Bulenox Review for 2025: Latest Discount Codes and Analysis

Last Updated: August 8, 2025

Author: Day Trading Insights Research Team

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

Bulenox Coupon Code 2025

Promo Codes: DTI83 (83% OFF)

- $50,000 / Up to 7 Contracts Account

- $100,000 / Up to 12 Contracts Account

- $150,000 / Up to 15 Contracts Account

- $250,000 / Up to 25 Contracts Account

Our Rating:

🌕🌕🌕🌕🌗(4.7/5.0)

Key Takeaways:

Account Sizes - $25,000 to $250,000.

Tradable Assets - Equity Index Futures, Cryptocurrency, FX, Commodities, Energies, and Metals.

Payout - 100% on first $10,000 of profits followed by 90/10 profit split.

Trading Platforms - MetaTrader 4 & 5, NinjaTrader, and TradingView.

Profit Target - $1,500 up to $15,000 varies by account size.

Withdrawal Limits - $750 to $2,500 based on account size.

Cost/Month - From $145 to $535.

Funding Days - 5 days minimum excluding weekends or holidays.

Free Trial - 14 Days Free Trial.

Multiple Accounts Management - Up to 11 Master accounts.

Drawdown - Between 2.2%-10% by account size.

I have had the chance to research Bulenox, a paradigm-shifting proprietary trading company in the futures market. They built a platform that gives traders the ability to enhance their strategies and multiply capital. Bulenox Accounts come in various sizes to fit every trading need and preference—the account types offer a healthy range of options, from at least $25K up to $250K. What I like the most about this prop firm is that it offers flexible trading rules and a competitive pricing structure. These, together with many other factors, give traders the free reign to implement different trading and risk management strategies.

Bulenox provides a healthy range of CME Futures services, including equity futures, cryptocurrency contracts, and trading with forex. Without this variety of options, I wouldn’t be able to broaden my trading portfolio in the manner I did. If nothing else, I would pick this company over rivals because I could access up to $250,000 in funding just a short while after onboarding. Plus, they have a profit-split payout scheme that would excite even the most aggressive negotiators out there. Knowing that I can keep 90 out of the 100 bucks I earn in profits is an unbeatable deal clincher.

Oh, before I forget, Bulenox has the smoothest payout system I have experienced. A few rounds in online forums and review sites like Trustpilot tell me that many former and current Bulenox members share this feeling. My experience with Bulenox was exciting and transformative, to say the least. I see it as the platform to join if you want the resources and community to compete favorably in the futures trading space.

Bulenox Overview

They say that when great minds come together, great things happen. This is the story ofBulenox,which is the result of the coming together of seasoned investors and traders. The company came off the ground in 2022, and the team chose the US city of Wilmington in Delaware as the firm’s home. Bulenox, being the brainchild of market veterans, is a platform whose main goal is to remove as many obstacles as possible for new traders who wish to cultivate and hone their skills.

The founders admit in the company’s About page that their mission is to offer one of the

best funded trader programs that fills a gap in the trading world. Being traders with many years of experience, one cannot doubt their diagnosis of the market. According to the company’s website, the founders’ vision rides on the understanding of the challenges that the everyday trader experiences. Another key pillar of their vision is a commitment to providing solutions that maximize traders’ potential.

Pros and Cons

If there is a principle that traders learn very early in their careers and stick to, it is that whenever they consider a new direction, partnership, or strategy, they must evaluate its advantages and limitations. So, this Bulenox review is incomplete without revealing the reasons you might want to join the company. It will also highlight the factors that might make it unattractive.

Pros

- Traders have a healthy range of options when choosing an account. Bulenox allows traders to open an account with an initial capital of between $25,000 and $250,000.

- Traders can create a properly balanced (in terms of risk profile) portfolio because Bulenox offers many tradeable assets, including Equity Index Futures, Cryptocurrency Contracts, FX, Commodities, Energies, and Metals.

- The first $10,000 in profits is yours, the whole of it. Afterward, the firm will take only 10%.

- Bulenox allows traders to choose the trading platform they like, as long as it is MetaTrader 4 & 5, NinjaTrader, or TradingView.

