Apex Trader Funding Review for 2024 and Discount Code - [Updated Regularly]

Last Updated: November 2, 2024

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

Apex Trader Funding Discount Coupon Code - November 2024

Get 80% OFF with promo code: UQZQSHZW

- Special Evaluation Pricing on Large Eval Sizes

- $35 Resets

- One Day To Pass

- $85 Lifetime PA Fees

Key Takeaways:

- Account Sizes: $25k, $50k, $75k, $100k, $150k, $250k, $300k, $100k Static

- Leverage: Up to 100:1

- Profit Share: 100% of first $25,000; then 90% of profits

- Minimum Balance for Payout (by Account Size): Varied by account sizes, from $26,600 to $102,600

- Maximum Withdrawal Limit: Varies by account size, from $1,000 to $3,500; removed after first three payout months

- Trading Platforms Supported: NinjaTrader, Tradovate, TradingView, Rithmic, Sierra Chart, Bookmap, and others

- Account Plan Costs (USD per Month): $137 to $657 based on account size and plan

- Profit Goal: Varies by account size, from $1,500 to $20,000

- Daily Drawdown: None for all FULL accounts, $625 for Static account

- Trailing Threshold: Varies by account size, from $1,500 to $7,500; None for Static account

Apex Trader Funding is one of the many proprietary trading firms (prop firms) responsible for fueling interest in the futures trading industry. A prop firm like Apex recruits individual traders, trains them, and gives them funds to set up and execute trades. But with such firms mushrooming the futures trading space, how do you distinguish the serious players from unscrupulous joyriders? This review should help you decide whether Apex Trader Funding (ATF) is worth considering.

Apex Trader Funding Update: October 20th, 2024

Apex Trader Funding has unveiled significant changes to its program this October, introducing several cost-effective options for traders. The firm now offers an 80% discount on Evaluations, covering initial and recurring payments.

Key updates include:

- $35 Reset fee

- "One Day to Pass" trading challenge option

- $85 Lifetime PA Fees

- Premium accounts ($150k, $250k, and $300k) available at $250

- With the 80% OFF discount applied (Coupon Code: UQZQSHZW) , these accounts can be accessed for $50

These promotional rates will remain active through October 2024. Apex recommends that traders review their latest program guidelines before selecting an account tier.

The updates focus on making funded trading more financially accessible while maintaining program integrity. All offers are subject to standard trading rules and requirements.

What is Apex Trader Funding ?

Apex Trader Funding (ATF) is a prop firm headquartered in Austin, Texas. The company’s official name is Apex Trader Funding Inc., and it was founded in 2021 by Darrell Martin, a veteran futures trader. Darrell has close to 20 years of experience in the futures trading market, and prior to launching this company, he founded and ran Apex Investing, an educational site for empowering traders. With such a powerful mind behind the company, the question of how long it has been in the market doesn’t arise.

Like most prop trading firms, the company implements a familiar template for its relationship with traders, which goes like this: the firm provides capital, and traders use their skills to put the money to work. For every sum of profit they earn, traders keep 90%, and the firm takes only 10%.

However, ATF is a breadth of fresh air regarding how it rewards traders. For instance, traders can keep 100% of the first $25,000 they earn. This is the result of the founder’s vision to develop a firm that favors traders. This vision is built on a model that focuses on fewer restrictions and lower costs; it grants traders greater freedom and flexibility in their trading activities. The founder’s approach also emphasizes the supremacy of risk management, profitability, and scalability in trading.

Is this model working? Well, let’s see: first, the company’s average monthly compensation to customers since January 2023 was over $15 million, which makes it over $334 million in total compensation paid out since 2022. In the last 90 days alone, Apex has paid out over $81 million to its traders.

Second, the prop firm has tens of thousands of members drawn from over 150 countries. For a company that is barely four years old, this is a massive achievement. Third, the company is the recipient of numerous awards, including the 2023 Top 10 Trading Solutions Providers Award by Financial Services Review and the 2023 Benzinga Global FinTech Awards. Darrell, the company’s founder, has also featured in several high-profile interviews. This is evidence that the firm’s model is working.

