Drawdown – Definition, Types, and Importance

Hitting a rough patch with a funded account is a rite of passage for traders at prop firms. When you're in this game, knowing the ropes about how much of a downturn you can handle and the timeframe you've got to make a comeback is crucial. It's all about staying in play and not getting sidelined.

Recovering from a downturn using a prop firm's funds is a unique challenge, distinct from managing your own capital. The margin for error is significantly smaller, with strict limits on losses and a strong emphasis on conservative strategies.

What Is A Drawdown?

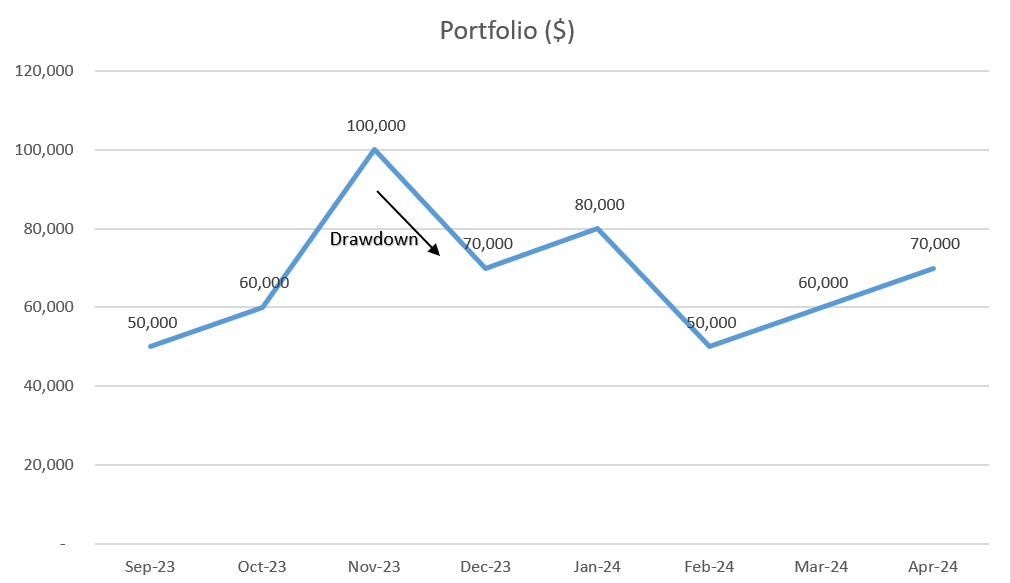

A drawdown is all about understanding the ups and downs in the value of your investment portfolio. Picture this: you've done well, and your portfolio has grown to $100,000. But then comes one of those rough market days, and suddenly, it's down to $70,000. That $30,000 hit, which is 30% of what you had at the peak, is what we call a drawdown.

Simply put, a drawdown measures how much you've lost from your portfolio's highest point (here, $100,000) to its lowest (now $70,000), giving you a sense of loss at 30%. This concept is super helpful in the world of finance and investing because it helps us get a clear picture of what kind of ride we're in for with our investments. By getting to grips with drawdowns, we can better manage our expectations and decisions, ensuring they match up with how much risk we're willing to take and what we aim to achieve with our investments.

What is Maximum Drawdown?

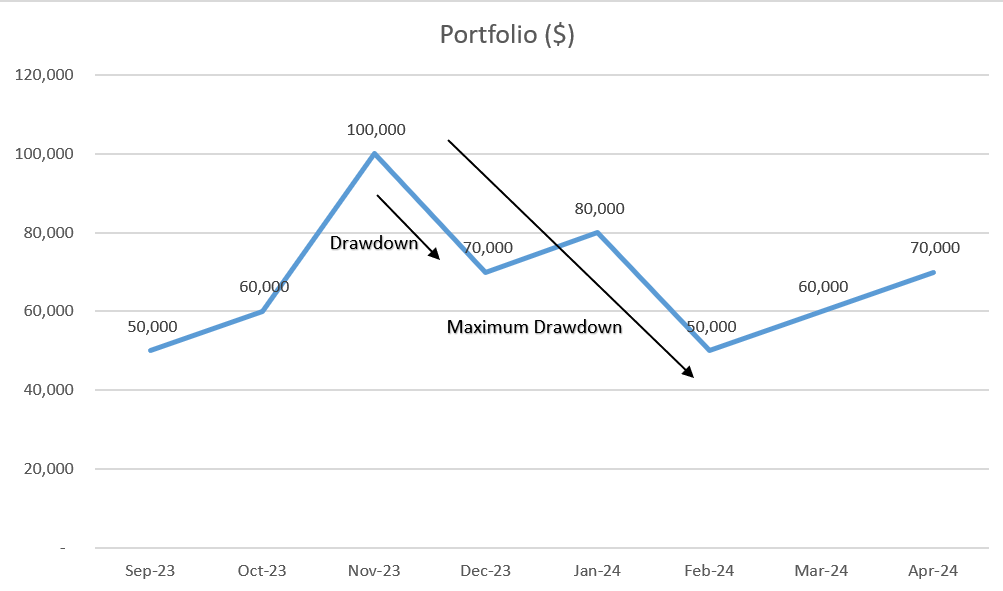

Maximum drawdown is like the worst dip your investment takes on its roller-coaster ride through the market. It's about spotting the steepest drop from the top of the hill (peak) to the bottom (trough) your trading account has seen over time. Imagine you jumped in at the highest point just before a big fall and got out at the bottom — that's the kind of loss we're talking about.

Looking at the graph below, you'll notice a bit of a dip — about 30% — in the portfolio between November and December of 2023. But when you zoom out and check out the whole graph, you see that the total dip in the portfolio for the whole period was $50,000. So, if we're talking numbers, the peak was $100,000, and the biggest dive it took was the trough, hitting a low at $50,000, which means the maximum drawdown was 50%.

