My Funded Futures Review 2025: MFFU Trading Discount Codes and Insights

Last Updated: January 1, 2025

Author: Day Trading Insights Research Team

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

My Funded Futures Coupon 2025

Key Takeaway:

Profit Split - 100% upto $10K, 90% thereafter

Min. Trading Day - 1

Max/Min Trading Day - None

Max. Withdrawal Amount - None

Plan Cost - Starting from $80/month to $375/month

Profit Target - From $3,000 to $12,000

Max Position for Accounts - From 3 Contracts up to 15 Contracts

Trailing Max Drawdown - From $2,500 to $4,500

Reset Fee - From $80 to $375

Jumping into the world of MyFundedFutures (MFFU) feels like joining a friendly neighborhood where everyone's into futures trading, whether you're just peeking into the scene or already a pro at navigating the markets. They've built a supporting space around pushing each other to grow, stay consistent, and bag some profits. Here's a kicker: traders get to manage simulated capital of up to $600K, making the stakes exciting yet educational. MFFU sets itself apart by giving traders the lowdown on everything they need to conquer the futures market. It offers a real shot at trading with the firm's capital through a neat evaluation process. They're all about sharing the wealth, too, with traders getting a good slice of the pie from the profits they rake in.

Beyond just the chance to trade with someone else's dime, MFFU hooks traders up with the latest market insights and analysis to keep everyone ahead. They're big on playing it smart and safe, so they have all these top-tier risk management tools to help traders stay disciplined and protect their assets. The cherry on top? A vibrant Discord community where traders can swap stories, tips, and tricks. And if you're wondering about the fine print, there's no need—MFFU prides itself on being an open book, ensuring everyone knows exactly what's up with payouts and trading rules. It's all about ensuring everyone's on the same page and fostering a transparent and supportive trading adventure.

My Funded Futures Review

Launched in September 2023 as an offshoot of its successful forex trading counterpart, MyFundedFX, MyFundedFutures entered the futures prop trading arena with a novel approach by simplifying the funding process to a single-step evaluation. This innovative strategy is designed to fast-track traders into the futures market, allowing them to manage up to $600K in simulated capital and promising the chance to keep a significant portion of their profits—100% of the first $10,000 and 90% after that.

Emphasizing its dedication to trader success and market flexibility, MyFundedFutures supports various futures contracts and provides funded accounts for real trading post-evaluation, all without the usual activation fees. This approach not only sets MyFundedFutures apart by making futures trading more accessible but also benefits from the proven track record of its parent company in the forex domain, showcasing a commitment to fostering growth and profitability within its trading community.

Pros and Cons

When considering the firm, it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals.

Pros

- Extensive Capital Access: Traders can manage up to $600K in simulated capital, offering a broad spectrum for practice and growth in futures trading.

- Simplified Funding Process: The evaluation process, streamlined to a single step, ensures fast and easy access to funding, reassuring potential traders about the platform's user-friendliness.

- Profit Sharing: MFFU's profit split is not just attractive; it's motivating. Traders keep 100% of the first $10,000 and 90% after that, providing a strong incentive for successful trading.

- Diverse Trading Assets and Platforms: Traders can engage with a wide range of assets across major exchanges, and the selection of trading platforms cater to various preferences and skill levels.

- Supportive Community and Resources: The vibrant Discord community and the provision of market insights and risk management tools support traders in developing their strategies.

Cons

- Prohibited Trading Practices: Strict guidelines against high-frequency scalping and unsanctioned automated trading may limit traders specializing in these strategies.

- Evaluation to Funded Account Transition: While the single-step evaluation process is a pro, transitioning from evaluation to a funded account requires careful navigation of trading parameters and could be challenging for some traders.

What are My Funded Future's Tradable Assets ?

My Funded Futures firm offers a broad selection of tradable assets across several major exchanges, ensuring traders can access various markets. Here's a simplified breakdown of the assets you can trade:

- Chicago Mercantile Exchange (CME): Dive into indices, currencies, and more with contracts like the E-mini S&P 500 (ES), E-mini NASDAQ 100 (NQ), Russell 2000 (RTY), Nikkei 225 (NKD), and a variety of forex futures including the Australian Dollar (6A), British Pound (6B), Canadian Dollar (6C), Euro (6E), E-mini Euro (E7), Japanese Yen (6J), Swiss Franc (6S), and more. Additionally, micro versions of these contracts, like MES, MNQ, and M2K, make it easier for traders with smaller accounts to participate.