What Can You Trade With Apex Trader Funding?

The company recruits traders capable of navigating and generating value in the futures market. Members can trade various assets across different sectors—the idea is to allow sufficient headroom for versatile trading strategies and portfolio diversification.

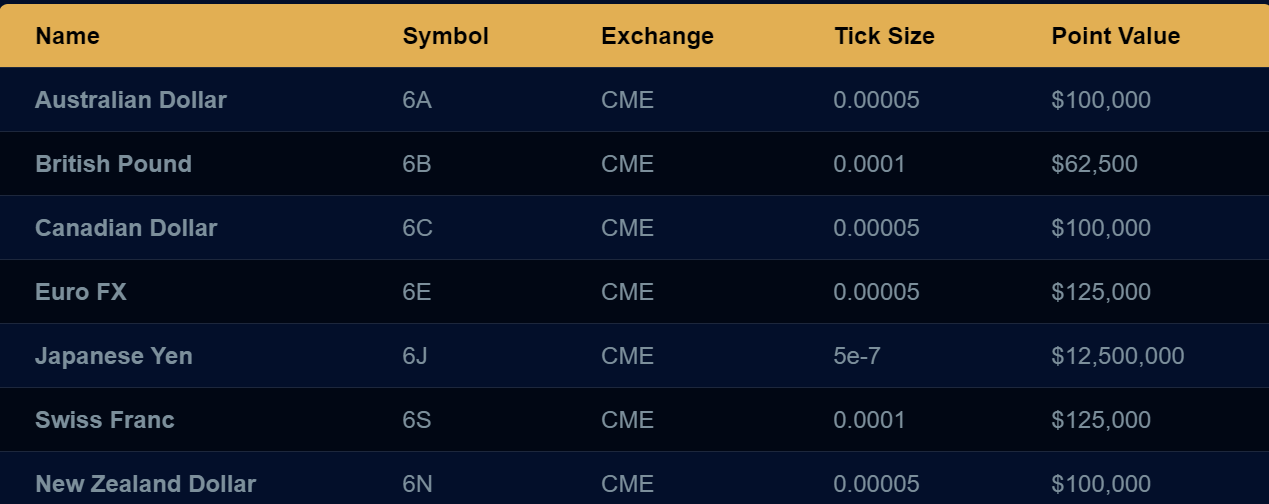

Apex Trader Funding provides its traders with access to specific assets depending on the trading platform they choose. For example, you can trade the following instruments if you choose Rithmic or NinjaTrader:

Equity Futures:

- E-mini S&P 500 (ES)

- Nikkei NKD (NKD)

- E-mini NASDAQ 100 (NQ)

- Mini-DOW (YM)

- E-mini Midcap 400 (EMD)

- Russell 2000 (RTY)

Agricultural Futures:

- Lean Hogs (HE)

- Live Cattle (LE)

- Feeder Cattle (GF)

- Corn (ZC)

- Wheat (ZW)

- Soybeans (ZS)

- Soybean Meal (ZM)

- Soybean Oil (ZL)

