OneUp Review 2025: Comprehensive Insights and Analysis

Last Updated: January 1, 2025

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

Key Takeaway:

Profit Split - 90% to the trader, first $10,000 profits free

Resets - Unlimited Balance Resets

Account Size - From $25,000 to $250,000

Contracts - From 3 to 25 depending on account size

Profit Target - $1,500 to $15,000 depending on account size

Trailing Drawdown - From $1,500 to $5,500 depending on account size

Daily Loss Limit - None

Price - From $125/month to $650/month depending on account size

OneUp Trader is a premier online platform dedicated to empowering traders through a combination of cutting-edge educational resources and practical trading tools. Renowned for its comprehensive blog and extensive library of webinars, video tutorials, and in-depth courses, OneUp Trader caters to traders of all experience levels. The platform stands out with its personalized mentorship programs and supportive community forum, fostering an environment of continuous learning and collaboration. Additionally, OneUp Trader offers innovative trading simulators and demo accounts, allowing users to practice and refine their skills in a risk-free setting, making it a go-to resource for aspiring and seasoned traders alike.

OneUp Overview

OneUp Trader was founded in 2017 by experienced traders and financial market professionals to democratize access to high-quality trading education and resources. The founders, driven by their own experiences and challenges in the trading world, recognized the need for a platform that provided theoretical knowledge and practical, hands-on training. This vision led to the creation of OneUp Trader, which has since grown into a leading online resource for traders worldwide.

OneUp Trader’s commitment to continuous improvement and staying current with market trends has made it a trusted name in the trading community.

Since its inception, OneUp Trader has attracted a substantial user base, boasting over 10,000 subscribers who actively engage with its resources and community features. The platform’s innovative profit split model is particularly appealing, allowing traders to retain up to 80% of their profits, which incentivizes performance and aligns the interests of the traders with those of the platform. But it's not just about the profits. OneUp Trader is about community. It offers personalized mentorship programs, one-on-one guidance from seasoned professionals, and a supportive community forum where traders can collaborate, share insights, and feel a sense of belonging. The platform also includes trading simulators and demo accounts, enabling users to practice and hone their skills in a risk-free environment before committing to real capital. This comprehensive approach ensures that traders are well-equipped to navigate the complexities of the financial markets and achieve long-term success.

Pros and Cons

When considering the firm, it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals.

Pros

- Extensive Educational Resources: OneUp Trader offers rich educational content, including webinars, video tutorials, and in-depth courses tailored for beginners and experienced traders. This helps users continuously improve their trading skills in a structured way.

- High-Profit Retention: The platform allows traders to keep 100% of the first $10,000 in profits and 90% after that, which is highly competitive and incentivizes traders to perform well.

- Support for Various Tradable Assets: Traders have access to a diverse array of tradable assets, including equity futures, currency futures, and commodities, providing ample opportunities to diversify trading strategies.

- No Financial Risk on Demo Accounts: OneUp Trader offers trading simulators and demo accounts, where users can practice trading without the risk of losing real money. This is ideal for testing strategies and gaining confidence.

- Community and Support: The platform fosters a supportive community with personalized mentorship programs. These programs provide one-on-one guidance from seasoned professionals and facilitate an environment where traders can share insights and learn from each other.

Cons

- High Account Reset Fee: The $100 fee to reset an account is steep for some traders, especially those needing multiple resets as they refine their trading strategies.

- Complex Rules and Requirements: The platform has strict rules regarding trading days, maximum position sizes, and profit targets, which might be overwhelming or restrictive for some traders, particularly novices who have yet to become familiar with navigating such requirements.

Tradable Assets, Platforms and Reset Option

Tradable Assets:

OneUp Trader provides access to a wide range of tradable assets across multiple categories. These include:

Equity Futures: E-mini S&P 500 (ES), E-mini NASDAQ 100 (NQ), E-mini DOW (YM), E-mini S&P Midcap 400 (EMD), E-mini Russell 2000 (RTY), and Nikkei (NKD).