- Chicago Board of Trade (CBOT): Focus on both financial and agricultural markets with assets like the Dow Jones Industrial Average (YM), U.S. Treasury Bonds (UB, TN, ZT, ZF, ZN, ZB), and a range of commodities including Corn (ZC), Wheat (ZW), Soybeans (ZS), Soybean Meal (ZM), Soybean Oil (ZL), and the micro version of the Dow (MYM).

- Commodity Exchange, Inc. (COMEX) Specializes in metals, including Gold (GC), Silver (SI), Copper (HG), micro Gold (MGC), micro Silver (SIL), and Platinum (PL).

- New York Mercantile Exchange (NYMEX): Trade in the energy sector with Crude Oil (CL), Natural Gas (NG), micro Crude Oil (MCL), RBOB Gasoline (RB), Heating Oil (HO), and their micro versions (QM, QG).

What are My Funded Future's Trading Platforms ?

MFFU offers a selection of trading platforms to suit various trader needs:

- NinjaTrader stands out for ease of use and versatility, making it ideal for all levels of traders.

- R | Trader Pro focuses on speed and reliability, which is perfect for those needing quick market data.

- Tradovate is known for its clean design and simplicity, targeting traders who prefer an uncluttered interface.

- TradingView caters to those who emphasize charting and visual tools for trading.

- Quantower combines advanced features with a user-friendly interface appealing to tech-savvy traders.

- Sierra Chart offers detailed charting tools for in-depth analysis suited for experienced traders.

To use Rithmic software or access its market data, users must electronically sign Rithmic’s Market Data Subscription Agreement and self-certify as either a Professional or Non-Professional Subscriber through Rithmic’s self-certification process. These documents can only be signed electronically via R | Trader™ or R | Trader Pro™ platforms. Importantly, using R | Trader Pro™ for signing incurs a usage fee, whereas R | Trader™ offers this service without additional cost. This requirement applies to all Rithmic market data users, including those using third-party interfaces for data viewing or trading on Rithmic’s platform, necessitating agreement, and electronic signature on the specified documents.

Note: In the challenges, it's essential that only the account holder trades on their account and avoids making any changes once they've moved to the next phase. This ensures fairness and a true test of one's trading skills. They are breaking this rule by altering account settings or letting someone else trade, which can lead to account termination. Keeping to these guidelines shows commitment to the process and helps maintain the integrity of the challenge.

What is My Funded Future's Payout and Withdrawal policy ?

Payout

MyFundedFutures is celebrated for its clear and favorable payout policy, reflecting a deep commitment to its traders' financial well-being and fairness. The firm offers a direct profit structure where traders retain their first $10,000 in profits, followed by a substantial 90% of subsequent net profits, showcasing respect for their trading accomplishments and promoting a hassle-free earning experience. This policy underscores MyFundedFutures' dedication to acknowledging traders' efforts and ensuring they are rewarded fittingly.

The platform distinguishes itself with its withdrawal flexibility, providing traders control over their earnings with bi-weekly withdrawal opportunities and no minimum activity requirements. A low threshold of $1,000 for withdrawals facilitates prompt access to funds, typically within a few days. Expert Accounts benefit from even more favorable conditions, including a 14-day payout cycle without the constraints of scaling or consistency rules. In contrast, Starter Accounts incorporate a consistency rule and initial withdrawal limitations to foster prudent trading practices. Introducing a buffer zone phase for withdrawals and detailed guidelines on account longevity further exemplify MyFundedFutures' approach to supporting sustained trading success. By removing trading and profit day restrictions for Expert Plan users, MyFundedFutures acts as a platform and a committed ally to traders seeking continuous growth and success.

Withdrawal

Before withdrawing from a funded account, ensure you've cleared the initial evaluation and secured your first payout. The process begins with completing the Know Your Customer (KYC) requirements; for those opting to use RISE or cryptocurrencies for their withdrawal, an account with RISE must be opened if choosing that option. Withdrawal requests are made via the platform's dashboard, and it's important to verify that the request meets the $1,000 minimum withdrawal threshold to proceed.

After your withdrawal request is submitted, it undergoes processing within 1-2 business days, and you can expect the funds to appear in your account within 1-3 business days, provided your banking or cryptocurrency details are accurate and up-to-date. This ensures a smooth transition of funds without unnecessary delays. Upon successful verification, the payout is transferred to your designated account, but be aware of any applicable bank or crypto transaction fees that may affect the final amount received. This procedure reflects the platform's dedication to providing an efficient, secure method for traders to access their earnings, emphasizing the importance of compliance and detail accuracy throughout the withdrawal process.