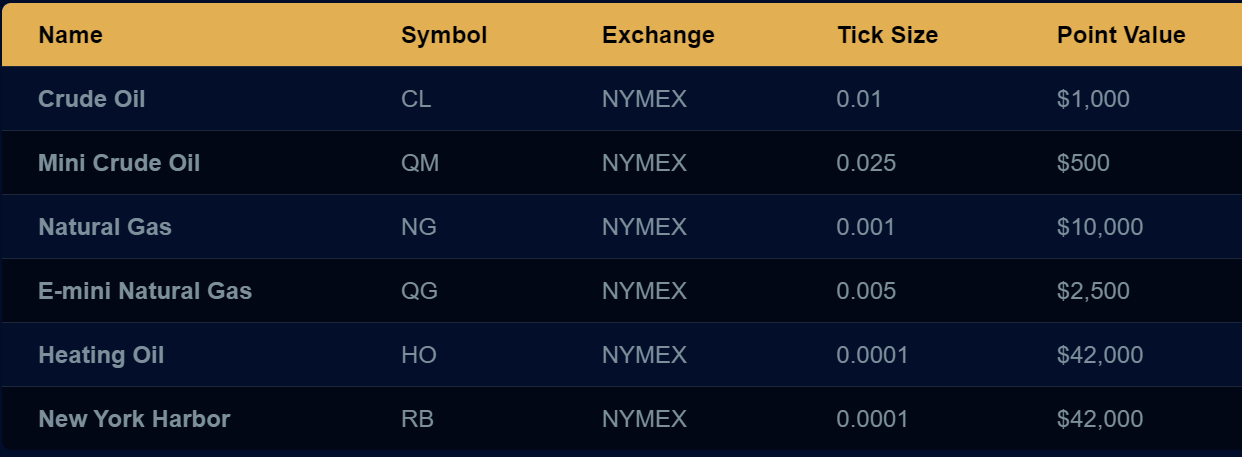

Energy Futures:

- Crude Oil (CL)

- Mini Crude Oil (QM)

- Natural Gas (NG)

- E-mini Natural Gas (QG)

- Heating Oil (HO)

- New York Harbor (RB)

Metal Futures:

- Gold (GC)

- Silver (SI)

- Copper (HG)

- Platinum (PL)

- Palladium (PA)

- miNY Silver (QI)

- miNY Gold (QO)

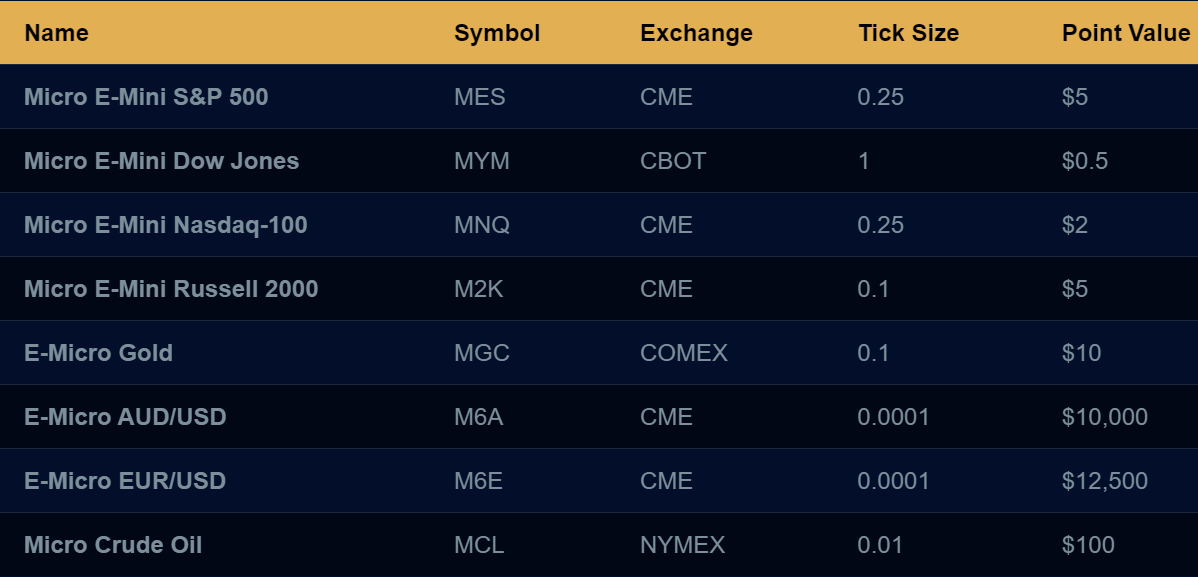

Micro Futures, for traders with smaller accounts or those who prefer tighter risk management:

- Micro E-Mini S&P 500 (MES)

- Micro E-Mini Dow Jones (MYM)

- Micro E-Mini Nasdaq-100 (MNQ)

- Micro E-Mini Russell 2000 (M2K)

- E-Micro Gold (MGC)

- E-Micro AUD/USD (M6A)

- E-Micro EUR/USD (M6E)

- Micro Crude Oil (MCL)

Cryptocurrency Futures:

- Micro Bitcoin (MBT)

- Micro Ethereum (MET) Note: Mini versions (BT and ET) are unsupported.

Interest Rate Futures: Including popular options like 2, 5, and 10 Year Notes and the 30 Year Bond.

EUREX Instruments: This is for traders interested in European markets, including popular indices like the German DAX.

ICE Exchange Instruments: Offering alternatives to instruments from CME, CBOT, NYMEX, and COMEX.

Image source: apextraderfunding.com

What are Apex Trader Funding's Trading Platforms ?

As you may already know, Apex Trader Funding supports three trading platforms: NinjaTrader, Tradovate, and Rithmic. Also, you’ve just learned that Tradovate and NinjaTrader support one more trading instrument, EUREX.

Trading Platforms and Instrument Availability:

- Rithmic/NinjaTrader: Supports Equity, Currency, Agricultural, Energy, Metal, and Micro Futures.

- Tradovate/NinjaTrader: Offers Equity, Currency, Agricultural, Energy, Metal, Micro, and EUREX instruments.

- TradingView: Popular for its powerful charting capabilities and social networking features, enabling strategy sharing among traders.

- Rithmic: Provides a high-performance data feed and trade execution solution, favored for its low latency and reliable market data.

Additional Platforms: Apex also supports Sierra Chart, Bookmap, and others, offering a range of choices to suit various trading styles.

Each platform is integrated to offer flexibility and choice, emphasizing Apex Trader Funding's commitment to accommodating different trading approaches and experience levels.

How do you check the availability of instruments on a particular platform?

The process of checking the instruments available for trading is the same regardless of the platform you are on. For instance, suppose you have an account on Rithmic and would like to know which instruments are available. In that case, follow these steps:

Step 1: Log into your account

Step 2: Navigate to the Trader Dashboard and right-click on the account name

Step 3: Select 'View Risk Parameters' to see active products

If you need a particular instrument that isn’t listed, contact customer service, and you'll get help. You must do this because the system will reject the trade if you place an order on an unlisted instrument. Although there is no penalty for this rejection, you'd have wasted precious minutes that would have gone into setting up another trade.

Please note: The instruments available depend on the platform you select.

Apex Trader Funding Pros and Cons

When considering Apex Trader Funding (ATF), it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals.

Pros:

- Members can trade with different account sizes, ranging from $25,000 to $30,000. f t

- Apex’s micro-futures allow traders to sharpen their skills without exposing their accounts to excessive risk.

- The company’s profit split arrangement is generous—members keep 100% of the first $25,000 in profits, then 90% thereafter.

- Members frequently access their earnings because the firm makes payouts twice each month.

- Traders can rest their accounts as many times as they want, although the option attracts a reset fee.

- Traders may choose to trade through any of the three platforms that Apex supports.

- The company prioritizes trader development; it avails plenty of educational resources and has a vibrant community who are eager to help one another.

Cons:

- Monthly costs range from $137 to $657, which might be high for some traders.

- Stringent drawdown limits (e.g., $1,500 for a $25k account) require careful risk management.

- Withdrawal limits in the first three months may restrict access to funds.

- Even with recent changes where Apex made it easier for traders to pass their evaluation, some traders still find the rules more restrictive than they would like them to be.

Apex Trader Funding Reviews: Who Is It For?