Interest Rate Futures: 2-Year Note (ZT), 5-Year Note (ZF), 10-Year Note (ZN), 30-Year Bond (ZB), and Ultra-Bond (UB).

Currency Futures: Australian Dollar (6A), British Pound (6B), Canadian Dollar (6C), Euro FX (6E), Japanese Yen (6J), Swiss Franc (6S), New Zealand Dollar (6N), and all micro and mini currency pairs.

Agricultural Futures: Lean Hogs (HE), Live Cattle (LE), Feeder Cattle (GF), Corn (ZC), Wheat (ZW), Soybeans (ZS), Soybean Meal (ZM), and Soybean Oil (ZL).

Energy Futures: Crude Oil (CL), E-mini Crude Oil (QM), Natural Gas (NG), E-mini Natural Gas (QG), Heating Oil (HO), and New York Harbor (RB).

Metal Futures: Gold (GC), Silver (SI), Copper (HG), Platinum (PL), Palladium (PA), miNY Silver (QI), and miNY Gold (QO).

Micro E-Mini Futures: Micro E-Mini S&P 500 (MES), Micro E-Mini Dow Jones (MYM), Micro E-Mini Nasdaq-100 (MNQ), Micro E-Mini Russell 2000 (M2K), Micro Crude Oil (MCL), and Micro Gold (MGC).

Traders can request their funding provider to set up accounts to trade up to 10x Micro Contracts for one standard contract, providing flexibility and broader market access.

Supported Platforms:

OneUp Trader supports a variety of trading platforms, offering flexibility and convenience to its users. These platforms are available free of charge during the evaluation period and, in many cases, remain free once funded. Here are the platforms supported:

NinjaTrader: The preferred platform, free during evaluation and free on the NinjaTrader Desktop Version V.8.1 once funded.

R | Trader and R | Trader Pro: Both are free during evaluation and once funded.

Other Supported Platforms:

- Agena Trader

- Inside Edge Trader

- Investor RT

- Motive Wave

- MultiCharts

- Photon

- QScalp

- QST- Quick Screen Trading

- Track’n Trade

- Trade Navigator

- Volfix.net

- eSignal

- Jigsaw Trading

- ATAS Order Flow Trading

- Bookmap

- Quantower

- Sierra Chart

- Medved Trader

Reset Option:

Traders have the flexibility to reset their balance at any time for a fee of $100. To do so, they need to log into their dashboard and click on "Reset My Balance." This action will reset their starting balance and evaluation rules, allowing them to start fresh.

Account resets are processed immediately and typically reflected in the trader's account within 30 minutes. This quick and straightforward process ensures traders can promptly continue their evaluation without significant downtime.

Payout, Withdrawal and Profit

OneUp Trader's payout structure is designed to be highly favorable for its funded traders. The payout structure includes the following key components:

- 100% Profit Retention on Initial Profits: Funded traders can withdraw and keep 100% of their first $10,000 in net profits.

- 90% Profit Split on Additional Earnings: After the initial $10,000, traders enjoy a 90% profit split on all subsequent earnings. This means that for every dollar earned beyond the first $10,000, the trader retains 90%, and OneUp Trader receives 10%.

- Immediate Access to Profits: OneUp Trader's withdrawal policy allows traders to access their profits from the first day of being funded without extended waiting periods.

For example, if a trader earns $20,000 in profits above the withdrawal threshold, they would receive:

- First $10,000 @ 100% = $10,000

- Next $10,000 @ 90% = $9,000

- Total Payout = $19,000

For each account:

$25,000 - Withdrawal Profit Threshold $1,500

$50,000 - Withdrawal Profit Threshold $2,500

$100,000 - Withdrawal Profit Threshold $3,500

$150,000 - Withdrawal Profit Threshold $5,000

$250,000

- Withdrawal Profit Threshold $5,500

To request a profit withdrawal, traders must email their funding provider specifying the desired withdrawal amount. As long as the withdrawal threshold has been met, the request will be processed on the same day, making the process straightforward and efficient. Withdrawal requests must meet a minimum transfer amount of $1,000 of the trader's profit share. These withdrawals can be processed via Bank Wire or Cryptocurrency and can be requested any time between Monday and Friday. Funds typically post to the trader's account within 1-2 business days, though actual posting times may vary depending on the banking institution.