Withdrawal Restrictions

In the Starter Plan, withdrawals within the first 45 days are limited to the account's maximum drawdown, for example, $2,000 from a $50,000 account with a 4% drawdown. After this period, there's no cap on withdrawals, halving the industry-standard wait of 90 days for increased withdrawal freedom. Conversely, the Expert Plan offers unrestricted withdrawals from the start. It provides an attractive option for those seeking immediate and full access to their funds without limitations, reflecting the platform's commitment to flexible and trader-friendly policies.

What are the Consistency Rules for My Funded Futures ?

In the challenge phase of the trading platform, there's no consistency rule to worry about. However, once traders move to the simulated funded stage, a 40% consistency rule kicks in, which does not apply to Expert plans. This rule means that, at most, every day's profits can be 40% of the total profits accumulated. Suppose a trader's daily profit surpasses this threshold. In that case, they cannot withdraw any profits until the profit distribution aligns with the rule—profits from any trading day must fall below 40%. For instance, if a trader earns $10,000 in total but one day's gain is $4,500 (over the 40% limit), they need to continue trading to increase the total profits, making the $4,500 less than 40% of the new total, enabling withdrawal. It's important to note that breaking this rule won't close your account; however, compliance is necessary before withdrawing profits, underscoring the platform's emphasis on balanced trading gains over time.

What are My Funded Future's EOD Trailing ?

MyFundedFutures has replaced daily drawdowns with a Maximum End of Day (EOD) Drawdown, set at 3%, to alleviate the pressure of constant market fluctuations on traders. This system ensures that traders only need to be concerned with the day's closing balance, not the intraday volatility. The maximum EOD drawdown also incorporates a safety feature where the drawdown limit is established at $100 plus the initial account balance. For instance, a $50,000 account will adjust its drawdown limit to $52,100, considering the 4% drawdown rate and the additional $100. Accounts starting at $100,000 and $150,000 will see their drawdown limits set to $103,100 and $154,600, respectively, making the trading experience less stressful by clearly defining risk boundaries.

What are My Funded Future's Trading Hours ?

The following day, trading hours are set from 6:00 PM to 4:10 PM EST, covering a nearly 24-hour cycle. It's important to note that any trades open will automatically close at 4:10 PM EST. However, this will not constitute a breach of account rules, ensuring traders can plan and execute their strategies within this timeframe without concern for unintended account penalties.

What are My Funded Future's Minimum Trading Days ?

The firm mandates a minimum of 1 trading day for all account types and phases to promote active market participation. This rule applies across the board—whether in evaluation, trial, or funded stages—ensuring that every trader engages in at least one day of trading activity to meet this criterion. The policy aims to foster a proactive approach to trading, allowing traders to demonstrate their skills and assess and refine their strategies over time. While the baseline requirement is set at a single day, the encouragement is towards more frequent trading to understand market dynamics better, improve strategies, and enhance overall performance.

What are My Funded Future's Sign Up Rules ?

Due to regulatory and compliance reasons, myFundedFutures aims to welcome traders globally but cannot accept traders from certain countries, including Cuba, Iran, Lebanon, Syria, North Korea, Libya, Russia, Sudan, Somalia, and Vietnam. Besides, MyFundedFutures emphasizes the importance of integrity and security on its platform. To trade, individuals must be of legal age per their local jurisdiction's requirements and undergo a thorough identity verification process. This process involves submitting Know Your Customer (KYC) documentation, such as government-issued ID and proof of address, to confirm identity and fulfill regulatory obligations. These steps are part of MyFundedFutures' commitment to maintaining a secure, transparent, and compliant trading environment for all participants, ensuring the platform operates within the bounds of legal and regulatory standards globally.

At MyFundedFutures, ending a subscription is made straightforward to accommodate any changes you might need, whether for a pause, strategy shift, or plan adjustment. Begin by signing into your MFFU dashboard. Look for the 'Billing' tab on the left, leading to your subscription details. Here, you'll see an option to 'Manage Subscription' and the choice to 'Cancel Subscription.' Your reason for canceling is valued for improving service, followed by a confirmation step to finalize your decision. Make sure to ensure no pending financial issues remain and understand data access changes post-cancellation. If issues prompted your decision, contacting support could provide alternatives to cancellation. Once you decide to cancel, your account will be active till the current billing cycle ends, letting you use the services till then. Departing only cuts off some ties; you're encouraged to stay updated through MFFU's social media or newsletters, with the community doors always open for your return. The aim is to keep the exit process smooth, respecting your choice while reminding you of the ongoing support for your trading aspirations.