The primary goal of this Apex Trader Funding review is to help you determine if it aligns with your trading approach and goals. So, how might you marry the company’s key aspects and your goals so that you know if it is for you? Well, one must begin from the basics: understand the broad spectrum of programs available, the potential for lucrative profit splits, the account sizes, and the tradeable assets available.

Apex Trader Funding's baseline is its structured and straightforward evaluation process designed to identify and nurture skilled traders. When a trader first signs up, Apex takes them through an initial phase where they’ll trade using a simulation (evaluation) account. The evaluation account is capable of trading full-size contracts, has access to real-time data, and has no daily drawdowns. In other words, the evaluation accounts replicate everything that happens in the paid performance accounts but without exposure to attendant risks. This allows traders to demonstrate their strategy in a safe environment. The company graduates successful traders to paid performance accounts where they manage real funds that the firm provides.

We learned that the firm supports three trading platforms: Rithmic, Tradovate, and NinjaTrader. This allows traders to operate in environments where their skills can come alive and where they can optimize their strategies. Moreover, the firm implements a lucrative payout structure that rewards successful traders. This emphasizes the firm's commitment to rewarding skill and success in trading.

What Is The Apex Trader Funding Leverage ?

As for leverage, Apex Trader Funding offers up to 100:1 leverage to their funded traders. This means that for every $1 the trader has in their account, they can control contracts worth $100. So, if a trader’s capital is $25,000, the maximum position size (or exposure) they can control is $2,500,000 ($25,000 x 100).

Apex Trader Funding Payout System

Profit Share: Traders get 100% of the first $25,000 they earn. After that, they receive 90% of the profits.

Payout Requests: Traders can request payouts twice per month—from the 1st to the 5th and from the 15th to the 20th of each month.

Payout Timing: Apex Trader Funding processes payouts on the 15th and the last day of the month, but the funds may take 3-7 business days to reach the bank account.

Trading During Payout Request: Traders can continue trading immediately after requesting a payout, but they should account for the requested funds as if they have already been deducted.

Minimum Requirements: Payout requests have specific minimum balance requirements, which vary based on the account size.

| Account Size | Min. Balance Required |

|---|---|

| $25k Account | $26,600 |

| $50k Account | $52,600 |

| $75k Account | $77,850 |

| $100k Account | $103,100 |

| $150k Account | $155,100 |

| $250k Account | $256,600 |

| $300k Account | $307,600 |

| $100k Static Account | $102,600 |

8-Day Trading Requirement: A minimum of 8 trading days is required between each payout request.

Maximum Withdrawal Limit: There's a payout amount for the first three payout months, removed from the fourth month onwards.

| Account Size | Max Withdrawal |

|---|---|

| $25k Account | $1,500 |

| $50k Account | $2,000 |

| $75k Account | $2,250 |

| $100k Account | $2,500 |

| $150k Account | $2,750 |

| $250k Account | $3,000 |

| $300k Account | $3,500 |

| $100k Static Account | $1,000 |

Apex Trader Funding Pricing Information

Members are subject to different pricing amounts depending on the size of their accounts. Below is the complete pricing list:

| Account Size (USD) | Rithmic/NinjaTrader Plan Cost | Tradovate/NinjaTrader Plan Cost |

|---|---|---|

| $25K FULL | $147 | $167 |

| $50K FULL | $167 | $187 |

| $75K FULL | $187 | $207 |

| $100K FULL | $207 | $227 |

| $150K FULL | $297 | $317 |

| $250K FULL | $517 | $537 |

| $300K FULL | $657 | $677 |

| $100K STATIC | $137 | $157 |

| Funded Account | $85 / Account | $105 / Account |

What are Apex Trader Funding's Evaluation Rules and Goals ?