Reputation and Social Media

OneUp Trader stands out impressively with a 4.7-star rating on Trustpilot across 1,010 glowing reviews, demonstrating exceptional customer satisfaction. An overwhelming 81% of reviewers have given it 5 stars, with an additional 15% awarding 4 stars, underscoring the platform's superior quality and strong endorsement from the trading community. Minimal ratings fall below 3 stars, with only 1% at 3 stars, less than 1% at 2 stars, and 2% at 1 star. This predominantly positive feedback underscores OneUp Trader's esteemed reputation and effectiveness in enhancing the trading experiences of its diverse user base.

Funded Trading Accounts

OneUp provides multiple account options.

| Account Size | $25,000 | $50,000 | $100,000 | $150,000 | $250,000 |

|---|---|---|---|---|---|

| Contracts | Max 3 Contracts | Max 6 Contracts | Max 12 Contracts | Max 15 Contracts | Max 25 Contracts |

| Profit Target | $1,500 | $3,000 | $6,000 | $9,000 | $15,000 |

| Trailing Drawdown | $1,500 | $2,500 | $3,500 | $5,000 | $5,500 |

| Daily Loss Limit | None | None | None | None | None |

| Profit | First $10,000 Profits FREE | First $10,000 Profits FREE | First $10,000 Profits FREE | First $10,000 Profits FREE | First $10,000 Profits FREE |

| Reset | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Profit Split | 90% | 90% | 90% | 90% | 90% |

| Platform | FREE NinjaTrader License | FREE NinjaTrader License | FREE NinjaTrader License | FREE NinjaTrader License | FREE NinjaTrader License |

| Price | $125/Month | $150/Month | $300/Month | $350/Month | $650/Month |

Rules and Evaluation

Evaluation

Traders begin with the Trading Evaluation program, a real-time assessment designed to demonstrate their trading abilities. This program allows participants to trade, track, measure, and share their progress, ensuring they are on the right path to securing funding. The objective is to identify and support skilled traders, fostering a mutually beneficial environment where the trader's success translates to success for the platform.

Funding

After successfully passing the evaluation, traders receive funding and can start trading in real-time. This setup offers the flexibility to trade from anywhere at any time, equipped with the necessary tools to operate independently.

Funded traders can retain up to $10,000 of their initial profits and enjoy a 90% profit split on any additional earnings, all with zero financial risk to themselves.

Evaluation Parameters:

Trading Days

To be eligible for placement with funding partners, traders must complete a minimum of 15 trading days. Holidays and weekends are excluded from this requirement.

Permitted Products

Traders can only trade the following permitted products: 6A, 6B, 6C, 6E, 6N, 6J, 6S, CL, E7, EMD, ES, GC, GE, GF, HE, HG, HO, LE, M2K, MES, MNQ, MYM, MCL, MGC, NG, NKD, NQ, PL, QI, QG, QM, QO, RB, RTY, SI, UB, YM, ZB, ZC, ZF, ZL, ZM, ZN, ZS, ZT, ZW.

Permitted Times

All positions must be closed by 3:15 PM CT. The trading day starts at 5 PM CT and ends at 3:15 PM CT, excluding holidays and weekends. No positions can be opened between 3:15 PM CT and 5 PM CT.

Max Position Size

The maximum position size depends on the account size chosen. This defines the maximum allowable open positions across all products at any given time.

Profit Target

The selected account size determines the profit target and represents the minimum net profit required for placement with funding partners.