What are My Funded Future's Refund and Cancelation Rules ?

Refund Policy:

- Who Can Get a Refund: If you still need to start trading, you can get a refund.

- How to Ask for It: Email their support team within 14 days after buying an account.

- Refund Details: You'll get back what you paid minus a $75 fee for administrative costs.

- Processing: Refunds go back through how you paid, and you'll be emailed once done.

When Refunds Aren't Possible:

- If you've made any trades, remember to get a refund. This rule helps keep things fair for everyone.

Cancelling Your Account:

- How to Do It: Just like refunds, send a cancellation email to their support.

- What Happens Next: You lose access to MFFU's services, and there are no refunds for any past expenses.

MFFU's Rights: MFFU can end your account if you break their rules. This might mean losing money in your account and being banned from their services.

Disputes: In the event of a disagreement, both parties agree to resolve it through arbitration, following the rules of the American Arbitration Association. This means traders waive their right to dispute any payments they've made.

My Funded Futures Rules - Evaluation Process

The journey through MyFundedFutures' (MFFU) evaluation process is designed to rigorously assess and hone a trader's skills, preparing them for real-world trading. Here's a simplified overview of the stages involved and what traders can expect:

- Initial Evaluation: Using a virtual account, the first phase tests your trading abilities. You're tasked with reaching profit targets while following specific trading rules without a set number of trading days. The key here is to demonstrate risk management, consistent profitability, and rule compliance.

- Simulated Funded Stage: This phase is about showing consistent trading over a longer period, aligning with MFFU's payout policy. The emphasis remains on profitability but also on applying a steady trading strategy and managing risks effectively.

- Live Funded Account: The final stage lets you trade with real money in actual market conditions. The goal is to manage trades responsibly, achieve profits, and grow the account with no fixed duration. Success hinges on applying advanced strategies, managing emotions, and navigating real-world trading scenarios.

Expectations for each stage:

- Initial Evaluation: Successful candidates receive a simulated funded account.

- Simulated Funded Stage: Traders aim to demonstrate consistent performance over time, aspiring to progress to a live funded account.

- Live Funded Account: Here, the trading journey advances with live market trades, embodying the ultimate objective at MFFU.

Advancing to the Next Level:

- Consistent Performance: Consistently meeting profit targets is crucial.

- Rule Adherence: Following MFFU's trading guidelines, including daily loss limits and strategy restrictions, is mandatory.

- Continuous Learning: MFFU values ongoing education and community engagement as part of a trader's development.

What are My Funded Future's Evaluation Types ?

MyFundedFutures (MFFU) offers two main evaluation plans to fit every trader's experience level and goals: the Starter Evaluation and the Expert Evaluation.

Starter Evaluation Challenge:

This plan is perfect for new traders or those wanting a simpler approach. It features supportive learning conditions, flexibility with no daily drawdown limits, low-profit targets, and affordable costs, including a flat rate for account resets. Payouts come every 14 days after the initial 60 days, with no trading consistency rule in the challenge phase and no minimum trading day requirement, making it an ideal starting point for beginners.

Expert Evaluation Challenge:

Aimed at experienced traders, this plan offers more freedom and advanced options. Traders can enjoy unrestricted trading without scaling or activation fees, no consistency rule, no daily drawdown limit, and an attractive financial setup with regular 14-day payouts without a minimum trading requirement. It's designed for those confident in their market knowledge and trading skills.

When choosing between the two, consider your trading experience, risk tolerance, and financial goals. The Starter plan might be better if you're new to trading, offering more guidance and lower risks. In contrast, the expert plan suits traders ready to take on more freedom and potentially higher rewards. Each plan's cost-effectiveness, reset fees, and payout potentials are critical factors in your decision-making process.

Now let’s look at which evaluation is best for you.

MyFundedFutures (MFFU) recognizes the uniqueness of every trader, offering tailored evaluation plans to match different trading levels and aspirations. For beginners or those new to trading, the Starter Evaluation provides a nurturing environment with features like no daily drawdown limits, low-profit targets, and the ability to get simulated funding quickly, all at lower upfront costs and with comprehensive customer support around the clock.

On the other hand, experienced traders might find the Expert Evaluation more appealing. This plan allows unrestricted trading with no need for scaling, no activation fees, and the same freedom regarding consistency rules and daily drawdown limits as the Starter plan. Both plans offer the advantage of receiving payouts every 14 days without a minimum trading day requirement, ensuring flexibility and regular financial benefits.