- The profit targets are within reasonable range even for newbies, from $1,500 to $15,000. So are the withdrawal limits, which range from $750 to $2,500.

- A single user ID can manage multiple accounts (several Qualification and up to 11 Master accounts). This allows traders to participate in the market without restrictions.

Cons

- Although Bulenox varies monthly costs by account type, some members may find the $115 to $535 range somehow on the upper side.

- The drawdown can reach up to 10% for smaller accounts, which might limit trading strategies.

- It may sound nice for traders to manage multiple accounts, but this might quickly overwhelm some

What are Bulenox Tradable Assets and Commissions ?

Tradable Assets: Whatever instrument you want in your portfolio, Bulenox has it, at least among the common options. This includes:

Equity Index Futures: Traders can include major indices like E-mini S&P 500 and E-mini NASDAQ 100 in their portfolios.

Cryptocurrency Contracts: This instrument suits traders focused on the crypto market. The allowable assets are Bitcoin and Ethereum futures.

Forex (FX) Trading: Traders who want to speculate on currency futures can leverage this instrument, with access to most major currency pairs.

Commodities: The specific markets that this instrument covers include physical commodities like gold, silver, oil, and agricultural produce. These many instruments allow traders to tap into some of the most highly liquid markets in the world. And, the huge option range is great for risk management and balancing the portfolio.

Commissions:

The commission depends on the instrument that traders choose. The table below shows a detailed list of commissions.

| Category | Products Range | Rate Range |

|---|---|---|

| Equity Indexes | E-mini & Micro E-mini Futures | 0.61 - 2.09 |

| Cryptocurrency | Micro Bitcoin & Ether Futures | 0.46 - 2.76 |

| Interest Rates | Various Futures | 1.41 - 2.12 |

| FX | Futures & E-micro Futures | 0.5 - 2.36 |

| Agricultures | Futures | 2.86 |

| Energies | Crude Oil, Natural Gas Futures | 0.76 - 2.26 |

| Metals | Gold, Silver, Copper Futures | 0.76 - 2.31 |

| Indices & Bonds | Dow Jones, Treasury Notes & Bonds | 0.61 - 2.09 |

What is Bulenox' Profit Split?

At Bulenox, traders start with an enticing 100% payout on their first $10,000 of profits. Beyond this initial earning, a profit split arrangement occurs where traders receive 90% of the profits, and Bulenox retains a 10% commission. This commission structure is consistent across the board, applying even to earnings from the Master Account after the first commission-free $10,000 withdrawal. The 10% commission is deducted during funds transfer to the trader’s personal bank account.

In line with established industry norms, Bulenox members can request payouts at any time within the month. The company processes them once a week (every Wednesday). Is there a catch? Absolutely. Only those traders who have completed at least ten individual trading days qualify for the payout. Also, they must have at least $1,000 in their account (this is the minimum withdrawal amount) to complete the first three payments.

The withdrawal conditionalities are not cast in stone, however. Instead, each trader falls within specific limits, depending on the account type. For instance, the minimum withdrawal amount for a $25,000 account is $1,000, but $2,500 for a $250,000 account. There is also a withdrawal safety threshold reserve for each account type. A withdrawal safety threshold simply refers to the minimum balance that traders must maintain to facilitate withdrawals. In the event that a Master Agreement ceases to exist, a Bulenox member can withdraw this safety threshold reserve, ensuring they can access their funds.

What is Bulenox's Drawdown ?

For the benefit of those who may not know, drawdown is the reduction in the initial funding (capital) from a relative high point to a subsequent low point before the account’s value recovers. So, if your account had $10,000 and it drops to $8,000 before rising back above $10,000, the drawdown would be 20%. Prop firms like Bulenox use drawdown to gauge traders’ risk management skills and to determine who can manage their capital more effectively.

You should know that Bulenox restricts drawdown levels to protect its investment, which the company tailors to each type of account. If you, for instance, choose a $250,000 account, you can draw up to

2.2% (on the lower end) of the initial funding. On the contrary, a trader using a $10,000 account can draw only as high as

10%, which tells you that Bulenox is tougher on smaller accounts.

What are the Trading Platforms for Bulenox ?