Every prop firm assesses potential members before entrusting them with any money. Apex Trader Funding is no different. As noted earlier, ATF’s evaluation process focuses on two critical aspects of a successful trader: ability and risk management skills. This whole time, traders use an evaluation account that mimics everything in the paid account except using real money. The elements of the evaluation process are:

- Profit goal and drawdown limits: Each trader’s evaluation account has a profit target, which they must achieve without depleting the dummy funds. Your account’s profit goal may be different from another, mainly depending on the type of account you choose. For example, the company might set $15,000 as the target amount for a $250,000 account. An account with a larger sum of dummy funds will have a higher profit target.

- Trailing threshold drawdown: A trailing threshold is a mechanism that Apex, or any prop trading firm for that matter, uses to adjust the minimum account balance based on your trades’ profits and losses. As you make profitable trades, the trailing threshold adjusts to a certain figure/amount below your highest account balance. To use an example, if your trailing threshold is set at $2,500, and your account balance reaches $52,000, your new trailing threshold would be $49,500. In this light, a trader must understand that the trailing threshold drawdown determines whether or not they’ll go past the evaluation stage. A trader will fail the evaluation if their account reaches a certain profit level and then drops back to the starting level.

- Minimum trading days: A trading day is when financial markets are open, and traders can place orders for specific instruments. ATF typically sets the minimum number of trading days at seven, but these do not have to be consecutive.

- Code of conduct and trading rules: Apex Trader Funding expects all members to play by their rules. For instance, one must not allow another individual to run their account. Moreover, members must understand the specific guidelines for trading various instruments.

- Trading platforms and multiple accounts: Members may choose one or more platforms out of the supported platforms. They may open as many as 20 accounts to operate simultaneously if they manage them properly.

- Risk management and compliance: This is another critical aspect of the evaluation process because it separates those who earn paid accounts from those who fail the test. Those who succeed adhere to the maximum drawdown limits, avoid prohibited trading strategies, and comply with risk management protocols and trading hours.

- Evaluation reset: Apex Trader Funding’s members may reset their evaluation accounts if they fail the test the first time. This option allows traders to start over with a fresh account, giving them another chance to achieve the targets without the setbacks of their previous attempts. For the Rithmic/NinjaTrader Plan, the reset fee is $80 per reset, unlimited resets, and for the Tradovate/NinjaTrader Plan, you can reset for $100 per reset, unlimited resets.

What are Apex Trader Funding's Account Sizes ?

Apex Trader Funding has two types of plans: the Rithmic/NinjaTrader Plan and the Tradovate/NinjaTrader Plan. Therefore, each plan includes a license for NinjaTrader. You get a NinjaTrader license included in the plan’s fee if you choose either Rithmic or Tradovate.

However, Rithmic has a robust data feed and executes trades faster, making it popular among algorithmic and high-frequency traders. Tradovate isn’t any less either, the users get an accessible and user-friendly interface, making it ideal for the less experienced or less technologically sophisticated traders.

For both Rithmic/NinjaTrader Plan and the Tradovate/NinjaTrader Plan:

No Scaling Option, NinjaTrader License ($75 Value) included, Real-Time Data Fees ($55 Value) included.

| Account Size (USD) | Contracts | Profit Goal | Trailing Threshold | Daily Drawdown |

|---|---|---|---|---|

| $25K FULL | 4 (40 Micros) | $1,500 | $1,500 | None |

| $50K FULL | 10 (100 Micros) | $3,000 | $2,500 | None |

| $75K FULL | 12 (120 Micros) | $4,250 | $2,750 | None |

| $100K FULL | 14 (140 Micros) | $6,000 | $3,000 | None |

| $150K FULL | 17 (170 Micros) | $9,000 | $5,000 | None |

| $250K FULL | 27 (270 Micros) | $15,000 | $6,500 | None |

| $300K FULL | 35 (350 Micros) | $20,000 | $7,500 | None |

| $100K STATIC | 2 (20 Micros) | $2,000 | None | $625 |

Apex Trader Funding Features

Apex Trader Funding offers a range of third-party tools and resources to assist traders. Some of the notable tools and services include:

- Trade Copier: This tool allows traders to manage multiple accounts with a single click, enhancing efficiency in executing trades.