Choosing between the Starter and Expert Evaluation depends on your trading experience, risk tolerance, and personal trading goals. The Starter Evaluation is ideal for those learning the ropes, offering a cost-effective and supportive pathway into trading. Meanwhile, the Expert Evaluation suits those confident in navigating the markets independently, seeking to maximize their trading strategies without constraints.

What are My Funded Future's Evaluation Parameters ?

At MyFundedFutures (MFFU), the trading evaluation parameters are crafted from extensive market experience to encourage disciplined and profitable trading. These parameters include:

- Profit Target: The goal profit traders must hit during the evaluation is a measure of success.

- Maximum Drawdown: The highest loss allowed from the account's peak balance, acting as a risk management tool.

- Daily Loss Limit: A cap on daily losses to prevent deep losses on volatile trading days.

- EOD (End of Day) Drawdown: The drawdown limit is adjusted based on daily profits, rewarding positive performance.

- Consistency Rule: Ensures traders maintain steady trading sizes and strategies.

- Minimum Trading Days: Requires trading on a minimum number of days to demonstrate engagement and discourage reckless risk-taking.

These parameters play a crucial role in shaping trading behavior:

- Risk Management: Parameters like Maximum Drawdown and Daily Loss Limit promote careful risk assessment and prevent impulsive trading.

- Goal Orientation: Setting a Profit Target encourages traders to plan and strategize effectively.

- Consistency: The Consistency Rule fosters a stable trading approach essential for long-term success.

What are My Funded Future Account Sizes?

My Funded Futures offers three account types, allowing traders to select a Starter or Expert Level based on their experience and comfort. All account types share common features: no Expert Level Daily Loss Limit, and Drawdown is calculated at the End of the Day.

This setup is designed to accommodate various trading strategies and preferences, ensuring that both new and seasoned traders can find an option that suits their trading style.

Let’s look at the comparison table:

Account Type $50,000

| Starter Level | Expert Level | Starter Plus | |

|---|---|---|---|

| Plan Cost | $80/month | $165/month | $120/month |

| Profit Target | $3,000 | $4,000 | $3,000 |

| Max Position | 3 Contracts | 5 Contracts | 3 Contracts |

| Trailing Max Drawdown | $2,500 | $2,000 | $2,000 |

| Reset Fee | $80 | $165 | $120 |

| Daily Loss Limit | $1,200 | N/A | N/A |

| Scaling Rule | Yes | No | Yes |

| Micro Scaling | Yes | No | Yes |

| Micro Scaling | Yes | No | Yes |

| Consistency Rule | Yes | No | No |

| Eval Consistency Rule | No | No | Yes |

Account Type $100,000

| Starter Level | Expert Level | Starter Plus | |

|---|---|---|---|

| Plan Cost | $150/month | $265/month | $200/month |

| Profit Target | $6,000 | $8,000 | $6,000 |

| Max Position | 6 Contracts | 10 Contracts | 6 Contracts |

| Trailing Max Drawdown | $3,500 | $3,000 | $3,000 |

| Reset Fee | $150 | $265 | $200 |

| Daily Loss Limit | $2,400 | NA | NA |

| Scaling Rule | Yes | No | Yes |

| Micro Scaling | Yes | No | Yes |

| Micro Scaling | Yes | No | Yes |

| Consistency Rule | Yes | No | No |

| Eval Consistency Rule | No | No | Yes |

Account Type $150,000

| Starter Level | Expert Level | Starter Plus | |

|---|---|---|---|

| Plan Cost | $220/month | $375/month | $300/month |

| Profit Target | $9,000 | $12,000 | $9,000 |

| Max Position | 9 Contracts | 15 Contracts | 9 Contracts |

| Trailing Max Drawdown | $5,000 | $4,500 | $4,500 |

| Reset Fee | $220 | $375 | $300 |

| Daily Loss Limit | $3,600 | NA | NA |

| Scaling Rule | Yes | No | Yes |

| Micro Scaling | Yes | No | Yes |

| Micro Scaling | Yes | No | Yes |

| Consistency Rule | Yes | No | No |

| Eval Consistency Rule | No | No | Yes |

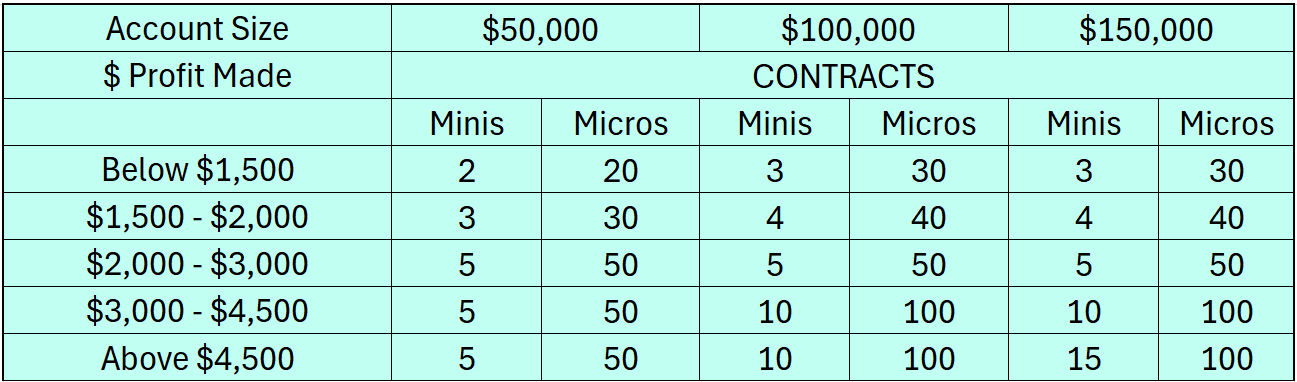

What is My Funded Future's Scaling Plan ?

The scaling plan at My Funded Futures is designed to increase trading capabilities as traders achieve predefined success metrics progressively. This structured approach enhances potential earnings and aligns with individual risk management and growth strategies. It embodies the platform's commitment to supporting traders' development and financial progression within the dynamic futures trading environment.

Managing Funded Accounts

For effective management of a funded trading account, incorporating structured practices and leveraging available platform features are essential steps toward achieving consistent trading success and ensuring the longevity of your account.

Daily Trading Discipline:

A disciplined approach to daily trading involves setting a limit of one or two daily wins or losses. This strategy helps maintain focus and prevents the common pitfalls of impulsively overtrading or attempting to recover losses. Documenting your trading activities in a journal every day is equally important. This practice enables you to reflect on your decisions, learn from your successful and unsuccessful trades, and identify areas for improvement. Being mindful of market conditions and knowing when to take breaks can significantly enhance your decision-making process and protect you from emotional trading.

Strategic Withdrawals and Account Growth:

Planning your withdrawals with a strategic mindset is crucial for the security and sustainability of your funded account over the long term. While it may be tempting to withdraw all your profits, setting aside a reasonable portion of your earnings and leaving a financial buffer in your account can help you navigate through market volatility more effectively. As your account balance grows, you can consider gradually increasing your risk exposure, but it should always be proportionate to your account size and in alignment with your risk management strategy. Thoughtful management of withdrawals and risk levels not only safeguards your account's longevity but also supports continuous financial stability, providing you with a sense of security and peace of mind.

Maximizing Platform Tools and Features:

Utilizing the dashboard and other account features provided by your trading platform can offer significant insights into your trading performance, opening up a world of potential success. Regularly reviewing your trading history, analyzing profitability, and understanding patterns in your trading behavior are key to identifying what works best for you. Being aware of the best trading days and adapting your trading schedule accordingly can optimize your chances for success. Additionally, exploring and making the most of the platform's available tools, such as various order types and risk management options, is essential for developing a comprehensive and effective trading strategy, filling you with hope and optimism for your trading future.

Moving from the evaluation phase to a funded account is a big milestone in a trader's path with MyFundedFutures. The transition begins when a trader hits the profit target in the evaluation phase, leading to an email notification confirming their success. This is followed by a short review period, usually 1-3 business days, after which the trader is informed about their new funded account via email.

In the funded account, some aspects change while others remain consistent. The account name will include 'SIM,' indicating it's a simulated environment with real market conditions, but the login details stay the same. The approach to managing drawdowns and understanding when and how to withdraw profits requires attention to new policies and strategies, specifically regarding the buffer zone and payout details available in the platform's help articles.

The dashboard has become an essential tool for managing the funded account. It provides a detailed view of trading analytics and progress after updating each trading day's data. This allows traders to monitor their performance closely, including monitoring the drawdown limits to ensure they manage risks effectively and stay on track with their trading objectives. Understanding these elements is key to leveraging the funded account fully and continuing the journey toward trading success.

What are My Funded Future's Data options and Add Ons ?

MyFundedFutures (MFFU) understands the critical role of accurate market data for successful futures trading. They offer various data options to suit the needs of different traders, from beginners to professionals.