Bulenox members have sufficient options when choosing what trading platform to use. The best part is that the supported platforms are standard in the market, which means a trader is likely to be familiar with them. These platforms often include:

- MetaTrader 4 (MT4): MT4 is the gold standard of what a trading platform should offer. What makes this platform outstanding is the fact that it has the shortest learning curve, and it is typically the first tool newbies learn when starting their trading career. Despite the age, MT4 packs sufficient analytical tools and customizable charts. The platform also offers automated trading features, including Expert Advisors (EAs).

- MetaTrader 5 (MT5): This brings a modern touch to MT4. In other words, MT5 is a refreshed and advanced version of MT4, which means that users enjoy the robustness of MT4 but with additional tools and features. MT5 offers more technical indicators, graphical objects, and timeframe options, along with enhanced trading operations.

- NinjaTrader: Like MT4 and MT5, NinjaTrader allows traders to set up and execute strategies on mobile devices, desktops, or the web. Users get integrated trading tools and access to popular futures markets—no wonder the platform is popular for futures and forex trading.

- TradingView was originally a web-based charting platform but has morphed into a fully-fledged trading platform in recent years. TradingView stands out particularly when it comes to community. The platform has a huge following because it allows experts to share tactics and strategies in an environment where traders can test and validate ideas.

How Can you Become a Bulenox Trader?

The trader funding model has been around for some time now. And as more companies seek to establish a robust process for onboarding members, a standard procedure has emerged. Typically, the process starts at the registration phase, then trial, and ends at either approval or rejection. Bulenox follows this standard process, although with a few modifications. It goes like this:

Registration Phase: Any relationship between a trader and a funding company must begin with the company knowing the trader. The only way this happens is when the trader shares personally identifying details, which sums up the registration phase. Prospective members can share details via a simple sign-up form that is accessible through the “Join Now” button on the website’s homepage. Once the company verifies the details, traders can proceed with selecting the desired account from within the member portal. One must note that Bulenox’s onboarding process is fast mainly because they go easy on the depth of required personal details. Some may fault this approach, but it enables the company to streamline the onboarding process and respect prospective member privacy.

Authorization Phase: This is the stage where the company sets the new members up for a successful trading experience. Among the activities in this phase, the company guides traders on how to connect their accounts with a trading platform. But first, the trader must identify the preferred platform (and preferably download and install it to their local machine). If there is no error and the platform can boot up without issues, the trader can now port the Bulenox Account credentials over to the trading platform, say MT4—this links the company’s backend system with the trading platform.

Qualification Phase: If you can connect to the Bulenox server within the trading platform, the authorization phase is successful. Now, you must obtain the Qualification Account; a trial account that prospective traders can use to demonstrate their skills. The objective here is for the company to evaluate the trader’s risk management strategies and for the trader to demonstrate that they are capable of achieving the specific profit targets.

Master Phase: This is the stage where the actual onboarding happens—if you’re a trader and reach the master phase, congratulations, you are almost a newly minted Bulenox trading member. Bulenox takes traders through five different activities at this stage: first, a trader must hit the profit target on the qualification account and trade for at least ten days—this amounts to what the company calls “Setup”; second, the company asks for additional personal details for verification; third, on successful verification, the company sends a certificate, a questionnaire, a contract, and instructions to the trader; fourth, the trader provides any additional information as requested and signs the contract; lastly, Bulenox reviews the submitted documents, approves them, and activates the trader’s Master Account. This might seem like too much work, but it is necessary to thoroughly prepare traders before they handle real funds.

What Are the Rules for Bulenox Trader Funding ?

According to Bulenox’s website, their mission is to create an optimal environment in which futures traders can flourish. To make this happen, the company has guidelines for molding members into traders who fit into the profile. Notably, the rules place a strong emphasis on critical aspects of futures trading, including trading days, timing, position management, trading objectives, and risk control. The objective is to create a clear framework to guide traders (new and existing) toward the ideal profile of a successful funded futures trader. Some of the elements of Bulenox’s guidelines include:

Trading Framework: This element defines the requirements for active trading days and the trading hours.

- Active trading days requirement: Traders must engage in trading activities for at least five days before qualifying for the Master Account, weekend and holidays are not counted as trading days. This requirement highlights the value Bulenox places on consistency and dedication in trading.