Consistency

Traders must exhibit consistent trading

patterns throughout the Evaluation. Consistency is measured by ensuring that the sum of the net profits from the trader’s three other best trading days equals at least 80% of the net profit from their single best trading day. For example:

- Best Trading Day: $1,000 (net after commissions)

- 80% of Best Trading Day: $800

- Sum of Three Other Best Trading Days: Must be equal to or greater than $800

Example of Consistency Calculation:

- Trading Day 4 - 2nd Best Trading Day: $400 (net after commissions)

- Trading Day 9 - 3rd Best Trading Day: $300 (net after commissions)

- Trading Day 15 - 4th Best Trading Day: $240 (net after commissions)

- Total: $400 + $300 + $240 = $940 (over $800)

Alternatively, consistency can be demonstrated within two days if the second largest trading day is $800 and the largest is $1,000.

Trailing Drawdown

The Trailing Drawdown is a dynamic value that increases as the account balance increases, maintaining a defined distance below the account balance. Traders must ensure their account balance stays within this amount to remain eligible for funding.

Funded Trader Rules

Traders must adhere to several key guidelines: they are only allowed to trade the permitted instruments during specified trading hours, must ensure their account balance does not touch or exceed the Trailing Drawdown, follow the Dynamic Scaling Targets, and close all positions before and during major economic releases.

Weekly Trading Volume

Traders must maintain a minimum weekly trade execution of at least 50% of the average trades completed during the evaluation. This trading volume is assessed weekly. CME holidays are excluded from this calculation, and the volume requirement is prorated accordingly. Traders must notify and request account hold approval from the funding partner for extended inactivity.

Positive Net PnL Requirement

Traders must have a positive net PnL greater than the initial starting balance at the end of every 15 calendar days during the initial 90-day probationary period, starting from the account's first trading day. Discretionary warnings are issued if the account balance falls below the initial starting balance.

Prohibited Activities

- Short-Duration Trading: Activities such as micro scalping, high-frequency trading, latency arbitrage, and tick scalping with a duration of less than 10 seconds, or those exploiting market data inefficiencies/errors, are strictly prohibited.

- Copy-Trading: Copy-trading between funded accounts held under different names or individuals is forbidden. However, copy-trading is allowed across multiple funded accounts for risk management and strategy diversification under the trader's name.

- Group Trading: Trading in concert with other individuals, executing identical trades across multiple accounts owned by different traders, is strictly forbidden.

- Hedging: Hedging positions across multiple funded accounts is strictly prohibited.

- Account Limits: Traders can have a maximum of three funded accounts simultaneously. For Express Accounts, traders are limited to one funded account at any time.

Please comply with these rules to avoid account termination.

Scaling Plan

Funded traders must adhere to the Dynamic Scaling Targets, with their buying power (number of contracts to trade) determined by the Cash On Hand value at the beginning of the trading session, as seen in R|Trader Pro. This buying power remains constant throughout the day, regardless of floating PNL, and allows for trading more or fewer lots, according to the provided graph. Upon making a withdrawal, the lot size will be adjusted to the current account balance based on the same graph, so it is recommended that ample profits be maintained in the account to continue trading the same lot size.

Scaling Targets:

Account Size of $25,000

$0-$1,500 – 2 LOTS

Over $1,501 – 3 LOTS

Account Size of $50,000

$0 to $1,500 – 2 LOTS

$1,501 to $4,000 – 4 LOTS

Over $4,001 – 6 LOTS

Account Size of $100,000

$0 to $2,000 – 3 LOTS

$2,001 to $3,000 – 4 LOTS

$3,001 to $5,000 – 6 LOTS

Over $5,001 – 12 LOTS

Account Size of $150,000

$0 to $4,000 – 5 LOTS

$4,001 to $8,000 – 8 LOTS

$8,001 to $12,000 – 10 LOTS

Over $12,001 – 15 LOTS

Account Size of $250,000

$0 to $5,000 – 6 LOTS

$5,001 to $12,000 – 12 LOTS

$12,001 to $20,000 – 18 LOTS

Over $20,001 – 25 LOTS

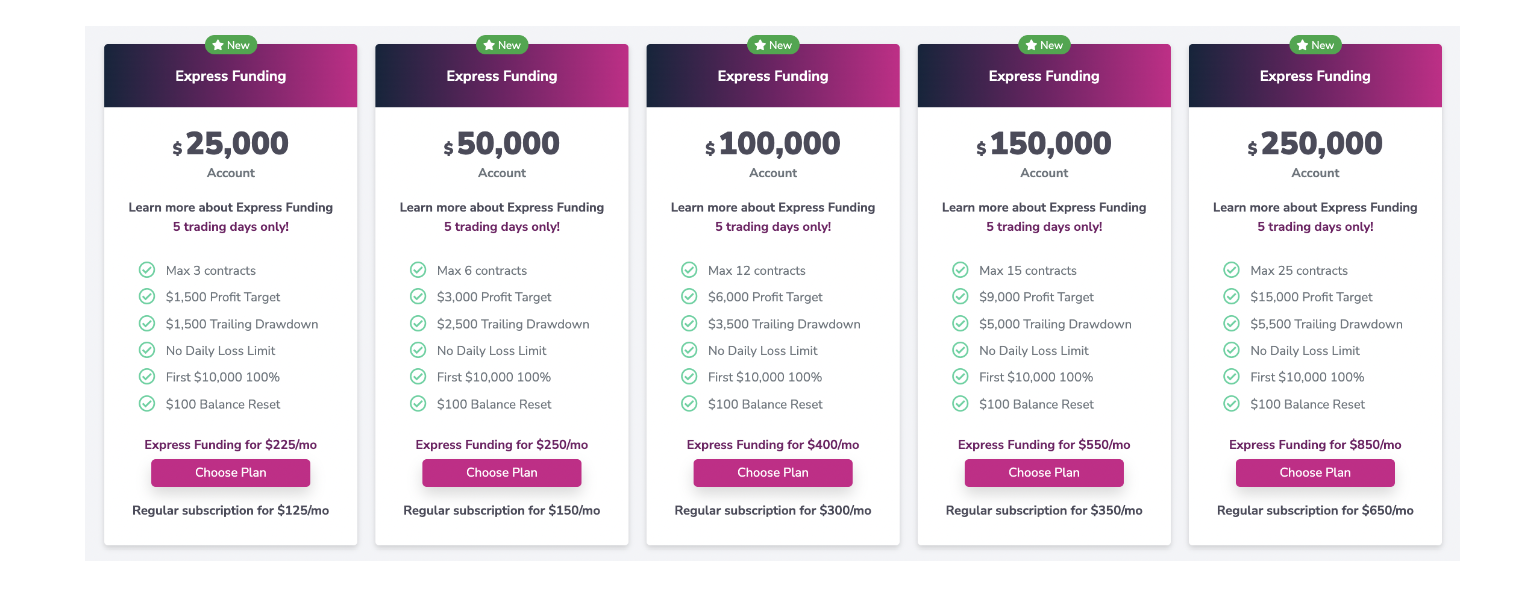

Express Funding

Eligibility for Express Funding

Express Funding is available to traders who have previously received a Funded Trader Account (FTA) through OneUp Trader but have had their FTA terminated within the past 30 days. This program is designed to provide a second chance to those who recently experienced an account termination, allowing them to quickly re-establish their funded status.

Benefits of an Express Funding Account

The primary benefit of an Express Funding Account is the expedited evaluation process, which allows traders to complete the Evaluation in just 5 trading days. This streamlined process is specifically tailored for traders who have already demonstrated their trading skills and may only need to revisit part of the evaluation criteria. This program enables traders to regain their funded status more rapidly, minimizing downtime and allowing them to return to active trading swiftly.

Monthly Fee for an Express Funding Account

The monthly fee for an Express Funding Account is determined by the account size for which the trader is eligible. This fee structure ensures that the cost aligns with the scale of the trader's account, providing a fair and proportional fee based on the specific funding level they qualify for.

Rules and Parameters of the Express Funding Account

The Express Funding Account follows the same rules as a normal Evaluation account, with the added benefit of completing the process within five trading days. Traders can only have one Express Funding Account at a time, but they can be funded on up to three accounts simultaneously using different email addresses.

Trading Days

Traders must trade at least five trading days to qualify for placement with funding partners. Holidays and weekends are excluded.