- Level 1 Data: This fundamental data set, included in all subscriptions, gives traders key market insights, such as bid and ask prices, the last traded price, volume, open interest, and a real-time record of trades. It's free during the challenge and simulated funded stages, providing essential information to make informed trading decisions.

- Level 2 Data (Non-pro): For traders wanting more detailed market analysis, Level 2 data, available for an extra $39.00, includes bid and ask ladders, market depth, order sizes, and the identities of market participants, alongside the real-time trade records provided in Level 1.

- Level 2 Data Pro Plan: Aimed at experienced traders, this plan costs $124 monthly and builds on the Non-pro plan by adding advanced tools and insights for professional trading.

Upgrading or adding data options is easy through the "Billing" section on your dashboard, where you can manage your data subscriptions. Whether you want to upgrade, downgrade, or check your current data plan, everything can be managed smoothly within the platform's dashboard, ensuring traders can always access the data they need to navigate the futures market effectively.

Reputation And Social Media

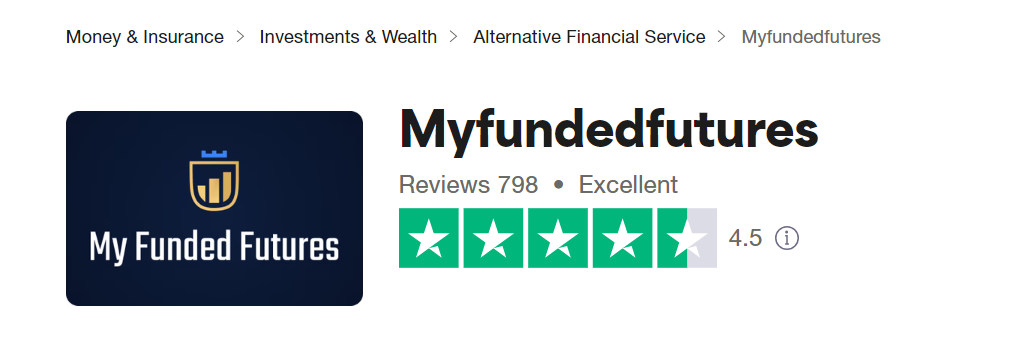

My Funded Futures shines brightly with an impressive 4.5-star rating on Trustpilot, reflecting outstanding customer satisfaction through 798 glowing reviews. A staggering 88% of reviewers awarded it 5 stars, complemented by another 3% with 4 stars followed by <1% with 3 and 4 stars and finally 8% with 1 star, highlighting the platform's exceptional quality and strong approval from the trading community. This overwhelmingly positive feedback, celebrates My Funded Futures' esteemed standing and effectiveness in enriching the trading experiences of its diverse clientele.

Stay connected with My Funded Futures on Instagram, boasting over 319 posts and a vibrant community of over 15.4K followers. Their feed is packed with insights, updates, discounts, weekly tips, monthly competition details, and educational content. For questions, the direct messaging feature offers a quick way to reach out.

Connect with My Funded Futures on social media and join a growing community of over 52.5K followers. Dive into their extensive collection of more than 2.2K posts for engaging insights and lively discussions. The platform offers a mix of insightful reviews, exciting announcements, and the latest updates, enriched with diverse media content. Keep up with the latest from My Funded Futures, including exclusive discounts, by interacting with their posts and staying engaged with every new development.

MFFU Prohibited Trading Practices

MyFundedFutures (MFFU) prioritizes maintaining a fair and ethical trading environment, especially given the nuances of trading in a simulated market that closely mirrors live trading conditions but isn’t identical. The firm outlines clear rules to prevent practices from unfairly exploiting the simulation or deviating from ethical trading standards.

Automated Trading Guidelines:

- High-Frequency Scalping: Automated systems are banned from being used for ultra-high-frequency trades, such as over 200 trades per day.

- Use of Automation: All automated trading tools, including AI and bots, are not allowed, ensuring all traders operate on a level playing field.

- Semi-Automated Trading: While fully automated trading is prohibited, semi-automated trading is acceptable if the trader remains engaged and the system is closely monitored.

Order Management and Market Practices:

- MFFU disallows practices such as placing multiple identical limit orders simultaneously, trading in illiquid markets to capture isolated fills, and using tight trading brackets to exploit non-existent slippage for unfair advantages.

- Trading during major economic announcements and any form of collaboration between traders to manipulate the market are strictly forbidden to uphold market integrity.

Consequences for Violating Guidelines:

Violations can lead to immediate contract termination, confiscation of profits derived from such practices, and potential exclusion from future funding, emphasizing the seriousness of adhering to these rules.