- Trading hours: The trading window extends from 5:00 PM to 4:00 PM the next day, Central Standard Time (CST), excluding holidays and weekends. A pivotal rule mandates the closure of all positions by 3:59 PM (CST) to uphold discipline within each trading day.

Position Management and Strategy:

- Position size flexibility: Bulenox’s members may manage multiple positions simultaneously. However, the company restricts the maximum number of positions one can hold to a specific figure—the exact limit may vary for each trader because they’re likely to use different accounts. Despite the restriction, traders are flexible enough to properly diversify their portfolio and effectively spread risks and volatility.

- Profit objective: As noted earlier, one of the conditions for advancing past the trial stage is to earn a stated amount of profit after a specific number of trading days. Traders must achieve this profit target before they can open a Master Account; this is the account that connects traders to the company’s purse. This target is strategically set to be challenging yet attainable, serving as a critical milestone in the trader’s journey.

- Risk management protocols: Bulenox tightly controls how deep a loss each trader can take for each trading session. That is why, at the evaluation stage (using the Qualification Account), traders must demonstrate that they can derisk their positions without inflicting untenable losses on their wallets.

- Diverse trading instruments: We saw earlier that one of Bulenox’s upsides is traders’ access to many trading instruments across several industries and markets. Moreover, the company allows traders to include both standard and micro contracts in their portfolios. Anyone who is partial to such a deep option range will most certainly prefer Bulenox.

Consistent Rules Across Account Sizes:

Bulenox enforces a uniform set of rules across all account sizes. Notably, the firm doesn’t cap the number of days new traders can spend in the trial stage. This allows those determined enough to learn and improve their skills, eventually earning access to the Master Account.

Free Trial: Those who choose Rithmic as their preferred trading platform get a complimentary 14-day trial account. The offer includes 10 trading days and is exclusively available to individuals who have not previously used or registered with Rithmic. Upon the conclusion of the trial period, individuals can acquire a Qualification Account, transitioning from the trial phase to a more advanced stage of trading engagement.

What Are Bulenox Account Tiers ?

Once the trader passes the trial phase, they can choose one account type from five options. The difference is in the size of the initial funding that Bulenox provides. The table below provides the complete details of the account tiers based on attributes like the maximum number of contracts, profit target, and drawdown limits.

| Account Size | Max Contracts | Profit Target | Drawdown Limit | Payout on First $10,000 | Monthly Fee |

|---|---|---|---|---|---|

| $25,000 | 3 contracts | $1,500 | Up to $1,500 | 100% | $145 |

| $50,000 | 7 contracts | $3,000 | Up to $2,500 | 100% | $175 |

| $100,000 | 12 contracts | $6,000 | Up to $3,000 | 100% | $215 |

| $150,000 | 15 contracts | $9,000 | Up to $4,500 | 100% | $325 |

| $250,000 | 25 contracts | $15,000 | Up to $5,500 | 100% | $535 |

What Are Bulenox Account Types and Evaluation ?

One of the primary objectives of this Bulenox Trading review was to highlight the types of accounts traders can use to participate in the futures trading market. In this regard, the company offers several account types, each designed to satisfy individual preferences, trading approaches, and skill levels.

When you sign up with Bulenox, the first account you get is the

Qualification Account (QA). As you will see later, the QA is the entry point for traders to demonstrate their trading prowess and risk management skills. If you satisfy the company in the trial stage, you graduate to the

Master Account (MA) where you can create more sophisticated trading strategies and take bigger risks because of the increased capital. Past the MA, you get

Special Accounts (SA)—these allow members more customizations and unique features that are unavailable in the standard QA and MA accounts.

Qualification Account

Suppose you select Rithmic at the initial stage (the trial phase) after signing up with Bulenox. In that case, you must identify yourself as either a professional or a non-professional trader. Rithmic uses this technique to determine how they charge monthky fees related to access to exchange data feeds. If, for instance, you are a professional trader, the system will deduct $116 every month from your wallet for access to data from exchanges like CME, CBOT, NYMEX, and COMEX. In contrast, non-professional traders enjoy the benefit of accessing this data without additional charges as part of their Qualification Account package. Please note that once you select the designation (professional or non-professional), you won’t be able to change, so ensure you know what you’re doing from the onset.