For anyone playing the trading game, getting a grip on maximum drawdown is key. It shows you the riskiest twist in your investment journey, helping you figure out how tough things could get. By understanding the biggest potential setback you could face, you're better equipped to make smart choices, tailor your risk game plan, and ensure your investment strategy fits what you're okay with risking.

What is the Trailing Drawdown?

A trailing drawdown, often seen in trading and especially within prop firms, is a dynamic risk management tool that adjusts your allowable loss limit based on the highest value your account has reached, not just your initial balance. This mechanism is designed to protect profits while still giving traders room to operate during market fluctuations.

Here's how it works: As your account value increases, the trailing drawdown recalibrates based on the new highs. If your account value grows, the amount of money you can lose before hitting the drawdown limit increases, too, effectively trailing your success to safeguard against larger relative losses as you make more profit.

For example, let's say you start with a $10,000 account, and your prop firm sets a 5% trailing drawdown limit. Initially, you can only afford to lose up to $500 by breaching the drawdown threshold. Now, imagine your account grows to $12,000. With the trailing drawdown in place, your new drawdown limit is recalculated off this higher value, so now you can only lose up to $600 (5% of $12,000) from the $12,000 peak, not just your starting balance.

This approach encourages traders to push for higher account values, knowing that their allowable drawdown buffer expands with their success. This offers a more flexible risk management strategy that aligns with their growing portfolio.

Drawdown in Prop Firms

Prop firms set a cap on how much you're allowed to lose — think of it as your financial guardrail. And yes, for many, there are also time constraints to add to the fun. Hit that loss limit, and it's game over. This starkly contrasts personal trading, where your only limit might be the depth of your pockets.

Most of the time, prop firms will let you ride a loss of about 4% to 10% of your account value. The key isn't necessarily the size of the buffer; you can adjust your risk level to match it.

Moreover, prop firms often set a profit goal with a deadline. This can be a double-edged sword: if you chase the goal too hard, you might slip into the very losses you're trying to avoid.

Types of Drawdown: Relative vs. Absolute

Getting the hang of relative and absolute downturns can be a game-changer. Some prop firms use a fixed figure to define your loss limit from your starting balance — that's your absolute downturn. Others go for a relative downturn approach. Here, as your account balance grows, so does your buffer zone. It's a bit like having a safety net that moves up with you.

For instance, with a 5% relative downturn on a $10,000 account, your safety net is $500. If you grow your account to $10,200, your new safety net adjusts to a $9,700 floor — always a $500 drop from your highest point. On the flip side, with an absolute downturn, your floor doesn't budge from $9,500, regardless of any gains.

Why is Drawdown Important in Prop Trading?

Drawdown in prop trading is like the guardian angel of both the trader's and the firm's funds, ensuring everyone plays it smart with risk management. It's the unsung hero that keeps traders from diving too deep into risky waters, marking the line between bold moves and reckless ones. Here's the scoop on why it's such a big deal:

Risk on a Leash: Think of drawdown limits as the safety net that keeps traders from plunging into the abyss of losses. By setting a cap on how much you can lose, prop firms make sure you're not putting yourself—or them—in a tight spot financially. It's all about keeping those losses in check, so one bad move doesn't sink the ship.

The Performance Litmus Test: Drawdown isn't just about the numbers in the red; it's a full-on performance review. It shows how much you lost and how you handled those losses and bounced back. It's like the resilience meter for traders, proving how well you can protect and grow your capital, even when it gets tough.

Keeping the Treasury Intact: Making money is the name of the game, but keeping it is the master strategy in prop trading. Drawdown limits are the discipline of the drill sergeant, ensuring traders don't burn through cash on a few bad calls. It's about playing the long game, preserving the war chest for battles that count.

Consistency is Key: Minimizing drawdowns nudges traders toward a steady, disciplined trading strategy, steering clear of the allure of quick, risky wins. This strategy is your ticket to lasting success in the volatile trading arena, proving that slow and steady can win the race.

Smart Risk, Smart Reward: With drawdown management, it's all about making calculated moves. Knowing your max loss limit sharpens your trade selection, pushing you towards decisions with better odds and more favorable risk-reward ratios.

Mental Peace: Knowing there's a drawdown cap brings a sense of calm to the trading storm, allowing traders to focus on strategy over stress. It's about making smart decisions without fearing total ruin looming over your head.

And here's the kicker: Most Forex prop firms have strict rules on daily and maximum drawdowns, which can be a tough hurdle even for seasoned traders. These rules aren't there to make life hard but to prepare traders for handling serious cash responsibly. The good news? There are plenty of strategies to keep you within those limits, enhancing your trading discipline.

Trading with a prop firm brings accountability that's hard to replicate, especially when dealing with smaller amounts of personal money. It's easy to shrug off losing 20% of your cash as a bad day at the market. However, having a drawdown limit is like having a personal trainer for your trading skills, pushing you to improve and thrive in the Forex arena. It's one of the many solid reasons to consider trading with a prop firm, as it teaches you to know your limits and play within them, ensuring you stay sharp, disciplined, and ready to make the most of your market edge.

Prop Firm Drawdowns Comparison

| Prop Trading Firm | Drawdown |

|---|---|

| Apex Trader Funding | None for all FULL accounts, $625 for Static account |

| Elite Trader Funding | From $1k to $7K based on the account size and type |

| Bulenox | Between 2.2%-10% by account size |

| Uprofit | From No Drawdown to $3,000 based on Account Type |

| My Funded Futures | From $2,000 to $4,500 |