Affiliate Program

The MyFundedFutures Affiliate Program is designed for individuals or companies connected to the proprietary trading industry, allowing them to earn a commission. By using a unique link or code to refer traders, affiliates get a 12% cut from evaluation and reset fees generated by their referrals. This program suits various affiliates, including funded account reviewers and trading educators, who can register directly through the MyFundedFutures dashboard.

Affiliates can earn commissions monthly, with a minimum payout threshold of $100. They are encouraged to promote MyFundedFutures' funding programs and platform features across multiple digital marketing channels like blogs, social media, and emails, except for paid advertising methods such as Google Ads or Facebook Ads, which are not permitted.

Commissions are disbursed on the last Friday of each month through Riseworks, provided the affiliate has met the minimum payout requirement. Affiliates are responsible for managing their taxes. The program has strict rules against spam, illegal marketing, and self-referrals from the same household. Violations or fraudulent activities can lead to termination, revoking all rights and access, and forfeiture of pending commissions.

Is My Funded Futures Legit ?

My Funded Futures is recognized as a legitimate and reliable funded trading platform, particularly for those in the futures market. The company has funded hundreds of traders, providing up to $100,000 in trading capital. The straightforward evaluation process allows traders a fair chance to prove their skills without unnecessary complexity.

Financially, My Funded Futures stands out with an 80% profit split, ensuring traders keep a significant portion of their earnings. The platform is transparent about its fees, with evaluation costs starting at $99, and consistently pays out profits, reinforcing its credibility. Customer feedback confirms the platform's legitimacy, with traders praising its user-friendly interface, clear guidelines, and responsive support team. The positive user experiences, combined with the platform's transparent operations and fair profit-sharing, make My Funded Futures a trustworthy option for traders seeking funded capital.

Comparison: MyFundedFutures (MFFU)Vs Other Firms

Let’s see how Apex Trading stacks up against the competition.

| My Funded Futures | Apex Trader Funding | Elite Trader Funding | TopStep | Bulenox | |

|---|---|---|---|---|---|

| Account Sizes | $50K to $150K | $25K to $300K | $50K to $300K | $50K to $150K | $25K to $250K |

| Profit Share | 100% up to $10K; 90% thereafter | 100% of first $25,000; 90% thereafter | 100% of first $12,500; 90% thereafter | 100% of first $5,000; 90% thereafter | 100% for up to $15,000; 80% thereafter |

| Account Plan Costs (USD/Month) | $80 to $375 | $137 to $677 | $165 to $655 | $49 to $149 | $145 to $535 |

| Profit Target | $3K to $12K | $1.5K to $20K | $3K to $20K | $3K to $9K | $1.5K to $15K |

My Funded Futures: Final Thoughts

MyFundedFutures (MFFU) has emerged as a vibrant platform in the prop trading arena since its launch in September 2023. Drawing from the success of its forex trading predecessor, MyFundedFX, MFFU offers traders up to $600K in simulated capital to trade a wide array of assets across major exchanges like the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX). Traders can engage with futures contracts ranging from indices and currencies to commodities and energy sectors, leveraging the platform's educational resources and community support to refine their trading strategies.

MFFU distinguishes itself by simplifying the funding process to a single-step evaluation, allowing traders to retain a significant portion of their profits—100% of the first $10,000 and 90% after that. This approach, coupled with a diverse selection of trading platforms, including NinjaTrader and TradingView, caters to a broad spectrum of trading preferences and experiences. Moreover, MFFU underscores the importance of ethical trading, implementing strict guidelines against prohibited practices like high-frequency scalping and unsanctioned automated trading to maintain a fair-trading environment.

The platform's clear and favorable payout policy and flexible withdrawal and account management options exemplify MFFU's commitment to supporting its traders' growth and success. Traders must navigate various evaluation stages, from initial evaluation to live funded accounts, adhering to specified trading parameters to ensure progression and longevity within the platform. By fostering a transparent, supportive, and hassle-free trading experience, MFFU is a reliable partner for traders looking to navigate the futures market successfully.

FAQs

Day Trading Insights Research Team

Day Trading Insights Research Team publishes articles written by active day traders, financial market researchers, or aspiring traders who are actively learning and investing on a regular schedule. Our research team brings formal training in finance and computer science, blending market theory with code-driven testing and tools. We’re passionate about understanding how trading works, how markets evolve, and how technology can sharpen professional decision‑making. Our content is education‑first and independently produced, free from outside bias.