The QA account has two main options tailored to fit different trading strategies and preferences:

No Scaling Account: This option features a trailing drawdown that dynamically adjusts based on the account’s current balance, factoring in profits and including commissions. It’s designed to offer flexibility but with a safeguard; if the trader’s balance decreases, the allowable drawdown does not increase, protecting traders from excessive losses. However, breaching the allowable drawdown leads to the account being temporarily blocked, requiring the trader to either reset or open a new account to continue trading.

EOD (End of Day) Account: This account updates the drawdown at the end of each trading day based solely on that day’s net profit, encouraging traders to focus on daily profitability. The EOD account includes a dynamic scaling plan that adjusts the number of contracts a trader can handle based on the cash on hand, promoting responsible risk management. This plan is meticulously designed to scale with the trader’s success, offering increased trading capacity as profits grow.

We’ve repeatedly said that one of the pillars of Bulenox’s vision is to help traders manage risk. To that end, the company implements a daily loss limit feature, which encompasses commissions and realized and unrealized trades, ensuring traders don’t exceed a predetermined loss threshold. This protective measure automatically suspends trading for the day on breaching the limit, preventing further losses. This means that you’ll be breaking an important rule if you fail to leverage this feature. As traders progress to the Master Account, the daily loss limits are lifted once the account’s drawdown meets its initial balance, offering more flexibility to seasoned traders.

For traders needing a fresh start due to reaching their maximum drawdown, Bulenox provides an easy reset option. A reset gives traders another chance to meet the required profit targets without starting from scratch. So, traders can update their account balance and carry on with trading without the burden of past performance affecting their new start. It takes almost an instant to complete the reset process, but one must remember that this doesn’t extend the QA account’s subscription or change the five-trading-day requirement.

Master Account

The Master Account is the ultimate measure of success for prospective members of the Bulenox family. It represents a trader’s ability to scale the challenges the company has set up to vet and retail members capable of helping it achieve its goal. Previously, we learned to arrive at the MA account, a trader must first satisfy all the requirements at the trial stage. Then, one must initiate a support ticket to trigger the process of setting up the new account. The required information for this ticket includes the trader’s full name, email address, specific trading platform user ID (Rithmic user ID if one chooses this platform), and, for those managing multiple accounts, the specific account numbers in question.

The MA account setup process is rigorous and might last up to two business days. Once Bulenox is satisfied with the details and has verified documentation, the company sends an onboarding email to the successful trader. The email contains a certificate of completion, detailed instructions for the next steps, a questionnaire, and the contract for the Master Account.

Note: Bulenox waives the subscription fees for the Qualification Account as the trader transitions to the Master Account. At the same time, the trader will pay a one-time activation fee to fully activate the MA account. The fee structure is tiered based on account size, starting at $98 for a $10,000 account and climbing to $898 for a $250,000 account.

If you may recall, we noted earlier that Bulenox allows traders to operate multiple accounts. For instance, those using Rithmic can activate more than one account and operate them simultaneously with a single user ID. And, a trader can operate both Qualification and Master Accounts at the same time—Bulenox allows up to 11 Master Accounts under a single user ID and three Qualification Accounts.

Bulenox governs the Master Account stringently yet in a very straightforward manner. This is to say that, while the company has made the account setup process to be quick and seamless, the accompanying guidelines are not so soft.

Interestingly, a good chunk of the guidelines for the Master Account mirrors that of the Qualification Account. For instance, the stipulations regarding drawdown limits are on a per-account-size basis, with a $1,000 Trailing and EOD Drawdown Amount (TDA) for a $10,000 account and up to a $5,500 TDA for a $250,000 account. Any trader who exceeds the maximum drawdown will have their account terminated; this should give you a hint on how Bulenox is strict with risk management.

Compensation on the Master Account is directly tied to trading performance. The initial $10,000 earned by the trader is exempt from commission, with subsequent profits subject to a 10% commission by Bulenox, leaving the trader with 90% of their earnings. Traders can make withdrawal requests at any time during the calendar month, although the company processes requests only on Wednesdays. Each withdrawal request is subject to minimum and maximum limits, although, again, this depends on the size of your account.