Permitted Times

All positions must be closed by 3:15 PM CT. The trading day starts at 5 PM CT and ends at 3:15 PM CT, excluding holidays and weekends. No positions can be opened between 3:15 PM CT and 5 PM CT.

Max Position Size

The maximum position size is determined by the account size chosen, defining the maximum allowable open positions across all products at any given time.

Profit Target

The profit target is based on the selected account size and represents the minimum net profit required for placement with funding partners.

Consistency

Traders must demonstrate consistent and regular trading patterns throughout the Evaluation. The net profits from the trader's three other best trading days must total at least 80% of the net profit from their single best trading day.

Consistency Example:

- Best Trading Day: $1,000 (net after commissions)

- 80% of Best Trading Day: $800

- Sum of Three Other Best Trading Days: Must be equal to or greater than $800

Example Calculation:

- Trading Day 4: $400 (net after commissions)

- Trading Day 9: $300 (net after commissions)

- Trading Day 15: $240 (net after commissions)

- Total: $400 + $300 + $240 = $940 (over $800)

Trailing Drawdown

Traders must ensure their account balance does not hit or exceed the Trailing Drawdown, which increases a defined distance as the account balance increases.

Frequency of Express Funding Accounts

Users can have an Express Funding Account a maximum of two times within a 30-day calendar period.

Account Size Purchase

Users can purchase an Express Funding Account the same size as their previous Funded Account.

Cancellation of Express Funding Account Subscription

If a user cancels their subscription to the Express Funding Account, they will lose the Express Funding Account offer and can only start a regular Evaluation Account.

Options if Trailing Drawdown is Hit

If users hit the trailing drawdown, they can reset their account for $100.

Subscription Renewal and Rule Violations

Suppose an Express Funding Account subscription renews, and the account hits the trailing drawdown or violates an Evaluation rule. In that case, the account will be subject to the same terms and conditions as initially stipulated, potentially resulting in account termination or the need for a reset.

Blog and Educational Resources

OneUp Trader offers a comprehensive suite of blog and educational services designed to equip traders with the knowledge and skills necessary for success in the financial markets. The platform's blog features many articles covering various topics, from basic trading principles to advanced strategies. These articles are crafted by industry experts and experienced traders, ensuring the content is informative and practical. The blog also delves into current market trends, providing timely analysis and insights that help traders stay ahead of the curve. Additionally, OneUp Trader's blog often includes interviews with successful traders and industry professionals, offering readers a glimpse into the minds of those who have excelled in the trading world. The blog's user-friendly interface and well-organized categories make it easy for traders to find relevant information quickly, enhancing their learning experience. Regular updates ensure that the content remains fresh and relevant, keeping traders informed about the latest market developments and opportunities.

OneUp Trader's educational services are designed with you in mind, catering to traders of all experience levels. The platform offers a variety of resources, including webinars, video tutorials, and in-depth courses that cover everything from the basics of trading to advanced techniques and strategies. These resources are tailored to help you develop a solid foundation in trading principles while also providing the tools and knowledge needed to refine and enhance your trading skills. OneUp Trader's educational services emphasize practical, hands-on learning, with a focus on real-world applications and trading scenarios. The platform also offers personalized mentorship programs, where you can receive one-on-one guidance from seasoned professionals. By leveraging these educational resources, you can build your confidence, improve your decision-making abilities, and ultimately achieve greater success in the financial markets. The availability of a supportive community forum further enhances your learning experience, allowing you to share insights, ask questions, and collaborate with peers. Additionally, OneUp Trader offers trading simulators and demo accounts, enabling you to practice and hone your skills in a risk-free environment before committing real capital to the market.

Is OneUp Legit ?

