hit a 20% profit, your share jumps to an impressive 90%. And in the live account, you're withdrawing profits over $50 weekly, keeping a cool 70% for yourself. Plus, if you're nailing it, there's an option for a performance-based commission to boost your earnings even more. It's like leveling up in trading with each success!

Ideal User

Funded Trading Plus is the go-to platform for various types of traders like me, offering something for everyone.

- Simulated Trading: Tailored programs and profit splits for simulation enthusiasts.

- Day Trading: Optimized services for daily trading activities.

- Strategy Flexibility: Open to various trading strategies for diverse trading preferences.

Trading Hours

Funded Trading Plus allows Trading during major market sessions, accommodating various trading styles, including overnight and weekend positions, depending on the program.

You can hold trades over the weekends, but it will need to be closed by the end of the day on Friday. Understanding these hours is crucial for strategizing trades, especially for those interested in day trading or international markets.

How to Sign Up

Signing up for a program or service typically involves a few key steps. Here's a detailed guide on how to sign up for any program that is suitable for you.

- Visit the Official Website: Start by navigating to the Funded Trading Plus official website. This is usually the primary source for accurate information and the sign-up process.

- Find the right program for you: From the drop down menu select the program you are looking for. You can chose from Experienced Trader Program, Advanced Trader Program, Premium Trader Program or Master Trader Program.

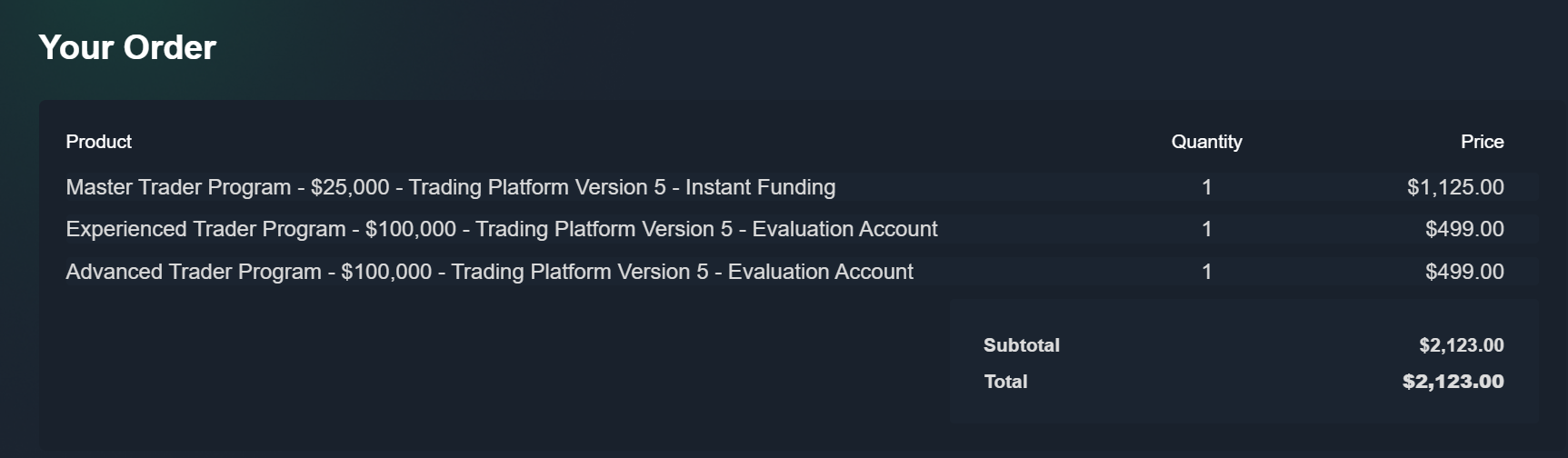

- Select the Account Size: Once you've chosen the Program, the next step is to select the account size. You will find an interactive table displaying comprehensive details about the Program and the chosen account size. This includes the number of phases, simulated profit target, simulated loss, refundable fee, and other pertinent information. Once you've chosen the Account size, click on Start Now.

- Now Chose your Platform: Here you have two platforms to chose from, Preferred Platform 5 and Legacy Platform 4.

- Preferred Platform 5: This is the most popular choice! This option opens the door to all cryptocurrency markets, making it an ideal and versatile choice for many trading scenarios. Plus, enjoy the convenience of weekend trading on this platform. Not only do you get access to a vast array of over 250 cryptocurrencies, but you can also trade forex, indices, metals, and oil. It's a comprehensive package designed to meet your diverse trading needs.

- Legacy Platform 4: This option provides traders with essential access to cryptocurrency markets. This is the original version of the platform, offering a classic trading experience. Along with a curated selection of cryptocurrencies, you also gain access to forex, indices, metals, and oil. It's a well-rounded choice for those looking to engage in various markets.