Upon seeking a withdrawal, traders are given the relevant tax paperwork indicating their status as independent contractors. This system, which is intended for advanced training and performance-based pay, prepares successful traders for prospective unique offers from Bulenox’s capital partners, guaranteeing a specialized and profitable trading trip.

Special Account

Bulenox offers Special Accounts alongside its standard accounts (QA and MA), which come with bespoke features and advantages. A notable example is the Micro Account, which permits members to trade up to five micro-contracts and extend their positions to the following day without the necessity of closing them, with the exception of weekends.

Micro Account Specifications:

- Traders must generate $1,000 in profits.

- Traders can choose one of the two drawdown options:

- Option 1: A Trailing Drawdown limit set at $1,000, which dynamically adjusts with the account balance.

- Option 2: An EOD (End of Day) drawdown of $1,000, coupled with a daily loss limit of $400, allows for strategic planning and loss management.

- The maximum position size is 5 micro contracts.

Eligible Instruments for Overnight Trading:

- MES (Micro S&P): Traders leverage this to speculate on the S&P 500 index movement.

- MNQ (Micro Nasdaq): MNQ exposes traders to NASDAQ-100.

- M2K (Micro Russell): This instrument is ideal for traders interested in small-cap stocks.

- MYM (Micro Dow): If a trader wants large-cap companies (typically those in the Dow Jones Industrial Average), this instrument is for them.

As you can see, the Micro Account is an excellent option for traders seeking exposure to to profitable instruments but only willing to commit a small amount of money to the position. And the kicker is that the drawdown options and daily loss limits are accommodating.

How to Set Up Bulenox Account ?

From our research, prospective members will jump through the fewest hoops in the market to join Bulenox. This straightforwardness is perhaps a critical factor in the popularity of the company in the prop trading environment. Here’s a quick overview of the onboarding process:

Registration Process:

- Open the Bulenox website in the browser and navigate to the “Join Now” button. Clicking the button should open a registration window.

- Obviously, if you’re a new visitor, you’ll choose the “Sign Up” option to open a new account. The registration window requires details like:

- Full name and email address.

- A username.

- A secure password.

- Select your preferred account size directly within your Bulenox profile.

Setting Up Rithmic Connection:

This step is relevant for traders who opt to use Rithmic to access the futures market and set up and execute trading strategies. Download the software to your computer (this is ideal because it offers more functionality than the web trader).

After installation, connect the R Trader account with Bulenox. To do this:

- Launch the application and log in using your User ID and Password in the clients portal.

- For the system, choose “Rithmic Paper Trading” to simulate trading environments.

- Select “Chicago” as your gateway for optimal performance, though options like “Europe” or “Frankfurt” for European servers and “Tokyo” or “Singapore” for Asia are also available.

- Do not forget to turn on Market Data and Allow Plugins for full functionality.

Accepting Rithmic’s Working Conditions:

As a responsible trader, one must always analyze and consider all options before making a decision. In this light, you’ll be required to agree to Rithmic’s terms and conditions—read the entire thing to ensure you know what you’re getting yourself into. Most crucially, ensure you tick the right option between “Non-Professional” and “Professional.” Remember, non-professional traders benefit from included exchange data feeds in their Qualification account, whereas professional traders are subject to a monthly fee of $112 per exchange.

Connecting NinjaTrader (With a Free License):

For those comfortable with alternatives, Bulenox supports NinjaTrader. Even better, the platform comes with a free license, meaning traders won’t have to part with a cent to use it. Here’s how to set it up:

- Ensure you’re connected to R Trader or R Trader Pro and have accepted Rithmic’s terms.

- Download and install NinjaTrader 8, and log in using your NinjaTrader Account Dashboard credentials.

- Navigating to Tools > Options and check the Multi-provider option. This enables the Multi-Provider Mode.

- In the Command Center, set up your connection by selecting My Rithmic for NinjaTrader Brokerage, adding it to your configured connections, and inputting your Rithmic credentials.

- Under “System”, choose Rithmic Paper Trading, then deselect Plugin mode, and rename the connection to Bulenox for clarity.

- Uncheck the Global Simulation Mode to turn it off. This is important to activate real trading capabilities.