- Tick Strike: A tool designed to help traders hear and read market order flow, providing valuable insights into market dynamics.

- Education and Trade Room: Apex offers a 30-day free educational program, tools, and access to a trade room, supporting traders in their learning and trading journey.

- Mobile Trading Solutions: For traders who need mobility, there are options to trade using mobile devices, have a backup PC, or trade on a Windows machine, even from a Mac.

- Markers Plus: This is an automation tool for trades, which can be a significant asset for those looking to streamline their trading processes.

- Trading Computer Assessment: Offers resources to ensure your computer's performance is adequate for trading activities.

- Trading Psychology: Resources to help traders master the psychological aspects of trading, which can be crucial for long-term success.

- Dyno Trading Tools: These tools and resources are designed to simplify the complexities of trading, making it more accessible for traders at various levels.

- The Ninja Suite: This includes a suite of Auto Trading Bots and Indicators aimed at helping traders pass their evaluation accounts and start earning real money efficiently.

- The Pit: An online Discord community where traders of all levels come together to trade Futures Markets, Equities, Options, and more.

- Quick Trade Ninja: A tool focused on management, allowing for efficient trade execution with a point-and-click interface.

- Futures Trading Coaching Program: This program is designed to help new traders with one-on-one coaching and mentoring.

- BackToTheFutureTrading: Offers services for securing and trading funded accounts with Tacheon Warp.

Is Apex Trader Funding a Scam or Legit?

Simply put, Apex Trader Funding is as legit as prop firms come. Sure there are mixed reviews online, however a lot of them were posted by disgruntled traders whose strategies didn't pay off. There is a good chance that they would have been writing the same reviews for any other prop trading firm where they didn't get funded. That being said, passing Apex Trader Funding evaluation is no easy feat, however, lots of people do pass them, get funded, and eventually start getting payouts if they continue performing well.

Apex does have stricter rules, which just recently became a bit more relaxed. However, based on our research, the firm is legit and has decent rules which makes it realistic (but not easy) to get funded and start receiving payouts. As with anything prop trading related, please be aware that prop trading is a risky game and you need to continuously develop your strategies and learn how to risk manage better.

Cybersecurity Bounty Program at Apex Trader Funding

Apex Trader Funding places a high premium on the safety of members’ data and funds. That is why the company began a bounty program to encourage specialists to help find and address vulnerabilities. This program proactively addresses issues that may allow bad actors to mess around with the platform and expose the company to lawsuits or, at worst, get away with members’ funds and personally identifying information.

Comparison: Apex Trader Funding Vs Other Firms

Let’s see how Apex Trading stacks up against the competition.

| Apex Trader Funding | Elite Trader Funding | My Funded Futures | Bulenox | TopStep | |

|---|---|---|---|---|---|

| Account Sizes | $25K to $300K | $50K to $300K | $50K to $150K | $25K to $250K | $50K to $150K |

| Profit Share | 100% of first $25,000; 90% thereafter | 100% of first $12,500; 90% thereafter | 100% up to $10K; 90% thereafter | 100% for up to $15,000; 80% thereafter | 100% of first $5,000; 90% thereafter |

| Account Plan Costs (USD/Month) | $137 to $677 | $165 to $655 | $80 to $375 | $145 to $535 | $49 to $149 |

| Profit Target | $1.5K to $20K | $3K to $20K | $3K to $12K | $1.5K to $15K | $3K to $9K |