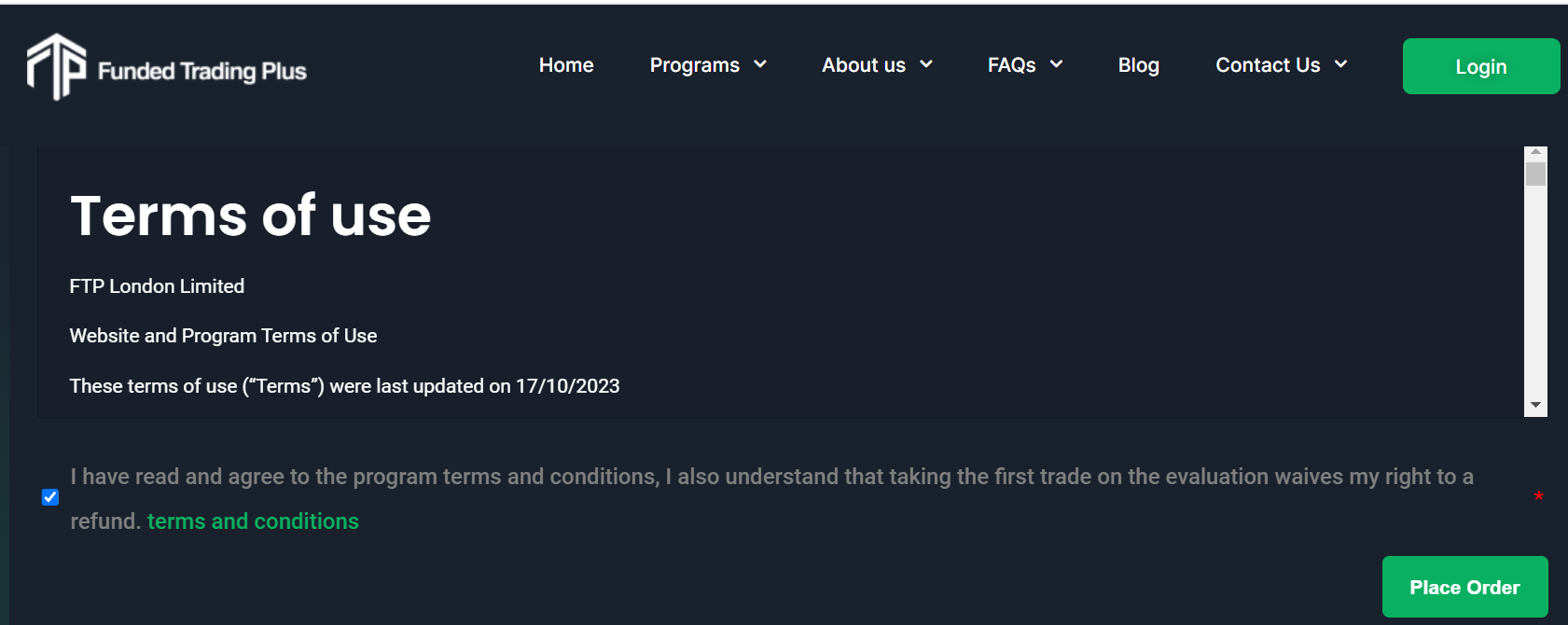

- Check out, Review order and Apply: Now that you've made your choices, it's a good idea to take a quick look at your order and confirm that everything is correct. Go through your selected items thoroughly, input your billing details, and fill in all the essential information. Choose the payment method that works best for you. If you have a coupon code, remember to include it too. Be sure to read the Terms of Use carefully. Finally, click 'Place Order' to finish your transaction.

Funded Trading Plus: Final Thoughts

So, my experience with the Funded Trading Plus, and let me tell you, it's like the cool kid on the block of proprietary trading. They've got a shiny 4.9 rating on Trustpilot, which is pretty impressive. They cater to everyone from newbies to trading gurus with various programs and platforms like MetaTrader 4 and 5.

What really caught my eye is how they adapt their accounts to fit all kinds of traders. They offer everything from beginner levels to a 'Master Trader' program. It's like choosing your adventure in the trading world. And the profit sharing? It's pretty generous. You get to trade in all sorts of markets - Forex, indices, commodities, crypto - it's like a trading buffet.

But here's the catch: there's no free trial, and if you're into trading while everyone else is sleeping, overnight trading isn't on the menu.

They also talk a lot about being on the up and up with regulatory stuff and being transparent, which is a big plus. They're also big on teaching and supporting their traders, so they're really in it for your success. If you're looking to get into or level up in trading, Funded Trading Plus might be worth a look.