- Enter your NinjaTrader license key (available in the Member’s Area) and restart the trading platform for changes to take effect.

- Reconnect to Bulenox via the Command Center to start trading.

Bulenox Reputation and Social Media

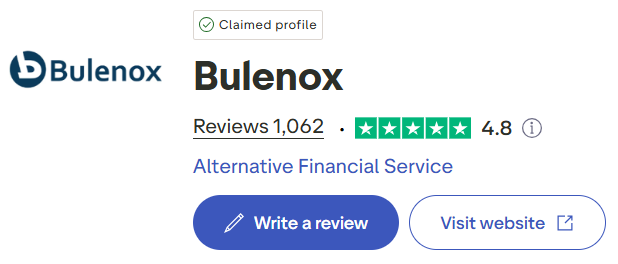

Evidence from our research shows that Bulenox is a popular prop trading firm. For starters, the company has a 4.8-star rating on Trustpilot, based on 1062 reviews. More than 89% of the reviewers gave the company five stars and only less than 5% think Bulenox is disappointing (they gave a 1-star rating). The bottom line is that the firm is well regard among current and past users.

Bulenox is present on several social media platforms. They have made over 125 posts on Instagram, which has garnered over 5,000 followers. Members will find this account useful because the company often posts exclusive discounts, the latest updates, and user reviews. Traders can also use the direct messaging (DM) feature to contact Bulenox customer care.

Is Bulenox Legit ?

Besides detailing what you get if you associate yourself with Bulenox, this review intends to answer a very important question: is the company legit? The short answer is YES. Our research found that Bulenox has a huge community on the internet and that the majority think of it as awesome. The company has also cultivated a good name within the futures trading community, having successfully funded numerous traders.

One of the most telling aspects of a legitimate business is in how they onboard new members. Looking at Bulenox, they run a rigorous process that is also fair, allowing any meritorious trader to join the family. If this isn’t a marker of legitimacy, nothing else is.

Financially, Bulenox offers a competitive profit split, with traders able to keep up to 75% of their earnings, which is fairly standard in the industry. The company has a transparent fee structure, with evaluation fees starting at $145, making it an affordable option for many traders.

Comparison: Bulenox Vs Other Firms

Let’s see how

Bulenox stacks up against the competition.

| Bulenox | Apex Trader Funding | Elite Trader Funding | My Funded Futures | TopStep | |

|---|---|---|---|---|---|

| Account Sizes | $25K to $250K | $25K to $300K | $50K to $300K | $50K to $150K | $50K to $150K |

| Profit Share | 100% for up to $15,000; 80% thereafter | 100% of first $25,000; 90% thereafter | 100% of first $12,500; 90% thereafter | 100% up to $10K; 90% thereafter | 100% of first $5,000; 90% thereafter |

| Account Plan Costs (USD/Month) | $145 to $535 | $137 to $677 | $165 to $655 | $80 to $375 | $49 to $149 |

| Profit Target | $1.5K to $15K | $1.5K to $20K | $3K to $20K | $3K to $12K | $3K to $9K |

Bulenox Review: Final Thoughts

Bulenox is a serious contender for the top prop firm status in the futures trading market. Although most of the offerings are standard (i.e., they do not deviate so much from the features that rivals offer), there is enough to set the company apart. Most of the standard features are what you’d expect from a regular prop firm, including tailored account options and a broad spectrum of tradable assets. Add to that a strategic approach to payouts and drawdowns, which appeals to various trading styles. Also, traders connect with the market through popular platforms like MetaTrader 4&5, Rithmic, and NinjaTrader. However, traders should expect potential challenges, such as variable monthly fees and a sharp learning curve for those interested in managing multiple accounts. Although the challenges may require consideration, they do not overshadow the upsides of the company.

FAQs

Day Trading Insights Research Team

Day Trading Insights Research Team publishes articles written by active day traders, financial market researchers, or aspiring traders who are actively learning and investing on a regular schedule. Our research team brings formal training in finance and computer science, blending market theory with code-driven testing and tools. We’re passionate about understanding how trading works, how markets evolve, and how technology can sharpen professional decision‑making. Our content is education‑first and independently produced, free from outside bias.