Apex Trader Funding Reviews and Social Media Presence

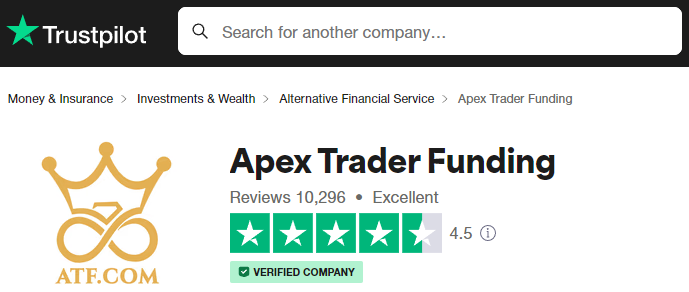

Apex Trader Funding has received a remarkable 4.5-star rating on Trustpilot based on over 10K reviews. Impressively, 87% of these reviews are 5-star, while 5% are 4-star, demonstrating strong customer satisfaction. Less than 1% of the reviews are 3-star or 2-star, and only 6% are 1-star, reflecting an overwhelmingly positive response from its users.

Stay updated with Apex Trader Funding by following their Instagram account, which features more than 531 posts and has attracted over 24K followers. Their Instagram feed provides a glimpse into the company's development, exclusive discounts, updates, and various related podcasts, among other things. For any direct questions, you can also contact them through Instagram's direct messaging option.

Follow Apex Trader Funding on Twitter to join their community of over 21K followers and explore their 620 plus posts. This platform is an interactive space for engaging with the company, featuring reviews, queries, and various media content. Stay informed about the latest news, including special discount offers, and actively participate by commenting on posts to keep up with the latest developments from Apex Trader Funding.

Apex Trader Funding Review: Final Thoughts

Apex is an important player in the futures trading market. The company has made it easy for skilled traders, who would have otherwise missed out because of inadequate funds, to participate and enrich the market. Various factors make this company outstanding, but most noteworthy is the structured evaluation process. ATF assesses traders on the two most important aspects of a successful futures trader: ability and risk management. This ensures that anyone who makes it to the paid account is a sure candidate for a professional and successful trader.

Most importantly, Apex Trader Funding could be valuable for traders looking for an on-ramp into the futures market. Those who appreciate structured guidance and a community support system might find this company a godsend. The combination of educational resources, flexible trading options, and a lucrative profit-sharing model is the cherry on the cake. However, potential members should take note of the associated costs and ensure that the program aligns with their trading style and financial goals.

FAQs

-

What are the costs for different account plans at Apex Trader Funding?

Monthly costs vary by account size and plan, ranging from $137 to $677.

-

What trading platforms does Apex Trader Funding support?

Apex Trader Funding supports a variety of trading platforms including NinjaTrader, Tradovate, TradingView, Rithmic, Sierra Chart, Bookmap, and others.

-

What types of futures can I trade with Apex Trader Funding?

Traders can trade a wide range of futures including Equity, Interest Rate, Currency, Agricultural, Energy, Metal Futures, and Cryptocurrency Futures like Micro Bitcoin and Micro Ethereum.

-

Are there any educational resources or community support available at Apex Trader Funding?

Yes, Apex Trader Funding offers educational programs and access to a supportive community, aiding trader development and learning.

-

What are the account reset options and fees at Apex Trader Funding?

Apex Trader Funding provides unlimited reset options with a fee, allowing traders to restart their evaluation process if needed.

-

What are the minimum balance requirements for payouts based on account size?

Minimum balance requirements for payouts vary by account size, ranging from $26,600 to $307,600.

-

What is the profit share structure at Apex Trader Funding?

Traders keep 100% of the first $25,000 in profits, and then 90% of profits thereafter.

-

Does Apex Trader Funding offer Free Trials ?

Currently, Apex Trader Funding does not offer free trials.

Trading Disclaimer: The information provided is for informational purposes only and is subject to change. We strive to keep it up-to-date and accurate. However, there may be instances where actual data differs from what's published on our website. Daytradinginsights.com operates as an independent platform, which may receive compensation for advertisements, sponsored content, or when you click on links on our site. Please note that the authors and contributors are not licensed financial advisors. Before making any financial decisions, it is recommended that you seek the advice of a professional.

Subscribe to our newsletter

Contact Us

We will get back to you as soon as possible.

Please try again later.