OneUp Trader is recognized as a legitimate and trustworthy funded trading platform, especially for those interested in futures trading. The platform has successfully funded thousands of traders, offering access to capital up to $250,000. OneUp Trader's evaluation process is straightforward, allowing traders to demonstrate their skills through a 15-day trading evaluation with clear and transparent rules that make it accessible for novice and experienced traders. Financially, OneUp Trader provides a competitive profit split, with traders keeping up to 100% of their first $8,000 in profits and 80% after that. This generous model is particularly appealing and highlights the platform's commitment to rewarding successful traders. The platform also stands out for its transparency, with no hidden fees or scaling plans and an evaluation fee starting at $125, making it affordable for many traders.

OneUp Trader's legitimacy and reliability are underscored by the consistently positive user feedback it receives. Users appreciate the platform's simplicity, clear guidelines, and responsive support team. The platform’s quick funding process, lack of hidden fees, and the flexibility to trade on a variety of futures markets further enhance its credibility. These factors, combined with a fair profit-sharing structure, confirm that OneUp Trader is a legitimate and reliable option for traders seeking significant capital.

OneUp Trader: Final Thoughts

OneUp Trader, founded in 2017 by experienced traders and financial market professionals, is dedicated to democratizing high-quality trading education and resources. The platform offers extensive educational materials, including a comprehensive blog, webinars, video tutorials, and in-depth courses, catering to traders of all experience levels. The blog covers various topics, from basic trading principles to advanced strategies and current market trends, providing timely analysis and insights. OneUp Trader also includes interviews with successful traders, enhancing the learning experience with real-world perspectives.

The platform has grown to attract over 10,000 active subscribers, offering features such as trading simulators and demo accounts, which allow users to practice and refine their skills in a risk-free environment. OneUp Trader's innovative profit split model is particularly appealing. It allows traders to retain up to 80% of their profits, incentivizing performance and aligning the interests of traders with those of the platform. Additionally, the platform provides personalized mentorship programs, one-on-one guidance from seasoned professionals, and a supportive community forum, fostering continuous learning and collaboration.

OneUp Trader supports a wide range of tradable assets, including equity futures, interest rate futures, currency futures, agricultural futures, energy futures, metal futures, and micro-mini futures. The platform supports various trading platforms such as NinjaTrader, R | Trader, and others, offering flexibility and convenience. Traders can reset their balance for a fee of $100, and the payout structure allows for 100% profit retention on initial profits up to $10,000, followed by a 90% profit split on additional earnings. The withdrawal process is straightforward, with bank wire or cryptocurrency options, and funds typically post within 1-2 business days.

The Trading Evaluation program is designed to showcase traders' abilities in real-time, requiring a minimum of 15 trading days to be eligible for funding. Traders can only trade specified permitted products and must close all positions by 3:15 PM CT. The maximum position size and profit target are based on the chosen account size, and traders must demonstrate consistent trading patterns, ensuring that the net profits from their three other best trading days total at least 80% of the net profit from their single best trading day. The Trailing Drawdown is a dynamic value that increases with the account balance, maintaining a defined distance below it.

Funded traders must adhere to several guidelines, including maintaining a minimum weekly trade execution of at least 50% of the average trades completed during the evaluation, having a positive net PnL during the initial 90-day probationary period, and avoiding prohibited activities such as short-duration trading and group trading. Traders can have up to three funded accounts simultaneously, with specific rules for Express Accounts.

Express Funding is available to traders who have had their Funded Trader Account (FTA) terminated within the past 30 days, allowing them to quickly re-establish their funded status. The expedited evaluation process can be completed in just five trading days, and the account size determines the monthly fee for an Express Funding Account. Traders can have an Express Funding Account a maximum of two times within 30 days.

The scaling plan for funded traders is based on Dynamic Scaling Targets, with the number of contracts to trade determined by the Cash-on-hand value at the beginning of the trading session. The buying power remains constant throughout the day, and the lot size is adjusted upon withdrawal. The scaling targets vary based on the account size, providing structured growth and risk management.

OneUp Trader's educational services are tailored to help traders develop a solid foundation in trading principles, focusing on practical, hands-on learning. The platform offers personalized mentorship programs, trading simulators, and demo accounts, enabling traders to practice in a risk-free environment. The supportive community forum allows traders to share insights, ask questions, and collaborate with peers, enhancing the learning experience.